Overview:

- It is likely that nuclear power will continue to be a vital source for electricity generation in the years ahead, even though there are a number of risks and concerns surrounding the industry.

- The price of uranium is cheap right now and it won’t stay this low forever. So you might want to start thinking about making a uranium investment.

- In 2016 and 2017, the uranium industry had a massive turnaround which indicates that now might be the time to invest in uranium.

- If you want to make a small investment in uranium, you have the option to use URA, which is an easy and convenient vehicle.

- URA, like any ETF, has its problems. But it has shown in the past two years that it can be cost-effective when the uranium investment thesis is proven to be correct.

Are you looking to invest in uranium? Before doing so, you will need to first familiarize yourself with uranium’s story: from 2003 through to 2008, prices and profits in the uranium industry increased; following the 2008 financial crash, there was another boom in the uranium sector from 2009 to 2011, from 2011 through to 2015, uranium entered a bear market (a market where prices are falling which, in turn, encourages selling) due to Japan’s Fukushima nuclear disaster in March of 2011.

Additionally, before you start uranium investing, familiarize yourself with uranium’s long-term bullish investment thesis. This is important as many credible natural resource investors, including Rick Rule, have been talking about it for a number of years.

Mentioned above, it is very likely that nuclear power will continue to be a vital source for electricity in the decades to come. Yes, it is true that there are other renewable energy sources (hydro, wind, and biomass) that are just as important, but on the grand scheme of things, coal is declining as an electric power source. This means that nuclear power will continue to be one of the top power sources for electricity.

Keep in mind that even though there was a lack of nuclear plants in the United States for a long time, the percentage of U.S electricity generation which was powered by nuclear has remained at 19-20% for the past 30 years.

As many financial analysts have deemed, uranium will not stay at the low prices that we have seen for the past several years forever. Despite there being an overhang of supply and demand being held down since 2011, these conditions are all temporary and should not be expected to last. As we move forward, uranium supply will decrease while the demand increases. Thus, the price of uranium will go up.

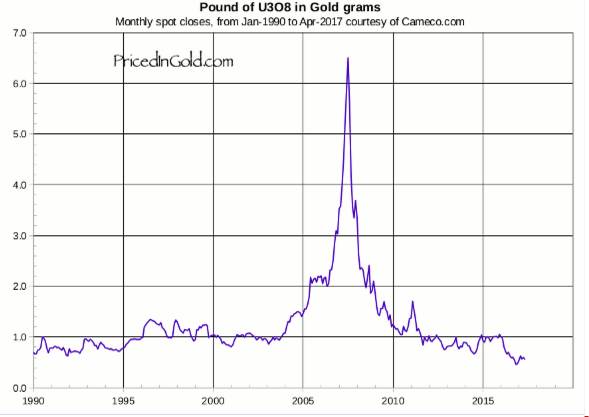

The following is a chart provided by PricedInGold.com, and it illustrates the current price of uranium. This chart compares uranium and gold prices from the 1990’s to the present:

As you can see, there was a bubble in the price of uranium from 2007 to 2008. However, before and after those years, the uranium to gold ratio held steady for decades. That said, look at the last few years on the right hand side of the graph: when compared to gold, the price of uranium has decreased to roughly half of its long-term level that it held during periods when uranium and nuclear power were out of favor.

Timing is crucial in the uranium industry.

As always, you need to take timing into consideration before you decide to invest in uranium. Long-term investments might be cheap, but you never want to have your money locked into an investment that is decreasing in value or making no signs of improving in the years to come. In 2015, having long-term investments might have been a good idea, but this is not so for 2016 and 2017.

When looking at uranium news today, it is recommended that you use the Global X Uranium ETF (URA). This ETF lets investors look at how the uranium mining investment industry is performing. As a result, investors are able to know when is the right time to start investing in uranium. With the Global X Uranium ETF, you are invested in Cameco Corp., which is a massive uranium company.

With that said, there are a number of risks connected to ETF’s and URA’s. Before you make any sort of uranium investment, do your research on each uranium company and then only invest in the ones that you trust the most. If you are an investor looking for an investment of, say 2%, for their uranium portfolio, URA is a fine choice if the timing is right.

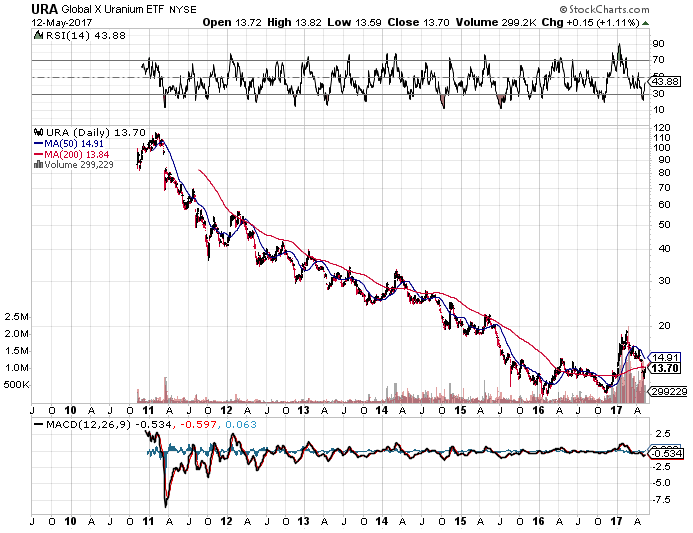

In 2016, for the first time in a long time, uranium started to display signs of life. To get a better understanding of the decline leading up to 2016, here is a graph that illustrates the history of URA from late 2010 to the present:

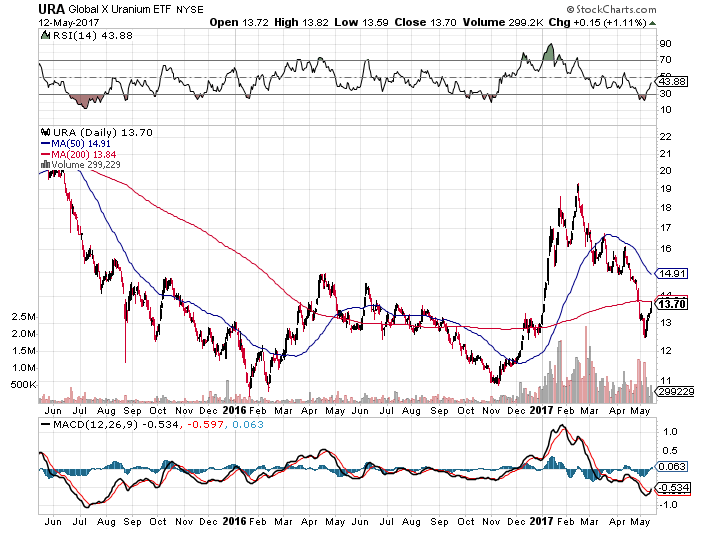

Additionally, here is a chart which illustrates the past two years. This better reflects the jump in investor sentiment towards the uranium sector in 2016 and 2017.

Overall, these charts are there to show prospective investors that they can make significant profits from uranium investing and from URA if it is the right time. Need more proof? Just look at the 50% rally in 2016 and the almost 75% rally following the election into early 2017. The takeaway here is this: don’t wait around for the rally to come in the uranium sector.

It’s worthwhile noting that the rallies of the last year and the current year have not gotten rid of the long term value available in uranium stocks. Moreover, due to the recent selloff following the post-election rally, there is now yet another opportunity for investors to buy URA at a better value. For example, instead of purchasing URA at $19 in February, investors can now get it for $14.

Thus, there are a number of signs which indicate that now is the time to invest in uranium. If, however, you just want to make a small uranium investment as part of your natural resources portfolio, it is recommended that you get a URA as it is a simple and convenient vehicle to use.

Featured Image: Twitter