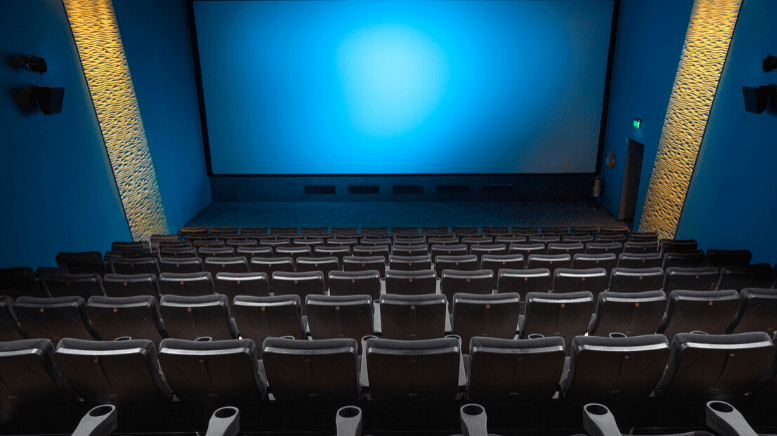

Movie theater stocks have long had a target on their back, with attendance dropping considerably in recent years. In 2019, for instance, attendance fell 4.6% from 2018 to 1.24 billion. And the coronavirus pandemic has not helped theaters, which have had to close all locations for public safety.

Here are two movie theater stocks that are in trouble if closures persist beyond June.

2 Movie Theater Stocks in Trouble: AMC Entertainment (NYSE:AMC)

Among the movie theater stocks that could go bankrupt is AMC Entertainment.

In March, AMC wrote to its landlords that it would stop paying its rent in April, on top of closing its theaters, furloughing 25,000 employees, and slashing payroll at its corporate office.

>> 5 Oil Stocks in Focus as Bankruptcy Looms After Oil Price Crash

When the news broke, Loop Capital analyst Alan Gould downgraded the stock, stating his concerns over the company’s liquidity and lowering his price target on AMC stock from $4 to $1. Additional Wall Street analysts downgraded the stock in April from Neutral to Sell, yet another sign that things could get worse for this movie theater stock in the coming weeks. While concerning, these moves aren’t surprising. AMC Entertainment has been struggling for a while, as it has been weighed down by a $4.9 billion debt.

Bankruptcy is a last resort, but with companies like AMC, it typically lets them keep the leases for profitable areas. However, that won’t be the case for AMC Entertainment if it files for bankruptcy during the coronavirus pandemic. In essence, the company won’t be able to operate, and there’s no timeline for when it will be able to work again.

On April 23, at the time of writing, AMC stock is down 2.2% at $3.11.

2 Movie Theater Stocks in Trouble: IMAX Corporation (NYSE:IMAX)

Imax Corporation is among the movie theater stocks that have seen drops because of the coronavirus pandemic. While bankruptcy might not be in the company’s near-future plans, the market does expect it to take a massive hit.

>> 3 Retail Chains That Could Go Bankrupt Because of Coronavirus

According to Yahoo Finance, the market forecasts Imax will announce a Y-O-Y decline in earnings on revenues when it releases its results for the quarter ended March 2020. It also doesn’t help that in March, figures showed that the company was underperforming the S&P 500, as shares were down around 33% since its last earnings report.

The new report will come out on April 30, and if the results compare favorably with the Street’s estimates, this movie theater stock might be in the clear. If they miss, however, IMAX stock may move lower. With all locations closed, the company won’t be able to put a turnaround plan into place. At least, not yet.

On April 23, at the time of writing, IMAX stock is up 1.56% at $11.09.

Takeaway

Of the two movie theater stocks mentioned in this article, which do you think is in the most trouble because of the coronavirus?

Let us know your thoughts in the comments below, and make sure to keep up with AMC stock and IMAX stock in the coming weeks.

>> Read About More Stocks to Sell

>> Read More Entertainment News

Featured image: PixaBay