Illinois Tool Works Inc. ITW recently announced that it closed the buyout of the test & simulation business of Eden Prairie, MN-based MTS Systems Corporation from Amphenol Corporation APH . The financial terms of the transaction were kept under wraps.

Illinois Tool’s shares gained 1.3% in the past couple of days, eventually closing the trading session at $235.12 on Thursday.

Based in Wallingford, CT, Amphenol specializes in manufacturing and selling antennas, connectors/ interconnect systems (electronic, fiber optic and electrical), specialty cable, sensors and others. The company operates facilities in Africa, the Americas, Asia, Europe and Australia. Its products are used across several end markets, including mobile networks, industrial, automotive, data communications, commercial aerospace and broadband communications.

Inside the Headlines

The acquisition of test & simulation business is expected to be a strategic fit for Illinois Tool’s Test & Measurement and Electronics segment. The transaction is expected to enhance Illinois Tool’s product offerings and technical abilities, apart from helping it to expand its footprint in various end markets.

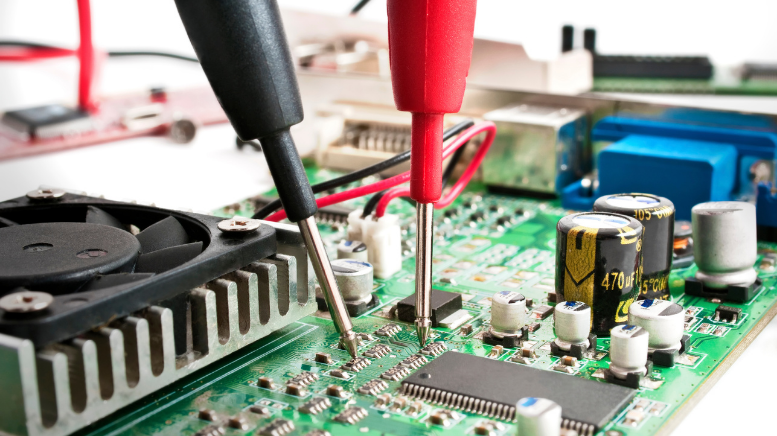

Illinois Tool’s Test & Measurement and Electronics segment is engaged in producing equipment, consumables and related software for testing and measuring materials and structures, and equipment and consumables used in the production of electronic subassemblies and microelectronics. Products offered by it are used in several end markets, including consumer durables, general industrial, automotive and consumer durables.

Zacks Rank, Estimates and Price Performance

With a $72.4-billion market capitalization, Illinois Tool currently carries a Zacks Rank #3 (Hold). The company is poised to gain from a diversified business structure, solid product offerings, buyouts and the policy of rewarding shareholders. However, it has been witnessing raw material and supply-chain constraints, which are likely to prevail in the quarters ahead.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In the past three months, the company’s shares have gained 2.9% against the industry ’s fall of 6.6%.

In the past 30 days, the Zacks Consensus Estimate for the company’s earnings remained stable at $8.45 for 2021, while the same for 2022 inched up 0.8% to $9.08.

Key Picks

A couple of better-ranked companies from the same space are discussed below.

Helios Technologies, Inc. HLIO presently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here . Its earnings surprise in the last four quarters was 37.54%, on average.

In the past 30 days, Helios’ earnings estimates have increased 7.9% for 2021 and 9.6% for 2022 in the past 30 days. Its shares have increased 16.9% in the past three months.

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #2 (Buy). Its earnings surprise in the last four quarters was 26.71%, on average.

In the past 30 days, Applied Industrial’s earnings estimates have been stable for fiscal 2022 (ending June 2022) and fiscal 2023 (ending June 2023). Its shares have gained 12.5% in the past three months.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report