The price of gold has been on an upward trend since the spring, reaching past $15,000 USD per ounce and experiencing highs not seen since 2013.

With rising political uncertainty due to the US-China trade war and Brexit, investing in gold stocks seems like the best option for investors to protect their portfolio from volatility. But, which gold stocks will offer the best payout?

Here are the small-cap gold stocks that have made significant gains so far this year.

High-Performing Small-Cap Gold Stocks

Canadian gold producer Equinox Gold Corp (TSXV:EQX) (NYSEAMERICAN:EQX) is one company that has had a rockstar year, increasing the mineral resources at two of its gold projects, closing a sizable $130 million investment and listing on the New York Stock Exchange.

Equinox expects to be producing over one million ounces of gold per year by 2023 from its three mines, two of which are located in California and one in Brazil, making this a small-cap gold stock worth watching. So far this year, Equinox’s share price has increased by 57.58% to $7.80 CAD.

Gran Colombia Gold Corp. (TSX:GCM) (OTCQX:TPRFF) is another Canadian gold company that has had a stellar 2019 so far. Gran Colombia, which is the largest underground gold and silver producer in Colombia, recently revealed that it is on track to produce between 225,000 and 240,000 ounces of gold this year.

The company has been on such a roll this year that is was one of the small-cap gold stocks featured in the TSX30, a program that recognizes the 30 top-performing TSX stocks over a three-year period based on share price appreciation.

Gran Colombia Gold’s share price is up 83% so far this year, likely due to its increased production guidance and growing revenue.

A third Canadian-based company, K92 Mining Inc. (TSXV:KNT) (OTCQX:KNTNF), has also seen some significant gains in 2019 thanks to the hard work being done at its Kainantu Gold Mine in Papua New Guinea.

Just last month, K92 announced its Q2 2019 results, which revealed a decreased 2019 cost guidance and increased production guidance.

Moving forward, there are a number of catalysts that could boost K92 Mining’s stock even higher, including a mine resource expansion and a Preliminary Economic Assessment (PEA). K92 stock is up an impressive 147.19% and is poised to go even higher.

>> Penny Stocks to Watch: Callon Petroleum and Liberty Defense

More Small-Cap Gold Stocks Making Gains

Veteran gold miner, Wesdome Gold Mines Ltd. (TSX:WDO) (OTCPK:WDOFF) is a small-cap gold stock with over 40 years of experience and more than 30 years of continuous gold production. The company is focused on three 100% owned projects in Canada.

Last month, Wesdome’s Q2 2019 financial results included revenue of $42.3 million CAD, representing a 30.2% increase from Q1, and an EBITDA of $19.5 million CAD, an increase of 57.3%. It makes sense why Wesdome is up 39.95% this year.

Speaking of long-standing small-cap gold stocks, mid-tier gold producer Leagold Mining Corp. (TSX:LMC) (OTCQX:LMCNF) has continued to see success in 2019. In the first half of the year, Leagold produced 194,234 ounces of gold at all-in sustaining costs of $951 per ounce, sold 201,724 ounces, and generated $258.3 million in revenue.

The company has four producing gold mines in Brazil and Mexico that are expected to produce 380,000 to 420,000 ounces of gold this year.

Leagold is up 46.56% so far in 2019 and analysts expect the stock will remain on that upward trend. Four Wall Street analysts have given the company an average 12-month price target of $3.99 CAD, representing a 44.1% upside.

Another small-cap gold stock analysts are bullish on is Continental Gold (TSX:CNL) (OTCQX:CGOOF). Although the company is not yet producing gold at its project in Colombia, the property is one of the largest and highest-grade gold deposits in the world.

In fact, Continental’s flagship project boasts proven and probable reserves of more than 3.7 million ounces of gold and 10.7 million ounces of silver and is expected to begin producing in 2020.

The company’s stock is up 65.29% this year, and three analysts have given it a 12-month target of $5.39, which is roughly 35% higher than its current $4.00 CAD.

If you are looking to protect your investments and portfolio by adding some small-cap gold stocks to your portfolio, the aforementioned companies could be a great place to start.

Are there any small-cap gold stocks on your radar? Let us know in the comments!

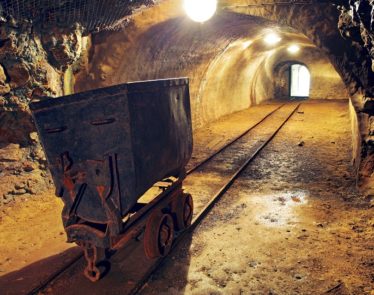

Featured Image: DepositPhotos © Petrovich99