USA Truck, Inc. (NASDAQ:USAK) shares spiked 135% in the last twelve months due to traders’ confidence in its potential to generate sustainable growth over the long-term.

Value investors, on the other hand, are wondering whether the rally is offering the opportunity to capitalize on its share price gains. It’s true that short-term investors can capitalize on recent gains by selling the stock, however, the company’s future fundamentals and valuations are offering further upside potential in the days to come.

Lower Valuations Indicates Further Upside Potential

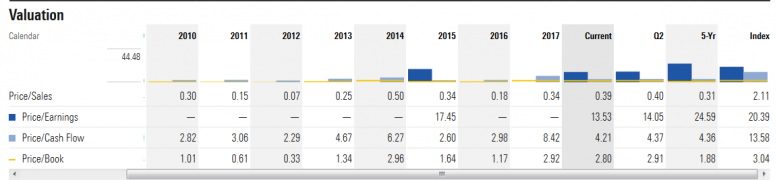

Although USA Truck share price increased substantially in the past couple of quarters, the stock price is currently trading well below the 52-week high of $29 a share that it had achieved two months ago. The company’s share price valuations are also trading below the industry average.

USA Truck shares are trading around only 14 times-to-earnings compared to the industry average of 20 times-to-earnings. Lower price-to-earnings ratio indicates that USA Truck Inc. is generating robust growth in earnings – which is outpacing the increase in its share price.

The stock also looks attractive, considering its price-to-sales and price-to-book ratio of 0.40 and 2.91 is lowering than the industry average of around 2.11 times-to-sales and 3.04 times-to-book ratio.

>> Blockchain Tech Stocks Rebound on Cryptocurrency Gains

USA Truck Financial Numbers Support Share Price Gains

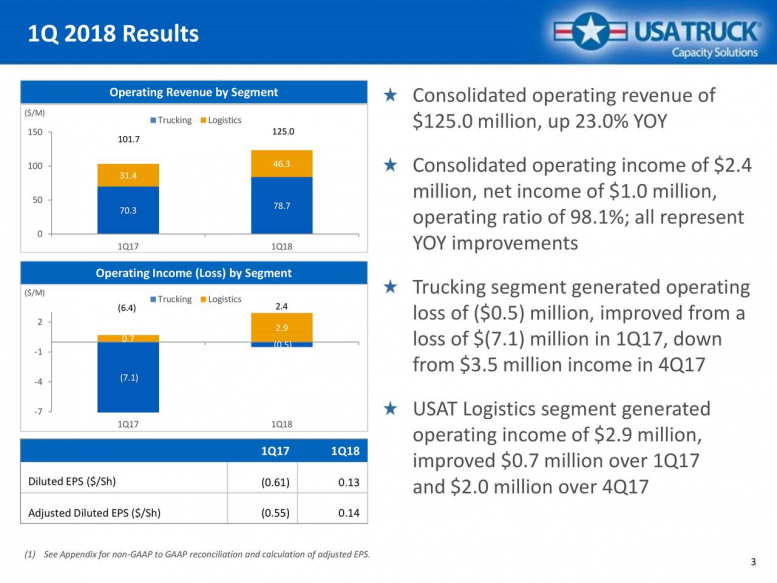

The company generated a revenue of $125 million in the first quarter compared to the revenue of $101 million last year. The growth from both its trucking and USAT Logistics business segment allowed the company to attain double-digit growth from the same period last year.

The company has generated earnings per share of $0.13 in the first quarter as compared to the net loss of $0.61 per share in the first quarter last year.

The company expects to generate similar results in the second quarter, given the demand for its trucking and logistics business. On the whole, several catalysts support USA Truck share price growth in the days to come.

Featured Image: Depositphotos/© welcomia