The oil crash this Monday proved to be historic as oil prices slid into negative territory and created a worldwide crisis in the markets. It has also created an existential threat for many oil stocks across the world. The primary reason behind the issue is the coronavirus pandemic, which has resulted in lockdowns across the globe, and, consequently, the demand for oil sank considerably.

In addition to that, up until the crash this Monday, both Russia and Saudi Arabia had flooded the market with excess supply. Eventually, the bubble burst on Monday, and experts are not yet sure how long it is going to take for the oil prices to recover.

While the price of oil remains a major concern for the global markets, it is also a major problem for many oil companies as there is a distinct possibility that some of those companies could go bankrupt as a result. For instance, Chesapeake Energy had already employed the services of restructuring experts before this even happened, and Whiting Petroleum (NYSE:WLL) has already filed for bankruptcy. Many other oil companies, particularly those involved in production and oilfield service, are expected to file for bankruptcies as well.

Here is a look at 5 oil companies that could be in danger of going bankrupt due to the oil price crash.

5 Oil Stocks in Focus as Bankruptcy Looms: Chesapeake Energy Corporation (NYSE:CHK)

Chesapeake Energy has been struggling under a mountain of debt for a considerable period of time, and the latest events might be enough to push the company over the edge.

>> 5 Oil and Gas Penny Stocks That Are Surging Despite Crashing Oil Prices

Reports suggest that the company has roped in the services of the law firm Kirkland & Ellis LLP, a restructuring specialist, as well as debt reworking investment bank Rothschild & Co. Chesapeake seems to be currently considering its options. The company currently has debts to the tune of $8.92 billion, and the oil price crash has placed it in a precarious position with its creditors. Will it be able to survive this time of chaos? We’ll have to wait and see.

5 Oil Stocks in Focus as Bankruptcy Looms: Denbury Resources Inc. (NYSE:DNR)

Another struggling company is Denbury Resources. Earlier in April, it emerged that the American energy-producing company had hired the services of the investment banker Evercore Inc in order to better manage its debts.

At the time, the company had debts to the tune of $2.3 billion. The news emerged on April 8, and at the time, Denbury was already struggling because of the continued decline in oil prices. It’s not much of a stretch to suggest that the oil crash this week is going to compound Denbury’s problems.

5 Oil Stocks in Focus as Bankruptcy Looms: Oasis Petroleum Inc. (NASDAQ:OAS)

Oasis Petroleum is another oil company that could be on the precipice of bankruptcy following the dramatic oil crash this week. The company was already weighed down by the considerable debt on its books, and market watchers suggested that Oasis wouldn’t be able to start restructuring its debts until 2021.

>> 3 Retail Chains That Could Go Bankrupt Because of Coronavirus

The company apparently has a breakeven point of $60 a barrel for WTI, and considering the current price of oil, this could trigger a crisis at Oasis. The long-term outlook for the company was already gloomy, but the current situation has only made things worse.

5 Oil Stocks in Focus as Bankruptcy Looms: Ultra Petroleum Corp (OTCQX:UPLC)

Well-capitalized companies might manage to survive this oil market crisis, but for companies like Ultra Petroleum, this could prove to be the final nail in the coffin. Last week, the company released an 8-K Filing announcing that the discussions with regards to an out of court debt restructuring had collapsed. In addition to that, Ultra announced that it was locked in talks with debt holders with regards to a possible Chapter 11 filing.

Chapter 11 refers to Chapter 11 of the U.S. Bankruptcy Code. The company also issued a going concern warning in the aforementioned filing. Experts are not quite sure how long it is going to take for oil prices to recover, so the current situation has made things incredibly difficult for Ultra.

5 Oil Stocks in Focus as Bankruptcy Looms: California Resources Corp (NYSE:CRC)

Last but not least, California Resources seems to be another oil company that could find itself in an increasingly difficult position in light of the recent oil price crash. In March, the company announced that it was considering ‘all options’ in the wake of the declining oil prices. However, it should be noted that the company also pointed out that it was not going to provide updates with regards to financial decisions.

Takeaway

While nothing yet is final, things are not looking very optimistic for the above-mentioned oil stocks. Investors may want to steer clear until these oily waters become less murky.

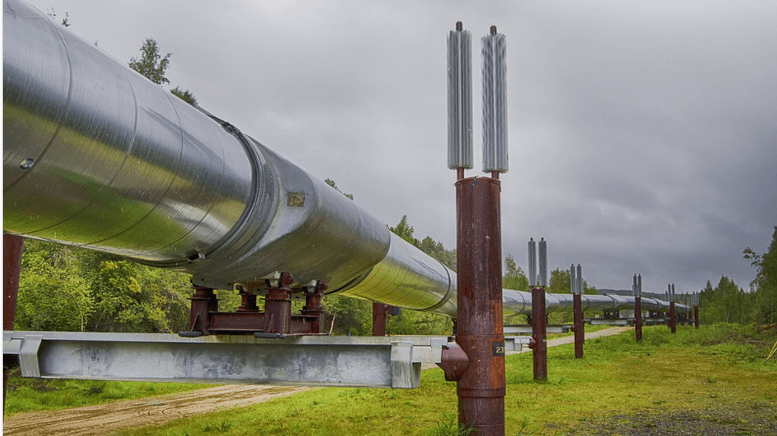

Featured image: Pixabay