In a recent session, Cobalt International Energy, Inc (NYSE:$CIE) experienced a downswing with a volume of 0.39 million. They also saw a change of -4.67% at a price of $1.43. The company currently has a 3 month average volume of 0.53 million.

The company’s aggregate recommendation currently sits at 2.70 according to analysts. The scale runs from 1-5, with 1 indicating a ‘Strong-Buy’ and 5.0 indicating a ‘Strong-Sell’. The stock is also 0.35% above the 52 week low, and -93.47% below the 52 week high. The company currently has 30.24 million shares outstanding with a value of 40 million.

The stock is currently trading down -42.11% during the recent quarter, giving a bearish signal to investors. In the last 5 trading days, the stock saw a negative move of -15.38%. As the stock is falling, it remains in negative radar. The stock dipped -82.13% over the past six months. Over the last 12 months, the stock moved even lower with a drop of -92.31%. From year-to-date, the stock has slumped down -92.19%.

As for risk, the company currently sits at a beta of 1.82, indicating it is 82% more volatile than the industry standard.

The company currently has a Return on Equity of 443.80%. This indicates how profitable the company is. They also have a Return on Assets of -107.30%. This can indicate poorly managed assets. Their Return on Investments currently sits at -138.10%, indicating that the costs may outweigh the returns. Because of these three factors, analysts view the stock as a net loss.

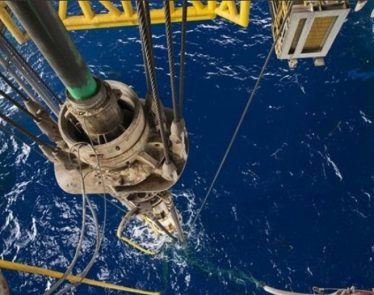

Featured Image: Depositphotos/© eyeidea