Almost all of the major indices have begun showing signs of revival since the COVID-19 crash. This crash began in late February and crescendoed in March, leaving once-in-a-generation losses across the board in its wake. Fortunately, April has provided some relief, and among the indices, the NYSE has done particularly well. The NYSE composite, for instance, is up 23.5% from the worst of the crisis, which is about halfway to returning to its pre-crash levels. In the spirit of optimism, today we’ve got an NYSE penny stocks list of companies investors should be watching through the end of the month and beyond.

NYSE Penny Stocks List: Build-A-Bear Workshop Inc (NYSE:BBW)

Build-A-Bear is a global toy brand with over 500 stores worldwide. At these stores, customers create customizable teddy bears.

For fiscal 2019, BBW posted total revenue of $338.5 million, a marginal increase of $2.0 million, or 0.6%, from the previous year. At the year-end, dated February 1, the company’s consolidated cash balance was $26.7 million, with no borrowings on its credit facility.

Of course, any outlook the company had for its fiscal 2020 was completely disrupted due to the COVID-19 crisis. Just a few weeks after its relatively optimistic earnings report, Build-A-Bear furloughed 90% of its workforce. These employees will not receive direct compensation from the company.

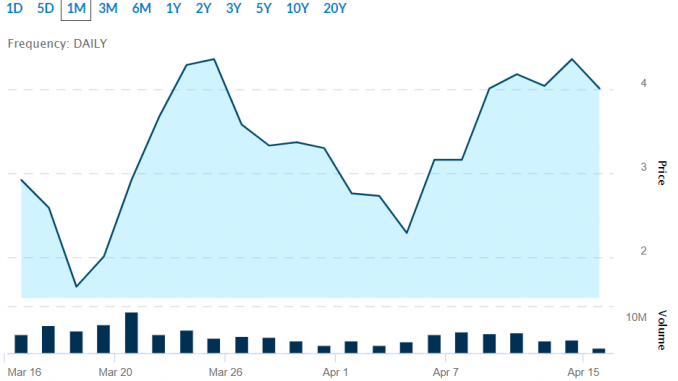

After dropping 78.6% from February 21 to the end of March, BBW has rallied in April. At first, its gains were gradual, but lately, the stock has been picking up steam. BBW is up 65.6% over the last week of trading and shows no signs of slowing down. Trading at $1.90 at the time of writing, it’s still lower than its price of $3.15 from the start of the year.

According to MorningStar, BBW has a “fair value” of $4.32, representing a potential 127.36% upside from its price at the time of writing.

NYSE Penny Stocks List: Everi Holdings Inc (NYSE:EVRI)

Everi supplies entertainment and technology solutions for the casino, interactive, and gaming industry. It develops gaming machines, systems, and services, and is the leading provider of core financial products and services. These include player loyalty tools and applications, as well as intelligence and regulatory compliance solutions.

Near the end of March, Everi provided a business update detailing how it will address the COVID-19 pandemic. To obtain near-term liquidity, the company drew down $35 million on its revolving credit facility. It also implemented targeted furloughs and company-wide salary reductions to reduce cash burn.

>> 5 High Volume Penny Stocks You Should Avoid

Pre-crash, EVRI shares were trading at $14.46. Within a month, the share price was down nearly 90% to a low of $1.65 on March 18. Since then, however, the stock has steadily rallied throughout April and could continue to rise as its next earnings report nears.

The most encouraging thing about EVRI is likely its three positive analyst ratings on MarketBeat. Likewise, MorningStar has set the stock’s “fair value” price at $9.65. This represents a potential 140% upside from its price of $4.01 at the time of writing.

NYSE Penny Stocks List: Alta Equipment Group Inc (NYSE:ALTG)

Alta owns and operates one of the largest integrated equipment dealership platforms in the United States. Through its extensive branch network, it sells, rents, and provides parts and service support for several categories of specialized equipment. This includes lift trucks, aerial work platforms, cranes, earthmoving equipment, and other industrial and construction equipment.

According to its full-year 2019 fiscal report, Alta’s net revenue increased 35% year-over-year to $557.4 million. This was driven by the acquisition of Northland Industrial Truck Co, as well as continued growth in Alta’s core businesses. In addition, gross profit increased to 27.3%, compared to 26.7% in 2018.

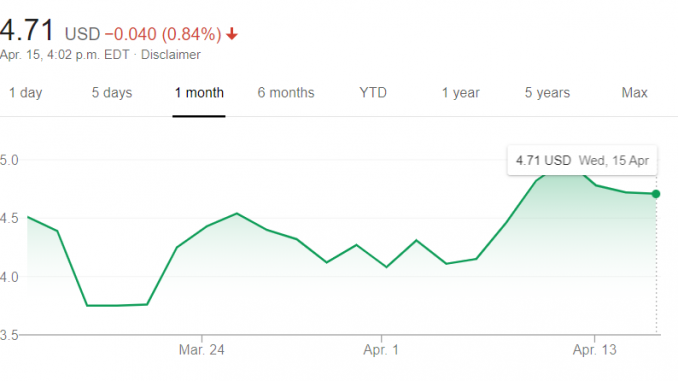

These highly encouraging results gave ALTG its first share price increase since the COVID-19 crash. That crash brought the stock careening down from $10.60 to a low of $3.50, which is a loss of 66% in just one month. Since announcing its gains from 2019, however, the company’s stock has regained 25% and is trading at $4.71 at the time of writing.

On April 7, analysts at Dougherty & Co initiated coverage on ALTG. Not only did they award the stock a “buy” rating, they also set a price target it $8.50. This represents an 80.46% increase from its current price.

NYSE Penny Stocks List: Tsakos Energy Navigation (NYSE:TNP)

Founded in Greece in 1993, Tsakos Energy is one of the most established public shipping companies in the world. Its highly diversified energy fleet consists of 68 double-hull vessels. This includes two suezmax tankers and one LNG carrier under construction, constituting a mix of crude tankers, product tankers, and LNG carriers.

The company published its 2019 fiscal report on March 24. For the year, Tsakos produced a positive net income of $15.1 million, which was $76 million more than in 2018. This improvement was primarily due to the very strong freight market that developed in Q4. That market resulted in voyage revenues of $597.5 million, and it is still going strong today.

>> Short Squeeze Review: 4 Stocks to Consider

In addition, operating income came out to $113.5 million, compared to $37.8 million in 2018. Finally, Adjusted EBITDA totaled $257 million in 2019, which was $66.2 million, or 35%, more than the previous year.

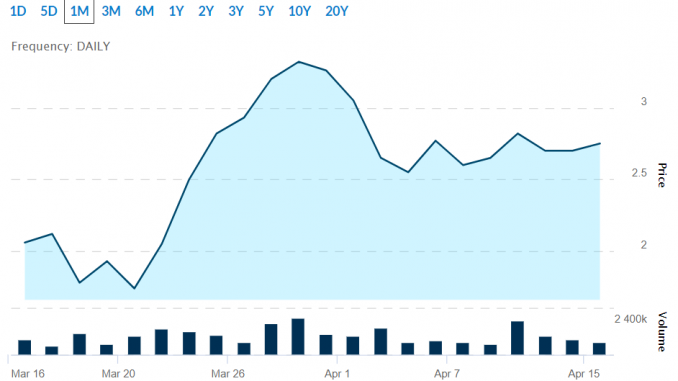

TPN’s astonishing results drove the share price up almost 90% between the end of March and the beginning of April. It’s holding tight around $2.75 at the time of writing, though that’s still down 28.76% from its price at the start of the year.

According to MorningStar, TPN has a “fair value” of $4.50. This represents a potential 63.63% upside from its price at the time of writing. The stock also currently enjoys an average “Strong Buy” rating from Wall Street analysts, according to InvestorsObserver’s ranking system.

NYSE Penny Stocks List: Tortoise Energy Infrastructure Corp. (NYSE:TYG)

Tortoise Energy Infrastructure is a closed-ended equity mutual fund launched and managed by Tortoise Capital Advisors. It owns a portfolio of master limited partnership investments in the energy infrastructure sector.

The company’s objective is to invest in companies operating in the energy infrastructure sector. However, it places an emphasis on those engaged in natural gas, coal, crude oil, or refined petroleum products.

As of March 31, the company’s unaudited total assets were $715.3 million. Its unaudited net asset value was $170.6 million, which accounts for $3.17 per share. This should keep it in a highly flexible position throughout the current economic downturn.

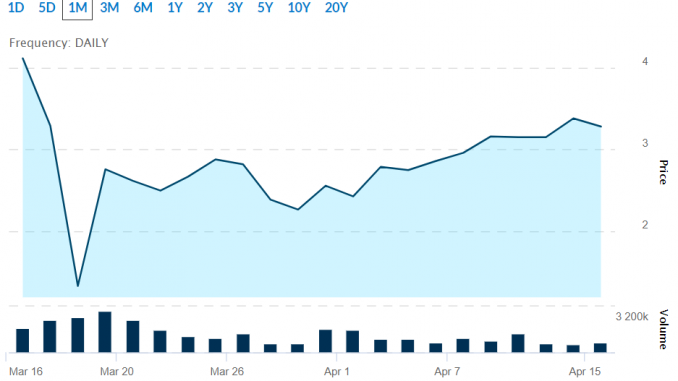

As with other energy stocks, TYG was hit not only by the COVID-19 crisis but also by the ongoing oil price war between OPEC and Russia. Though the stock has recovered 144% from its lowest point during the crash, which it hit on March 18, it remains down 82% from its price at the start of 2020.

Trading at $3.28 at the time of writing, TYG is one of the best long-term plays for the oil price war. As part of the larger Tortoise network, it is likely one of the more stable companies in the sector. What’s more, investors are unlikely to find such a diversified energy stock at such a low price again.

Takeaway

Today’s list isn’t dominated by one industry, which is encouraging for investors. Perhaps the days of single-sector-swings—where healthcare penny stocks or gold penny stocks were the only ones to rise—are over. Though that’s not to say the market promises to be stable throughout the end of April or beyond.

Another encouraging takeaway from today’s list is that many of these companies haven’t been penny stocks for long. Prior to the recent crash, most would be trading around, or above, $10.00. So if any entry on our NYSE penny stocks list seems like a good play to you, consider this your chance to buy low.

Remember, though: always make sure to do your own research before investing. Happy hunting!

Featured image: DepositPhotos © stu99