Denbury Resources shares are up almost 100% since the start of this year, moving the twelve-month rally to 250%. The company continues impressing investors with its growth opportunity investments and balance sheet strengthening strategies.

Denbury Resources (NYSE:DNR) is an exploration & production company with a focus in two key operating areas: the Rocky Mountain regions and the Gulf Coast.

Denbury has completed two Mission Canyon wells during the second quarter this year, which is likely to generate 2,500 – 3,000 barrels of oil per day. It has also recently completed the development of its Grieve Field EOR project. The company plans to drill five additional wells in the following quarters of this year. Investors are applauding its expansion strategy.

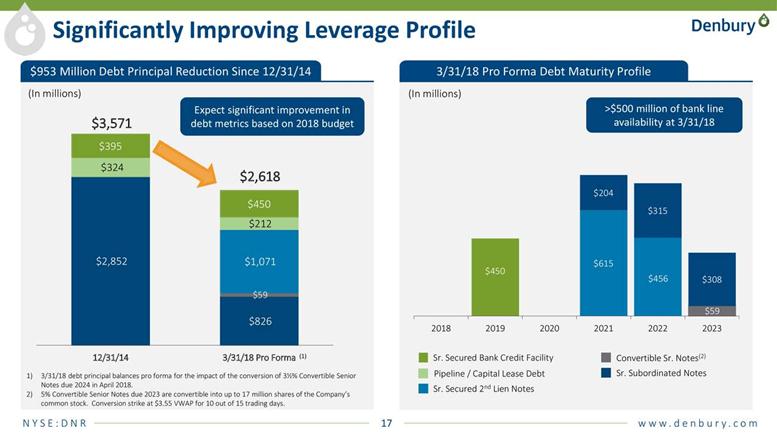

Aggressive Debt Reduction Affects Denbury Resources Shares

Denbury Resources management has been aggressively working on different strategies to reduce their debt level.

The E&P company has lowered its debt principal by $72 million in the first quarter. It recently announced that $85 million convertible notes were converted into common stock in April and the company paid an additional $25 million towards debt reduction. The company has reaffirmed its bank credit facility borrowing base at $1.05 billion.

Denbury believes that it is in a position to generate positive free cash flows in the following quarters – which would allow them to reduce their debt position. Its free cash flows were standing close to $35 million in the first quarter.

>> How Medical Billing Services Benefit Small Practices?

Improving Oil Prices is a Big Catalyst

Denbury’s business model is directly correlated to oil prices. Improvement in oil prices always has a positive impact on its revenue, earnings, and cash generation potential.

Oil price is currently standing around $65 a barrel, higher than its average realized prices of $57 a barrel in the first quarter. This is because its financial numbers and cash generation potential is likely to expand significantly in the second quarter. The market pundits are suggesting further upside potential in oil price, thanks to increasing demand and economic sanctions on Iran.

Featured Image: twitter