Every day, fears about the trade war and an ensuing recession have analysts feeling increasingly bearish about the economy. But whenever the rest of the market looks like dirt, there’s one sector that glints brightly at investors. Once again, it’s time to talk about how gold stocks can keep your portfolio safe—and even provide some growth—when the economy takes a turn for the worse.

Why Gold Stocks are a Good Investment Right Now

During the last global recession, the S&P 500 Index fell approximately 37% between late-2007 and mid-2009. That’s a pretty disastrous tumble. At one point during that time, gold was down around 10%—but it didn’t stay there for long.

In fact, gold stocks came out of the 2009 recession 24% higher than they entered it.

Ironically, gold stocks tend to better when the rest of the market takes a notable hit. Because gold is famous for being a less volatile investment than almost any other material or industry, investors treat it as a safe haven.

Currently, amidst US-China trade war tensions, the Swiss multinational investment bank UBS Group AG projects that the metal will be worth $1,600 in less than six months and hit $1,650 within a year.

Why Small- and Micro-Cap Gold Stocks Might Be the Best Play

While any kind of gold stock is likely a good play right now, small-cap gold stocks might be the best choice of all. Small-cap and micro-cap companies tend to be better able to adapt to changing economic conditions. In fact, small-cap gold mining companies have already provided a 27% return on the year-to-date.

We’ve already given you a breakdown or two about small-cap gold stocks. This time, let’s take a look at some of the micro-cap gold companies that are poised to be the likeliest candidates for investor safe havens in the coming months.

Remember, the earlier you find one of these havens, the better you’re likely to come out in the long run.

Mandalay Resources Corporation (Market Cap: 108.35M)

Mandalay Resources Corporation (TSX:MND) (OTCQB:MNDJF) is currently focusing on increasing production at its gold operations in Australia and Sweden to generate near-term cash flow.

Additionally, on October 8, it announced that it has entered into an agreement with Equus Mining that is likely to net the company shares in Equus and significant percentages of gold operations from the Cerro Bayo Mine in Chile. This makes it one of the most promising gold stocks on the TSX.

>> US Steel Stock Hits 3-Year Low on Cost Cutting Plans

According to Mandalay’s Q2 financial results, which were released in August, the company generated revenue of $26.3 million for the three months ending June 30. Adjusted EBITDA worked out to $4.1 million, and it posted an adjusted net loss before special items of $3.9 million. Also, gold production was approximately 19,500 oz/Au, and cash costs were around 1,130/oz. This puts the resource corporation on solid footing as it moves towards cash flow.

Mandalay started the year at $0.85 and opened the market today at $1.15. That’s a 35% return on the year-to-date.

GoGold Resources Inc. (Market Cap: 118.93M)

Another of the TSX’s high-performing gold stocks is GoGold Resources Inc. (TSX:GGD) (OTCQX:GLGDF). At the start of 2019, the stock price was $0.27, and today it’s $0.64, providing 137% returns.

What’s more, the company—which produces both gold and silver at its operations in Mexico—began trading its common shares on the OTCQX Market just a few days ago.

At the end of August, GoGold announced that it was accelerating the acquisition of the Los Ricos asset, which it now fully owns. According to the company’s most recent assay results, a hole in one of the Los Ricos veins averaged 3.33 g/t gold equivalent made up of 1.38 g/t gold and 145.9 g/t silver. President and CEO of GoGold called these results “encouraging.”

Liberty Gold Corp. (Market Cap: 215.18M)

Like GoGold, Liberty Gold Corp. (TSX:LGD) (OTCPK:LGDTF) has had a great year, becoming a major gainer among gold stocks on the TSX.

In just over nine months, it’s grown from $0.32 to $0.97. That means its returns on the year-to-date have been just a hair’s breadth above 200%. A lot of this growth has come from recent news.

At the start of the month, the company announced that it had hit high-grade gold at its Black Pine project in Idaho. Results included 2.51 grams per tonne (g/t) oxide gold over 41.1 meters and 0.94 g/t gold over 100.6 meters.

In addition to its operations in Idaho, the company also has major gold projects in Utah and Nevada. All of its projects fall within the Great Basin area.

To quote George Hearst from the American western TV show Deadwood, “Gold is every man’s opportunity. Our agreement that gold has value gives us power to rise above.”

These three micro-cap gold stocks, and others like them, might just be investors’ best opportunity to rise above the current economic woes introduced by the trade war and recession fears.

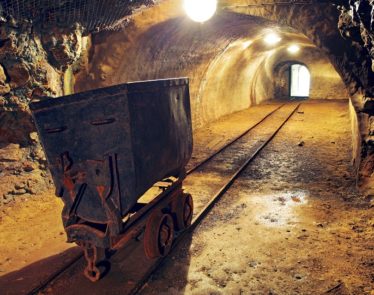

Featured image: DepositPhotos © tankist276