At Thursday close, Nova Measuring Instrument, Ltd. (NASDAQ:$NVMI) saw an incredible drop of volume. The volume dropped below its normal daily average by 98.24%.

In short interest, investors are looking more bearishly at the company’s stock. From August 15 to August 31, 2017, saw a rise in short interest of 29.03%, with short shares growing from 249,946 to 322,513. The days to cover are 2.0 based on a volume of 182,745 and the aforementioned 322,513 shares. On August 31st, the percentage of short interest is 0.01%.

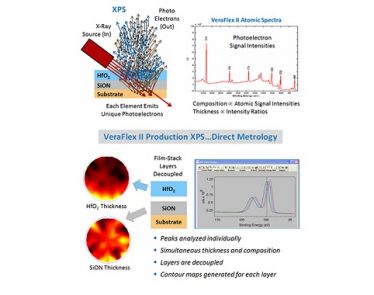

Nova Measuring Instruments Ltd. is involved in metrology solutions and the manufacturing industry. The company builds x-ray and optical standalone metrology systems, which attach to wafer fabrication process equipment. Its products are used to test critical-dimension variables, film thickness, and composition properties.

At close on Wednesday, September 20, the company traded at $25.94, 1.18% lower. Its 50-day moving average is $23.95 and a 200 day moving average of $22.22. The company has a market cap of $717.41 million.

During the company’s last earnings report, it reported an EPS of $1.09 with a forecast of $1.79 for the current year with 27,655,000 shares outstanding. Forecasts predict next year’s EPS to be $1.87 and next quarter’s EPS is predicted to be $0.39.

Several firms traded the company’s stock recently;

- Sensato Investors LLC sold 76,131 shares, resulting in a current ownership of 11,771 shares valued at $260,000, an overall drop of 84.1%.

- Edmond De Rothschild Holding S.A. bought 2,141 shares in the quarter. They now own 27,591 shares valued at $633,000, representing a 38.5% increase.

- Ubs Group AG bought 5,981 shares and now holds 6,541 shares worth of $144,000, representing an increase of 1,340.0%

- Eam Investors, LLC sold 25,720 shares. They currently own $2,466,000, a 18.7% decrease since last quarter.

Featured Image: novameasuring