Large Drill Programs Planned for 2022 as the Company Drives Towards Mineral Resource Estimates

Vancouver, British Columbia – January 20, 2022 – Summa Silver Corp. (TSXV:SSVR)(OTCQB:SSVRF) (“Summa” or the “Company”) is pleased to provide an update on exploration activities and to report results from a rock sampling program at its high-grade Mogollon Property, near Silver City, New Mexico.

Sampling Highlights

- Ultra High Grades Present: Multiple samples returned grades which exceeded 1,000 g/t AgEq* and locally exceeded 5,000 g/t AgEq* (see Table 1).

- Widespread High-Grade Silver and Gold: The sampled area covers a footprint of 3.5 x 3.5 km, highlighting the considerable scale of the Mogollon property and confirming it as a mineralized high-grade precious metal district (see attached figures).

- Numerous Undrilled Targets Emerging: Most high-grade veins at surface have never been drilled and present compelling discovery opportunities after the Consolidated Extension area is drilled out in 2022.

*Silver equivalent (AgEq) based on 85(Ag):1(Au)

Aggressive Drilling Planned for 2022

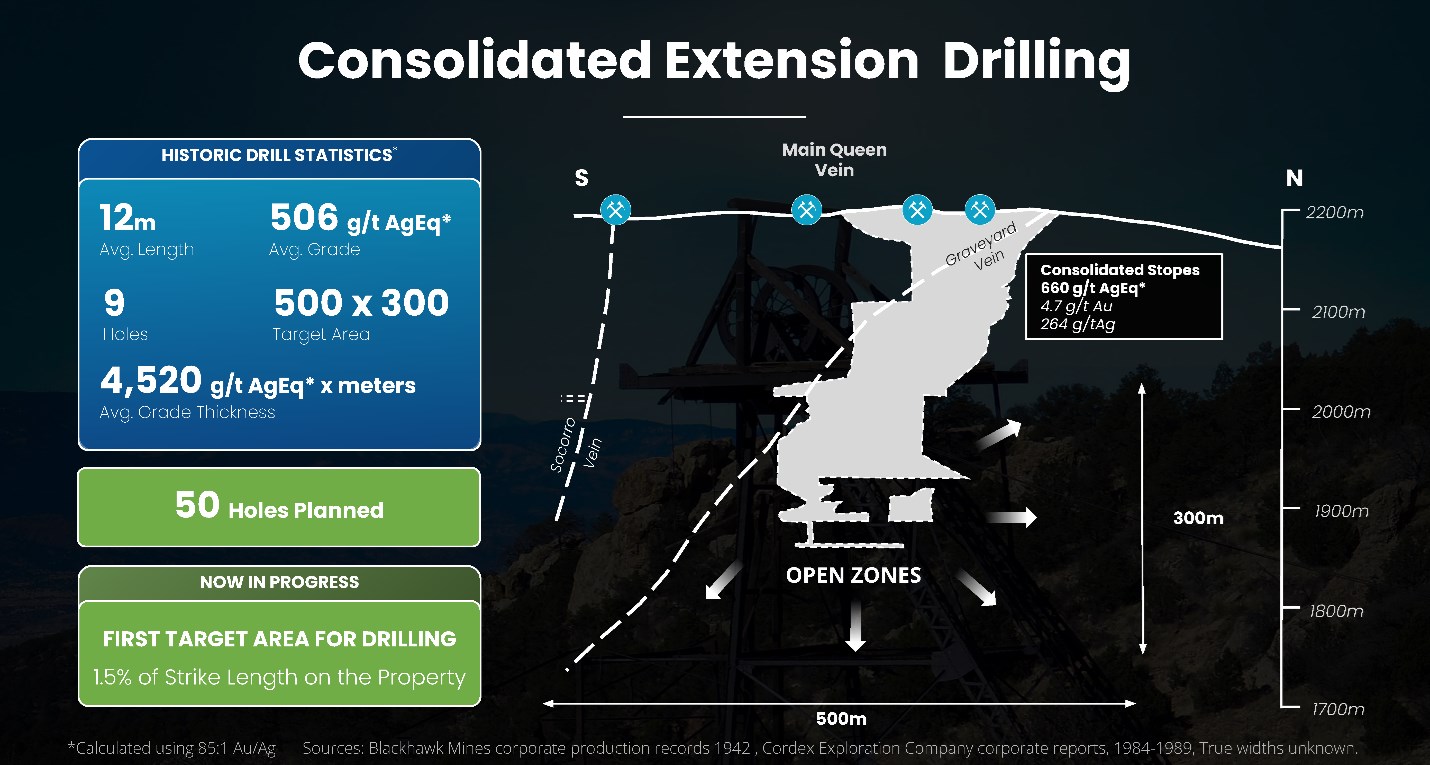

- Fifty Holes Planned at the Mogollon Property: The Consolidated Extension target, which is currently being drilled and represents only 1.5% of the prospective strike length of vein/structure on the property warrants 50 holes of drilling.

- Consolidated Extension: High-grade mineralization has been intersected in historical drilling over an area of 500 x 300 m where it remains open to expansion and 9 historic holes intersected an average grade of 506g/t AgEq* over an average length of 12.0 m1.

- Twenty-Five Holes Planned at the Hughes Property: In addition, The Rescue and Murray targets, which have already returned substantial high-grade drill intercepts warrant 25 holes of drilling.

- Mineral Resource Estimates: The major focus for drilling in 2022 will be geared towards delivering mineral resource estimates when the planned holes are completed.

- Drill Hole News Flow: It is anticipated that results from holes testing zones of known high-grade mineralization will be released regularly throughout 2022.

Galen McNamara, CEO, stated: “We expect 2022 to be transformative for the Company. Extensive drill programs are required on both properties as we aggressively push towards mineral resource estimates. As this process moves forward, we also expect to regularly release results from up to 75 holes, all of which are planned to test zones of known high-grade mineralization on either an extension or infill basis. Additionally, the presence of high-grade at surface in numerous veins validates the high potential of the Mogollon property. In the bigger picture, the current drilling area at the Consolidated Extension target represents only a small part of the story here. As exploration and drilling advance, we will soon find out if Mogollon is one of the great vein fields left in the United States.”

Figure 1: Sample Locations showing current drilling area at the Consolidated Extension target

Table 1: Selected results from rock samples

| Sample ID | Sample Type | Vein | Easting | Northing | Au (g/t) |

Ag (g/t) |

AgEq* (g/t) |

| MOG1101-05 | Float | Fanney | 704504 | 3698081 | 43.1 | 1,960 | 5,624 |

| MOG1101-03 | Dump | Fanney | 704448 | 3698216 | 27.0 | 1,450 | 3,745 |

| MOG1101-07 | Dump | Fanney | 704422 | 3698208 | 10.7 | 794 | 1,704 |

| CO905C-2 | Outcrop | Fanney | 703823 | 3698414 | 7.3 | 167 | 789 |

| CO908D-3 | Outcrop | Fanney | 703653 | 3698589 | 5.4 | 153 | 609 |

| MOG1101-02 | Dump | Queen | 704411 | 3698303 | 32.8 | 2,450 | 5,238 |

| MOG1031-01 | Dump | Queen | 704542 | 3697650 | 30.8 | 914 | 3,532 |

| MOG1101-01 | Outcrop | Queen | 704627 | 3698023 | 21.6 | 756 | 2,592 |

| MOG1031-02 | Float | Queen | 704923 | 3698748 | 21.3 | 435 | 2,246 |

| MOG1031-05 | Dump | Queen | 704753 | 3698637 | 14.8 | 245 | 1,499 |

| CO907A-3 | Outcrop | Queen | 704774 | 3698526 | 4.0 | 187 | 529 |

| C1003D-3 | Outcrop | Maud | 703698 | 3698106 | 21.3 | 371 | 2,182 |

| MT-249 | Outcrop | Last Chance | 703069 | 3697361 | 13.4 | 376 | 1,515 |

| MT-033 | Outcrop | Great Western | 702322 | 3698756 | 12.1 | 344 | 1,373 |

| MT-236 | Outcrop | Great Western | 702321 | 3698753 | 2.7 | 211 | 444 |

| CO830A-2 | Outcrop | Johnson | 703723 | 3698810 | 10.5 | 170 | 1,063 |

| CO830B-4 | Outcrop | Johnson | 703604 | 3698810 | 6.8 | 108 | 689 |

| MT-016 | Outcrop | Johnson | 703488 | 3698821 | 2.7 | 303 | 536 |

| MT-010 | Outcrop | Gold Dust | 703603 | 3696146 | 2.7 | 175 | 405 |

| MT363 | Outcrop | Pacific | 702932 | 3697907 | 7.2 | 255 | 867 |

| C1006C-2 | Outcrop | Pacific | 702972 | 3697861 | 5.3 | 292 | 743 |

*Silver equivalent (AgEq) based on 85(Ag):1(Au). Coordinates are presented in NAD83 Zone 12N. Summa Silver Corp. (TSXV:SSVR)(OTCQB:SSVRF) cautions readers that grab samples are selective in nature and that the resulting assays may not be representative of all mineralization on the property.

Figure 2: Longsection of the Consolidated Extension target (current drilling area)

Figure 2: Longsection of the Consolidated Extension target (current drilling area)

Property-wide Geological Mapping and Rock Samples

Areas of historic surface workings (e.g. blasted pits and trenches), as well as newly identified zones of mineralization were the focus of systematic geological mapping and rock sampling across the property. Selective rock-chip and representative channel samples across outcropping veins were collected as well as selective samples of historic mine dumps and float. The goal of the sampling program was to confirm the grade, style and nature of vein-hosted high-grade silver and gold mineralization historically mined in the district.

A rock geochemical database of over 450 samples has also been constructed with approximately 200 samples collected by the company and 250 acquired from a third-party. The sample data cover a footprint of approximately 3.5 by 3.5 km and comprise geochemical data from most of the main structures and veins recognized on the property.

North- and northwest-striking, structurally-controlled veins and vein-breccias are dominantly comprised of quartz with lesser calcite and minor adularia, fluorite and barite locally mineralized with native gold, electrum and argentite. Veins vary in width from 0.5 to 10 m and are traced for over 2.5 km. Over 34 km of veins have been delineated on the property, however, only 0.5 km of veining is currently being drill tested.

Highlights from the geochemical database are:

- Fanney Vein: Channel and grab samples collected systematically along a 1.2 km strike length of locally exposed Fanney Vein system as well as from dumps near the historic Fanney mine (e.g., 2,450 g/t Ag with 32.8 g/t Au) confirm the high-grade silver and gold contents. Although the site of significant but unknown total amounts historic mining, the Fanney Vein remains relatively underexplored and there is good potential for the discovery of un-mined ore shoots.

- Queen Vein: The north-trending Queen vein system has been mapped with a strike-length of at least 2.8 km. Selective and representative grab samples were collected from along the Queen vein (Figure 1) covering a distance of over 1.2 km. High-grade results (e.g., 914 g/t Ag with 30.8 g/t Au and 756 g/t Ag with 21.6 g/t Au) confirm the significant potential of the underexplored Queen vein system.

- Last Chance Vein: Rock samples were collected over 1.2 km of strike length along the east-west striking Last Chance vein system. Samples returned grades of up to 376 g/t Ag with 13.4 g/t Au from outcropping veins and support the potential for discovery of un-mined ore shoots.

- Pacific Vein: The Pacific vein has been traced for over 500 meters on the property and selective sampling of the veins yielded high-grade results such as 255 g/t Ag with 7.2 g/t Au. The north-trending Pacific vein is approximately 1.7 km west of the parallel Queen vein and has never been drill tested.

- Great Western Vein: The north to northeast-trending Great Western Vein system has been traced for up to 1.6 km on the property. Grades of up to 244 g/t Ag with 12.1 g/t Au were returned from rock-chip samples from north-striking veins to the south and up to 102 g/t Ag with 5.0 g/t Au from northeast-striking veins to the north. This vein has never been drill tested.

- Johnson Trilby Veins: The east-west trending Johnson Trilby veins have been mapped for over 1.3 km of strike-length. Samples of outcropping veins returned high-grade results including 170 g/t Ag with 10.5 g/t Au. Besides local historic exploration pits and evidence of some mining, the prospective Johnson Trilby veins remain completely undrilled.

Associated multi-element geochemical data (e.g., pathfinder elements) are also used to provide key alteration and geochemical proxies for the lateral and vertical zoning within the epithermal-related veins. Many of the outcropping veins with anomalous silver and gold concentrations also have high-epithermal pathfinder element geochemistry (e.g., As, Sb, and Hg). These data suggest that many of the outcropping veins represent the upper portions of the epithermal system. Recent modeling of the district suggests that certain paleo-depth horizons contain the bulk of the high-grade mineralization. The company is currently compiling all new and historic data from across the entire vein field with the goal of reconstructing the epithermal systems. These models will be used inform drill depths to better target deeper, higher-grade zones on many of these new and untested targets.

Mogollon Property

The 2,467-acre Mogollon Property is located in the historically prolific Mogollon mining district of southwest New Mexico, approximately 120 km north of Silver City. Numerous underground workings have exploited high-grade gold and silver veins from three primary mines: Fanney, Last Chance and Consolidated. Mining ceased in 1942 and the district has since been largely inactive other than a few exploration drill programs in the 1980s and in 2010: totalling 15,600 m. The property hosts approximately 34 km of near-continuous epithermal-associated veins and faults where only 0.5 km of that veining is currently being drill tested. The Company believes that the Mogollon Property therefore offers a unique opportunity to build high-grade ounces near historic past-production while systematically exploring for new discoveries using modern techniques.

Analytical and Quality Assurance and Quality Control Procedures

Select samples were sent to ALS Global Ltd. (“ALS”) in Reno, NV for preparation and analysis. ALS meets all requirements of International Standards ISO/IEC 17025:2005 and ISO 9001:2015 for analytical procedures. Samples were analyzed for gold via fire assay with an AA finish (“AU-AA23”), and for silver via inductively-coupled plasma, atomic-emission spectroscopy (ICP-AES) after four-acid digestion (“ME-MS61”). Samples assaying over 10 ppm Au via AU-AA23 were re-run via fire assay for Au with a gravimetric finish (“AU-GRA21”). Samples that assayed over 100 ppm Ag via ME-MS61 were re-run via fire assay for Ag with a gravimetric finish (“AG-GRA21”). ALS Global inserts reference standards, duplicates, and blank samples in each batch of samples with standard internal QA-QC procedures, which all returned results within acceptable levels.

Select samples were sent to Paragon Geochemical Laboratories in Sparks, Nev., for preparation and analysis. Paragon meets all requirements of the International Accreditation Service AC89 and demonstrates compliance with International Organization for Standardization/International Electrotechnical Commission standard 17025:2017 for analytical procedures. Samples were analyzed for gold via fire assay with an AA (atomic absorption) finish (Au-AA30) and silver via atomic emission spectroscopy after four-acid digestion (AgMA-AAS). Samples that assayed over five parts per million Au were rerun via fire assay with a gravimetric finish (Au-GR30). Samples that assayed over 200 ppm Ag were rerun via fire assay for Ag with a gravimetric finish (Ag-GRAA30). Paragon inserts reference standards, duplicates, and blank samples in each batch of samples with standard internal QA-QC procedures, which all returned results within acceptable levels.

Data Verification

The data disclosed in this news release relating historic drilling is historic in nature. The Company is unable to verify the data as drill hole rock samples are unavailable, precise drill hole collar locations are unknown, and down-hole survey data is incomplete. As such, the Company is treating the drill results as historical in nature and investors should not place undue reliance on such data. The Company’s future exploration work will include verification of the data.

Marketing

The Company has entered into a 12-month marketing and consulting contract with Toronto-based marketing firm, North Equities Corp. (the “Contract”). North Equities Corp. specializes in various social media platforms and will facilitate greater awareness and widespread dissemination of the Company’s news. In connection with the Contract, which can be cancelled by the Company after 6 months, the Company agreed to pay North Equities $200,000 and has issued 200,000 stock options at a price of $0.99. The stock options vest in equal installments every three months beginning three months after they were issued and expire on July 19, 2023. North Equities does not currently own any shares of the Company.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp

Summa Silver Corp. (TSXV:SSVR)(OTCQB:SSVRF) is a Canadian junior mineral exploration company. The Company has options to earn 100% interests in the Hughes property located in central Nevada and the Mogollon property located in southwestern New Mexico. The Hughes property is host to the high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929. The mine has remained inactive since commercial production ceased in 1929 due to heavily depressed metal prices and little to no modern exploration work has ever been completed prior to the Company acquiring an interest in the property.

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

References

1Drill Logs, Cordex Exploration Company Records, 1984-1989

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. These forward‐looking statements or information relate to, among other things: the release of assays, the intended completion of mineral resource estimates, and the exploration and development of the Company’s mineral exploration projects including completion of surveys and drilling activities.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the requirement for regulatory approvals; enhanced uncertainty in global financial markets as a result of the current COVID-19 pandemic; unquantifiable risks related to government actions and interventions; stock market volatility; regulatory restrictions; and other related risks and uncertainties.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses, and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

SOURCE Summa Silver Corp. (TSXV:SSVR)(OTCQB:SSVRF)

[BONUS-POPUP id=”1″]