You can learn a lot about a stock just by looking at the technical signals. So what can we learn from the technicals for Cobalt International Energy (NYSE:$CIE)?

The company’s Commodity Channel Index signal is currently at ‘Hold’ for the last 40 days. This is a bearish signal direction. The CCI metric is generally used to identify if a stock has been oversold or overbought. However, the 50 day moving average, which is used to watch for price changes, is reading ‘Sell’. The signal strength is ‘Minimum’ and the signal direction is ‘Strongest’.

The company has a moving average of $1.76 over the last month. They also have a 100 day moving average of $2.71. The moving average is versatile; it can be used as a back-up or as a trading tool. Investors can also use the moving average to monitor price movement and set a particular moving average for the stock to cross. They also serve as good indicators of entry and exit points, as well as for spotting momentum shifts. Crossing below a certain moving average may indicate a stock is swinging downward, where the opposite might be true above the moving average.

Stock price support and resistance levels are also important points to consider. The support level is defined as a point where the stock might bounce back after it has fallen. The resistance, on the other hand, measures where a stock may retreat to after a dramatic rise. In regards to Cobalt International, the investors are watching the first support level of $1.59 and the stock’s first resistance level of $1.73.

Longer term company shares are also worth considering for investors. Cobalt International currently has a 52 week low of $1.58 and a 52 week high of $21.90. Data such as this can provide investors with a wide range of data for long-term analysis.

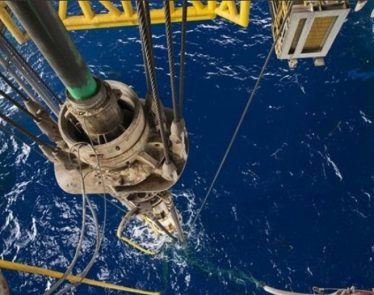

Featured Image: depositphotos/maxkabakov