Online car-sharing service Getaround, which allows drivers to rent their vehicles to people they’ve never met, continues its steady growth after a new round of funding.

The company — founded in 2009 by Sam Zaid, Jessica Scorpio, and Elliot Kroo — raised $300 million in a Series D funding led by the SoftBank Vision Fund, bringing its total capital so far to an impressive $400 million.

Toyota (NYSE:TM), who along with others, invested $45m last year, also contributed to the latest round of financing.

“We’re confident in our product, playbook, and team,” says Getaround CEO Zaid. “We look forward to leading the growth of next-generation car sharing.”

Future’s Bright

Zaid and his colleagues have every right to be confident; in the last year, the San Francisco-based company has seen a sevenfold increase in booked hours. Car sharing allows members to rent a vehicle for a few hours or several days at a time.

Getaround’s competitors include Daimler (OTC:DDAIF) subsidiary Car2Go and GM subsidiary Maven, while arguably their best-known rival would be Zipcar, which has more than 12,000 vehicles available for rent.

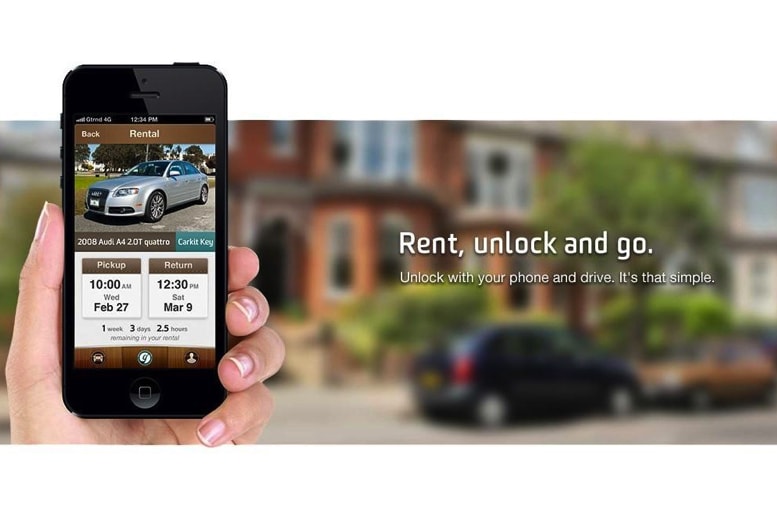

Using Getaround

When using Getaround, customers can rent cars from people nearby for as little as $5 per hour. Users can sign up free of charge, and there are no monthly or annual fees, while all rents include insurance along with 24/7 roadside assistance.

For SoftBank (OTC:SFTBY), the investment comes only a few months after the company agreed to buy a 20 percent stake in GM’s (NYSE:GM) autonomous vehicle subsidiary Cruise Holdings. The Japanese company has also invested more than $9 billion in Uber.

>>Cannabis Penny Stocks Are Working Hard! – The Supreme Cannabis Company Inc.

“SoftBank sees carsharing as an accelerating trend that will disrupt car ownership”, said Michael Ronen, managing partner of SoftBank Investment Advisers.

Getaround’s car-sharing network already includes thousands of vehicles in 66 US cities. And if it continues to experience investment similar to that generated in the latest round, it’s likely those numbers will grow significantly.

Featured Image: Forbes