3D Systems stock: 3D Systems (NYSE:DDD) share price regained momentum since it announced its first quarter results for fiscal 2018. Traders and analysts are showing confidence in its business restructuring activities as the improving financial numbers vindicate the management’s stance; they believe fiscal 2018 is a corner turn year in its multi-year turnaround and transformation process.

Source Image: finviz.com

3D Systems stock price rose almost 40% in the last month alone, driven by better than expected performance in the first quarter. The 3D stock currently trades around $14 a share – with a 52-week trading range of $7.92 – $22.57 per share.

Financial Numbers are Showing Progress

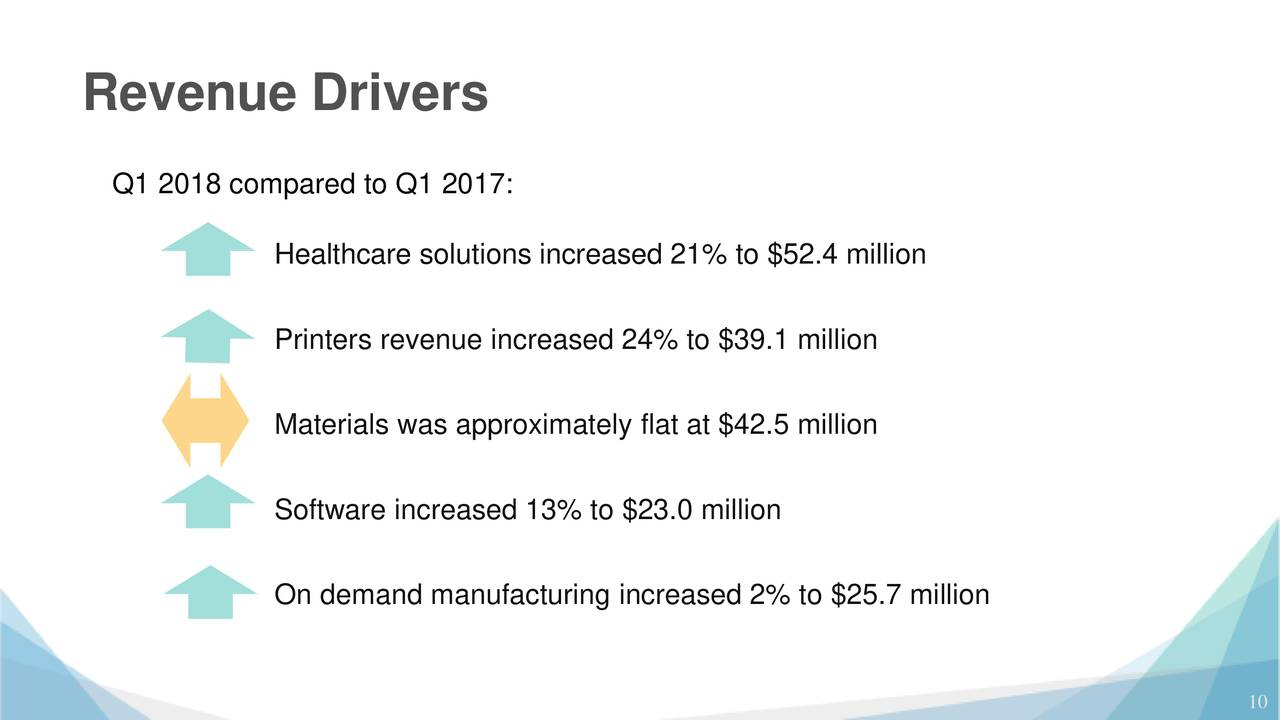

3D reported year over year revenue growth of 6% in the first quarter, supported by solid revenue growth from printers, software, and healthcare segments.

Source Image: seekingalpha.com

Revenue from the printer segment rose 24% over the past year, while healthcare solutions’ revenue jumped 21% year over year in the first quarter. The company is working on a strategy of improving its efficiencies along with the introduction of disruptive new products to sustain the momentum in the following months.

It is planning to launch a series of new products this year to increase its market share in the rapidly changing environment.

“We have made significant progress in many areas of the company, and we continue to make strategic investments in organizational and operational improvements which we believe are critical for the long term success,” commented John McMullen, executive vice president, and chief financial officer of 3D Systems.

Valuations and Stock Price Trend

3D Systems stock has gained a lot of momentum last month amid its turnaround story and smart business strategies. The market participants believe its business strategies and financial numbers will provide solid support to its share price in the following quarters. 3D stock also trades below the industry average. DDD shares are trading around 2 times to sales and 2.15 times to books ratio compared to the industry average of 2.15 time and 3 times, respectively.

>> Ameri100 Partners with Bayestree Intelligence

Featured Image: Facebook