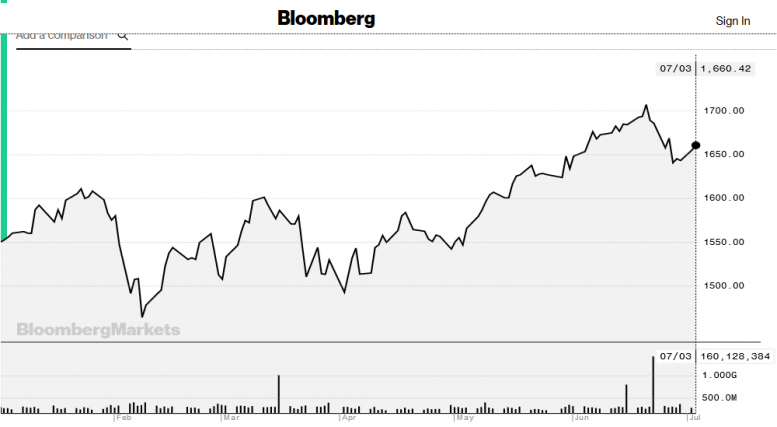

The small-cap Russell 2000 index outperformed S&P 500 index by a wide margin this year!

The Russell 2000 index, which is composed of 2000 small-cap stocks, has been generating solid returns for investors over the years. The index grew more than 7% since the start of this year, compared to the increase of only 2.5% from the S&P 500 index. The higher returns from the Russell 2000 index indicate the strength of small-cap stocks that are in the stage of growing their businesses combined with setting their direction for long-term gains.

The Russell 2000 index had experienced a stunning rally in the second quarter this year; the index rose for eight weeks straight before posting the first weekly loss at the end of June. The Russell 2000 index currently stands at around 1660 points, just shy from the all-time high of 1700 points it achieved at the end of last month.

Donald Trump’s Strategies Are Enhancing Investors Confidence

Small-cap stocks are gaining confidence from investors; these stocks are less exposed to external headwinds, such as the impact of the trade war and higher tariffs. Donald Trump’s strategy of reviving domestic industry and reducing the country’s dependence on imports has also been providing substantial support to small-cap companies.

Investors have also realized the impact of Trump’s strategy on domestic markets; roughly $7.5 billion is poured into exchange-traded funds (ETFs) that are focused on small-cap stocks – the highest level of investments in small-cap ETFs since November 2016.

Chief investment strategist at Charles Schwab & Co says, “The growth in investments in small-cap stocks represents the strategy of capitalization on more domestically-oriented companies that are more immune to the trade disputes.”

>> Cannvas MedTech Hits 52-Week High After CNSX Listing Application

Small-cap Russell 2000 Index Outperformed S&P 500 Index: The Takeaway

Though the risk of loss is higher than large-cap stocks, small-cap stocks always have the potential to move faster due to their simple business models, innovative new business ideas, as well as less competition from multinational companies.

Featured Image: Twitter