Options expiring in April 2018 have begun trading for Kulicke & Soffa Industries (NASDAQ:$KLIC) on the market. With 212 days until expiration, the newly trading contracts represent a possible opportunity for put and call sellers to achieve bigger profits than they would later on, due to the time value,

There is a current bid of $1.35 for the current put contract at $19.00. The price would drop to $17.65 if a seller was to sell-to-open the put contract and then collect the premium. This could be an attractive alternative to those who are already purchasing stocks of Kulicke and Soffa at the current market rate of $19.87.

It is also possible that the put contract would expire worthless, since the strike of $19.00 lies 4% below the current trading price. Odds of this happening are roughly 63% according to current analytical data. However, one could still collect a premium of 12.23% annualized if the stock was to expire worthless.

As for the call sides of this option, the current strike price of $20.00 has a bid of $1.85. Buying shares at the current price of $19.87 would result in a ‘covered call’, with a commitment to sell the stock at $20.00. If the stock gets called away at the expiration date, the investor can expect a total return of 9.96%, including the premium.

There is a rating of approximately 34% for the implied volatility. Meanwhile, the trailing twelve month volatility sits at roughly 31%.

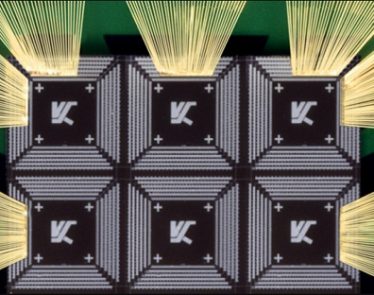

Featured Image: Depositphotos/© krasyuk