Amkor Technology (NASDAQ:AMKR) shares have been struggling to make attractive gains for investors since the beginning of this year. The stock has risen only 2% year to date, and it continues to trade in a narrow range of $17.65 – $22.98 over the last twelve months.

Traders’ concerns over unstable revenue growth have been restricting the Amkor Technology share price growth. The company’s revenue plunged from $380 million in 2015 to $370 million in fiscal 2017.

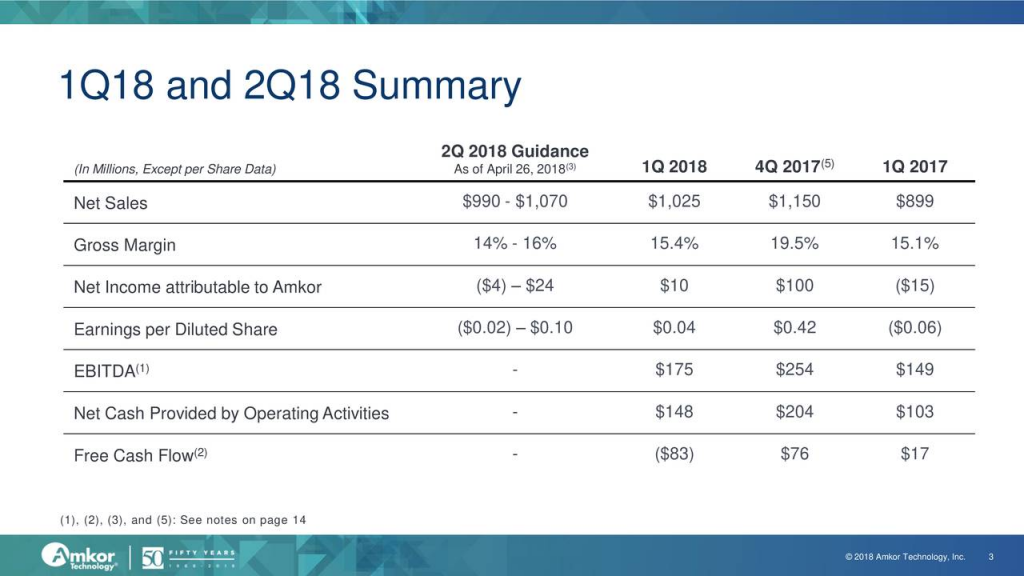

The company continues to face challenges in expanding revenue from the high-end smartphone market. This is because its first-quarter revenue extended the downtrend; the revenue dipped 13% from the previous quarter, and the company expects a similar drop for the second quarter.

Portfolio Moves to Offset Slowdown in Smartphone Market

The company has been expanding its presence in industrial, automotive, computing, and consumer markets to offset the sluggish growth from the communication industry.

Chief Executive Officer Steve Kelley says, “We believe that our balanced growth approach is leading to sustainable gains in factor utilization and financial performance. It also produces better results in trough [sic] quarters as demonstrated in the first quarter.“

Amkor Technology is giving importance to high growth automotive markets as a part of its portfolio restructuring strategy. As a result, its automotive revenue increased from 11% of total sales to 25% of consolidated sales over the past four years. At the same time, though, its communication market revenue declined from 56% of total revenue to 44%.

The management also plans to capitalize on emerging IoT, artificial intelligence, and high-performance computing markets in the following years.

Growth Investors Like Aggressive Growth

Although the company is making attractive portfolio moves, the outcome of these moves isn’t offering enough support to overall revenues.

Growth investors love to chase companies that are providing significant support to share price through high double-digit growth in revenue and earnings. Can Amkor keep up, or will it be a disappointment to this kind of investors?

Amkor Technology shares are likely to remain under pressure amid expectation for the further decline in its revenues.

>> Glance Technologies Partners with BIG Blockchain, Stocks Drop: Rough Start

Featured Image: Twitter