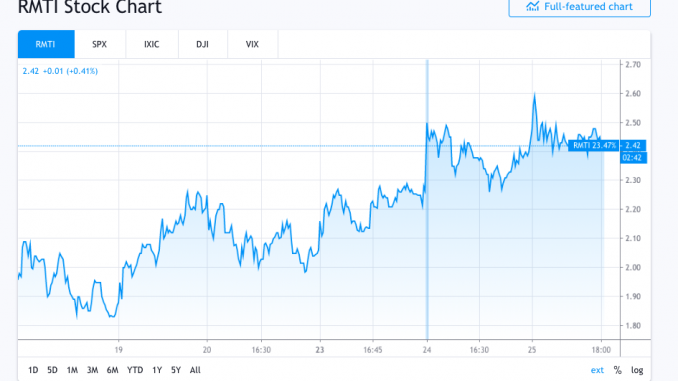

Biopharmaceutical company Rockwell Medical, Inc. (NASDAQ:RMTI) increased by 1.22% to US$2.48 just minutes into after-hours trading on Wednesday after closing at US$2.45, bringing its market cap to US$169 million. Throughout the day Wednesday, RMTI experienced a high of US$2.65 and a low of US$2.36, with a trading volume of 1,184,072. This additional stock price gain compliments the 7.93% increase seen on Tuesday.

Since early February, Rockwell Medical stock has been trading at a much higher volume than usual. Daily trade volume of RMTI shares has averaged over 1.5 million since early February, with just a few exceptions. In the last seven days, the average daily trade volume of RMTI stock was 1,686,477, with the highest number of trades taking place on March 17 at 3,187,434 trades.

Rockwell Medical’s simple moving average (SMA) 50 price is US$2.67, while the SMA 200 price is US$2.65. The company’s total stock float is 69 million shares.

Rockwell Medical’s insider holding accounts for 3.9%, while 174 institutional owners hold 21.48% of the company’s shares. RMTI’s largest shareholders include BlackRock Inc., Vanguard Group Inc, Vanguard Total Stock Market Index Fund Investor Shares, iShares Russell 2000 ETF, State Street Corp, Geode Capital Management, Vanguard Extended Market Index Fund Investor Shares, Perkins Capital Management Inc, Northern Trust Corp, and iShares Russell 2000 Growth ETF.

Rockwell Medical experienced significant insider buying in Q3 2019, with board member David S Richmond making several purchases in July and August 2019. David S Richmond is now a majority shareholder of the company with 179,039 shares in his possession. His largest purchase took place on July 22, 2019, when he acquired 161,457 shares at a price of US$2.95 for a total cost of US$476,298.15.

Four Wall Street analysts have issued ratings and price targets for RMTI in the last 12 months. The average 12-month price target for Rockwell Medical is US$9.33, which suggests the stock has a possible upside of 280.95%. The high price target offered to RMTI is US$11.00 from HC Wainwright, who also reiterated its “BUY” rating for the company. Meanwhile, the low price target for RMTI is US$6.00 from Piper Jaffray Companies, who downgraded from its initial price target of US$10 in November 2019.

Rockwell Medical’s price-to-book ratio is 7.75X, while its price-to-sales ratio is 2.79X. The company reported its Q4 2019 earnings on March 12, which showed a net loss of US$7.3 million (US$0.11) per share for the quarter, compared to a net loss of US9.4 million (US$0.17) per share in Q4 2018. The loss topped Zacks consensus estimate of US$0.12 by US$0.01. RMTI reported net sales of US$15.5 million for the fourth quarter, missing the Zacks Consensus Estimate by 6.47%. This compares to Q4 2018 revenue of US$16.85 million.

Rockwell Medical reported net sales of US$61.3 million for the full year, a decrease from FY 2018. The company said it is primarily due to lower international concentrates sales. Luckily, the loss was offset by an increase in Triferic net sales and sales of concentrates through its contract with DaVita Inc.

For more information on Rockwell Medical (NASDAQ:RMTI), please click here.

Featured image: DepositPhotos © Gajus-Images