Penny stocks are tricky. If you want to make serious gains in this game, watching the stock market closely is imperative. Volatility is a big fact of small-business trading, so knowing when to buy and when to sell is important for success.

We like keeping an eye on potential winners offering opportunities.

Tulsa-based Mid-Con Energy Partners LP (NASDAQ:MCEP) could be one of these at present.

Penny Stocks to Watch: Mid-Con Energy

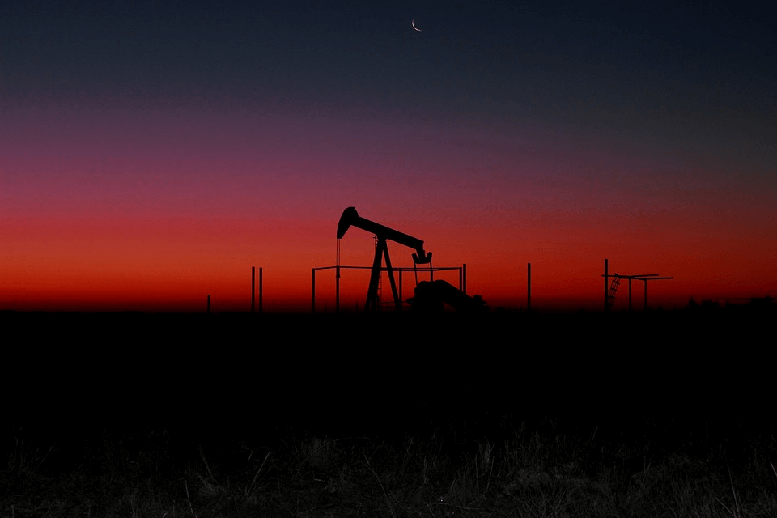

Mid-Con is an upstream oil and natural gas producer. Any company in this business faces one fact: oil prices may boost your stock, but equally may kill your stock.

As an oil producer, times are great when oil is selling high. But unfortunately, times are bad if oil is selling low. And 2018 was no easy year for the oil sector, meaning Mid-Con struggled to generate revenue.

All-in-all, with oil barrels selling for as low as $46 USD, this penny stock fell low too… very low.

>> Tenax Therapeutics Stock Soars Following Heart Study Update

Now, crude oil trades at around $68 per barrel. At these prices, oil is climbing again. So shouldn’t MCEP be climbing with it?

Well, unfortunately for the MCEP penny stock, it has yet to recover back to its once $27 per share price tag. After the oil slump of 2016, MCEP became a penny stock and has never truly recovered since.

Penny Stocks Potential

But now, analysts are saying that “company financials may have begun a turnaround.”

Estimated revenues remain below $60 million for both 2018 and 2019, and this means the stock is still speculative.

But there was that time when MCEP traded above $20 per share. This was also when oil traded above $100 per barrel. Oil is gaining again, and if it can hit those highs once more then who knows where MCEP will go. This is why for $0.79 USD at present, the MCEP penny stock could be offering big potential for a low price.

Of course, whether you want to risk it or not remains up to you. Always do your own research or seek professional opinion before making any investment decisions.

Feature Image: Pixabay