Greece is in talks with Eldorado Gold Corp (TSX:ELD) (NYSE:EGO) to secure higher royalties from the mining firm, causing EGO stock to trade down slightly.

Greek Energy Minister Kostis Hatzidakis has said the government has entered talks with the Vancouver-based mining company, which operates two mines and two development projects in the country, in order to obtain higher royalties and new jobs. The company’s planned investment is seen as one of the biggest in the country in years; however, the plans have been stalled numerous times due to licensing issues and environmental concerns. EGO stock is currently valued at $8.39.

Greece’s recently elected conservative government pledged to find a solution to the impasses faced by Eldorado, and it looks to increase foreign investment in the country. “We want to move ahead with a contract which, on the one hand, will send a business-friendly message, and on the other hand, a contract that will secure more jobs, more royalties and clear environmental protection for the region in line with European standards,” Hatzidakis told Reuters, which should represent positive news for EGO shares.

>> TNXP Stock Soars After Announcing License Deal for TNX-1700

Eldorado Gold CEO George Burns has said the company is open to negotiations with the Greek government and described the royalty payments in the country as “modestly in the middle of the range worldwide.” The company had been stuck at an impasse with the previous leftist government over plans to build an ore processing plant at its development in Skouries, but the new regime appears to be more receptive of giving this the go-ahead. EGO stock is up nearly 200% in the year to date and should be further benefited by the proactive approach of the new Greek regime.

Prime Minister Kyriakos Mitsotakis has also said his government would be open to renegotiating its contract with Eldorado to include a new investment in another region of the country, paving the way for possibly even more gains for EGO stock.

Last week, we featured Eldorado Gold on our pick of small-cap gold stocks to pad put your portfolio—check it out!

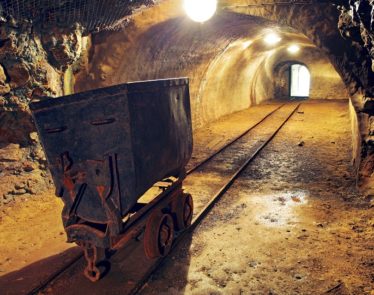

Featured Image: Deposit Photos © Kacpura