Value investing is a popular way to find great stocks in any market environment, and the best way to participate in this is by looking at several key metrics and financial ratios. With that in mind, let’s evaluate Kulicke and Soffa Industries, Inc. (NASDAQ:$KLIC) to see whether or not it’s a good choice for value-oriented investors right now.

PE Ratio

The Price to Earnings Ratio (PE Ratio) is a key metric for value investors. PE Ratio shows how much investors are willing to pay for each dollar of earnings in any given stock. To get the most out of PE Ratio, compare the stock’s current PE ratio with where this ratio has been in the past, with how it compares to the industry/sector average, and with how it compares to the market as a whole.

Kulicke and Soffa currently has a trailing 12-month PE ratio of 15.3, which compares favorably with the market on the whole (the PE for the S&P 500 compares at about 20.6). When considering the stock’s long-term PE trend, the current level puts the company’s current PE ratio a little below its midpoint of 16.9 over the past five years.

Kulicke and Soffa’s PE also compares favorably with the industry’s trailing 12-month PE ratio of 21.6. That means that their stock is comparatively undervalued at the moment.

Due to the fact that Kulicke and Soffa also has a forward PE ratio of 15.9, an increase in the company’s share price is likely to happen in the near future.

P/S Ratio

The Price/Sales ratio compares a given stock’s price to its total sales. A lower reading is considered better.

Currently, Kulicke and Soffa’s P/S ratio is about 2.4, making it a bit lower than the S&P 500 average of 3.3. It is also a little below the highs for their stock from the past few years. Together, this suggests that there has been some undervalued trading, compared to historical norms.

Broad Value Outlook

Kulicke and Soffa currently has a Value Style Score of A, which puts it in the top 20% of all stocks that can be looked at in this way, and makes the company a good choice for value investors.

The company’s P/CF ratio is 16.1, a value better than the industry average of 23.1, further suggesting its worth for value investors.

Overall Outlook

There are other things to consider beyond value when investing. Kulicke and Soffa does have a Growth grade of A, and a Momentum score of A, which gives them a VGM score/overarching fundamental grade of A as well.

The company’s recent earnings estimates have also been encouraging. In the current quarter, two estimates have gone higher in the past sixty days, while none have gone lower, and the full year estimate has seen a similar trend over the same time frame.

These trends have impacted the consensus estimate, with the current quarter consensus estimate surging to almost 57.9% in the past two months and the full year estimate rising about 6.3%.

Kulicke and Soffa has a Zacks Rank #3 (Hold), indicating in-line performance in the near future. Kulicke and Soffa is, however, enjoying bullish analyst sentiment with the many positive estimate revisions, which works in the company’s favor.

Bottom Line

Kulicke and Soffa is great for value investors, being within the top 7% of over 250 industries. However, its Zacks Rank of #3 is a cause for pause. Regardless, Kulicke and Soffa has still managed to outperform the broader market over the past year, so despite its Zacks Ranking, it is a compelling choice for value investors.

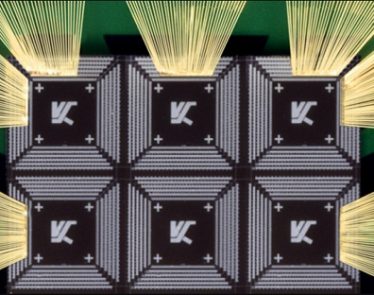

Featured Image: facebook