April 24, 2020 (MicroSmallCap via Comtex) — It’s a unique story at a time when there’s not much to look forward to in the world. There was no confetti, no ringing of the bell, and no photos on the stock exchange. And yet, on April 24, a daily fantasy sports company completed its first trading day on the Nasdaq. And DraftKings stock surged.

DraftKings Stock: A New Player on the Nasdaq

On April 23, DraftKings (NASDAQ:DKNG) said it received approval to begin trading on one of the world’s most popular stock exchanges. The approval came after DNKG finalized a $3.3 billion merger with special-purpose acquisition company (SPAC), Diamond Eagle. Keep in mind that SBTech, a back-end betting technology provider, is also included in the merger and that the combined company will have roughly $500 million in cash on hand.

“It’s a big milestone for us, and I think in many ways some of the things we went through, the different ups and downs and curveballs, make it that much more special,” said Jason Robins, CEO of the combined company.

With no live sports to bet on, and a global pandemic keeping most people indoors, it’s easy to think that DraftKings going public with a SPAC isn’t what investors had in mind. But life is funny, and it appears this was the best move for the Boston-based company.

Not only did DraftKings stock jump 14% in its first day of trading before closing up 10.38% at $19.35, but the company was also able to add another half a billion dollars on the balance sheet at a time when it’s not easy to raise money. (DraftKings gets to add the $400 million raised in Diamond Eagle’s offering last May).

“If this were a traditional IPO, forget ringing the bell, I don’t even think we’d be able to close the transaction,” explained Robins.

>> 4 5G Penny Stocks to Add to Your Watchlist

DraftKings Stock is an Outlier

A company going public with no IPO is a standout move—especially during a global pandemic. While there are no live sports to bet on, DraftKings will be in the minds of many when the sports industry makes its return. And you know that when this happens, the drive of sports lovers will be triple what it was before the world went into lockdown.

As a result, DraftKings could very much become a household name in sports betting (just as DraftKings stock could on the market). If sports return in the fall, users will be using DraftKings to bet on everything from baseball games to golf tournaments all at the same time.

For instance, users can enter daily and weekly contests and win money based on the individual team and player performances across several sports, including the NHL, the NBA, Premier League and UEFA Champions League soccer, the XFL, and NASCAR auto racing.

There’s also speculation that some states may reconsider their hesitation about legalizing sports betting. Such reconsiderations will be based solely on the tax revenue benefits of doing so. That in itself could positively impact DraftKings stock in the future.

Takeaway

DraftKings didn’t go down the traditional IPO route, and it worked out for the better. Its established itself as an innovative company among investors, resulting in DraftKings stock surging 14% on its first day. Plus, as the world looks for something to fill the void of no sports, the excitement to eventually use DraftKings just might be that thing.

>> Read More Entertainment News

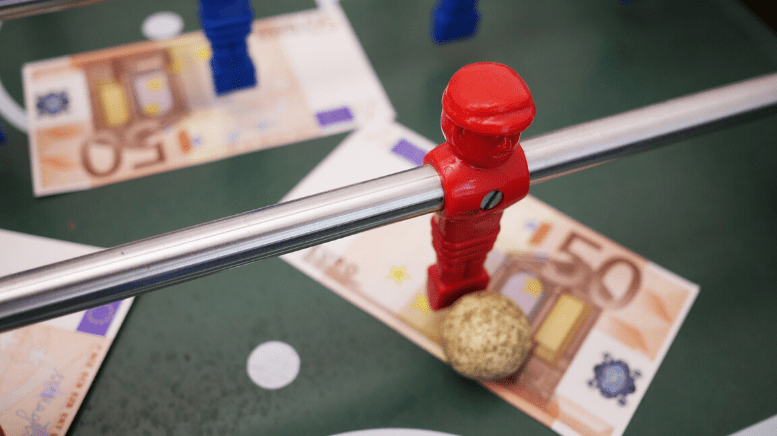

Featured image: PixaBay

Risks and Disclosure:

Information provided in this correspondence is intended solely for informational purposes and is obtained from sources believed to be reliable. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained on this website is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions made or suggested and the actual results.

All statements and opinions expressed are the opinions of the author and not of Microsmallcap.com or its officers. The author is wholly responsible for the validity of all statements. Microsmallcap.com was not involved in any aspect of the article preparation. The author was not paid by Market Jar Media Inc for this article. The author did not pay Microsmallcap.com to publish or syndicate this article.

This article does not constitute as investment advice. Each reader is encouraged to consult with his or her individual financial advisor; any and all actions taken by a reader as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Microsmallcap.com’s terms of use and full legal disclaimer. This article is in no way a solicitation for investment. Microsmallcap.com does not render general or specific investment advice. Any information on Microsmallcap.com should not be considered a recommendation to buy or sell any security. Microsmallcap.com does not endorse or recommend the business, products, services or securities of any company mentioned on Microsmallcap.com.

Futures, stocks and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks, and options may fluctuate, and, as a result, clients may lose more than their original investment and possibly their entire investment. Any content on this website should not be relied upon as advice or construed as providing recommendations of any kind. It is your responsibility to confirm and decide which trades to make. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Please see our full disclaimer here for additional details before making any investment decisions.