This has been quite an exciting week for American Aires Inc. (CSE:WIFI). In addition to having a red-hot stock that’s been drawing a lot of attention from Wall Street analysts, the innovative, Ontario-based tech company has been dropping some major news.

After revealing an entirely new product line designed for 5G devices on Tuesday, the innovative tech company today announced the launch of a new global website to support consumer demand for these products.

Aires’ e-commerce website is expected to be fully operational before the end of Q1. Until then, Aires products can be found at the company’s current website.

New Website Positions American Aires for Global Sales

The new site will facilitate sales all over the world, offering Aires products in multiple languages and jurisdictions. Its back-end system will be capable of supporting up to 10,000 sale transactions a day. At present, the average sale transaction per customer is approximately C$292.

Though it’s impossible to predict with certainty the website’s future performance, the company forecasts daily sales through the site will hit 1,000 by the end of the year.

American Aires Inc. (CSE:WIFI) CEO, Dimitry Serov, says of the company’s plans:

“As 2020 unfolds we look to numerous sales and marketing initiatives that include social media, influencer campaigns and website optimization. Aires goal is to be the consumers first choice solution for protection from the negative effects of EMR emitted from 5G and related technology and we are ready to deliver.”

WIFI’s Incredible Run Up the Market

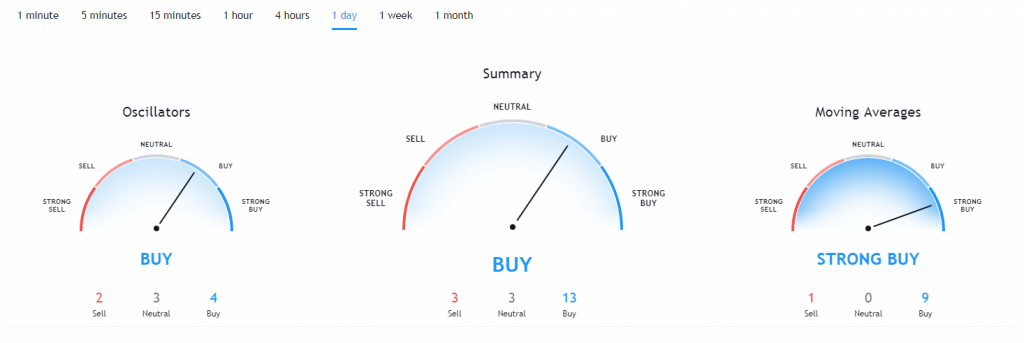

Experts from across the tech sector—and from all over Wall Street—have been taking notice of American Aires this week. Not just because of its big announcements, but also due to the undeniable performance of its shares.

In addition, Morningstar.com listed the company’s fair value at C$0.90. This represents a 28.5% upside from its current price.

Since the company’s IPO in early November, WIFI has more than doubled from its initial price of $0.30.

Aires Offers Leading EMR Protection

American Aires (CSE:WIFI) develops and retails innovative devices that help eliminate the harmful effects of electromagnetic radiation (EMR). For more than 12 years, the company and its research partners have analyzed the effects of EMR, which is emitted from electronic devices like cell phones, Wi-Fi routers, baby monitors, and more.

Thanks to its findings, Aires offers globally-recognized, scientifically-backed technology. Its products restructure and transform electromagnetic field haze into a more biologically-compatible form. This successfully reduces the potentially harmful effects of EMR.

WIFI stock has already been performing admirably, but today’s news might just kick it into overdrive. As the e-commerce site is launched and begins offering the company’s products for the 5G market, there’s no telling how high WIFI might soar.

Be sure to keep watching this exciting tech company for its next big move.

Feauted image: American Aires