The energy sector is doing amazingly well for a number of reasons that most of us are already quite familiar with. Since the energy boom is likely to stretch further into the foreseeable future (Zacks Consensus Earnings Estimates represent 105% growth this year with only slight declines from that high in the following two years), there’s no doubt that this sector is a great place for investment.

But that doesn’t mean that other sectors aren’t doing very well also. It’s just that the growth in energy is so sexy that it tends to overshadow what we’re seeing elsewhere. In fact, the latest numbers from the labor department are indicative of continued broad-based recovery.

There were total job gains of around 428,000 in April, with the most significant additions in leisure and hospitality, manufacturing, and transportation and warehousing. But professional and business services, financial activities, healthcare, retail and wholesale trade, and mining also saw notable increases. There was little change in employment levels within the construction, information, other services and government segments.

Additionally, incremental wage inflation was 0.3% in April, which was 5.5% above year-ago levels.

The unemployment rate was 3.6% with the number unemployed at 5.9 million, similar to the pre-pandemic numbers of 3.5% and 5.7 million in Feb 2020.

Recent results of companies from diverse segments reflects this view:

WestRock Co. WRK

WestRock is a primarily a provider of paper, packaging and specialty packaging solutions for consumer and corrugated packaging markets. The company is one of the largest integrated producers of containerboard by tons produced, and one of the largest producers of high-graphics preprinted linerboard on the basis of net sales in North America. It is also one of the largest paper recyclers in North America.

Other than North America, its products are sold in South America, Europe, Asia and Australia. It also provides structural and graphic design and engineering services; custom, proprietary and standard automated packaging machines; and turn-key installation, automation, line integration and packaging solutions.

The Zacks Rank #1 stock belongs to the Paper and Related Products industry (top 26%). Its Value, Growth and Momentum Scores are C, D and C, respectively.

WestRock beat earnings estimates by over 15% in the last quarter, on top of a revenue surprise of around 6%. In the last 30 days, the Zacks Consensus Estimate of WestRock’s earnings was up 11 cents (2%) while the 2023 estimate increased 21 cents (4%).

Analysts currently expect the company to post 2022 revenue and earnings increases of 11% and 42%, respectively. Its valuation of 10.31X P/E looks reasonable, given that it is close to its median value over the past year and well below the annual high of 14.32X. It also trails the S&P 500’s 17.87X. It typically trades slightly above the industry.

Nutrien Ltd. NTR

Saskatoon, Canada-based Nutrien Ltd. provides crop inputs including potash, nitrogen, phosphate and sulfates; and distributes crop nutrients, crop protection products, seeds, and merchandise through approximately 2,000 retail locations in the US, Canada, South America and Australia. In addition, it provides services directly to growers through a network of farm centers in North America, South America and Australia.

The Zacks Rank #1 stock belongs to the Fertilizers industry (top 2%). Its Value, Growth and Momentum Scores are C, D and A, respectively.

Nutrien beat March quarter earnings estimates by around 4% and its revenue also came in around 13% higher. The Zacks Consensus Estimate for its 2022 and earnings have been rising steadily. In the last 30 days, the 2022 estimate has increased $3.07 (24%).

The estimate for 2023 has increased $3.19 (29%). Revenue and earnings in the current year are expected to grow a respective 41% and 158%. The shares are also very cheap at just 6.77X P/E, which is also their lowest level over the past year.

Vishay Intertechnology, Inc. VSH

Malvern, Pennsylvania-based Vishay Intertechnology manufactures and supplies discrete semiconductors and passive electronic components in Asia, Europe and the Americas. It operates through six segments: Metal Oxide Semiconductor Field Effect Transistors (MOSFETs), Diodes, Optoelectronic Components, Resistors, Inductors and Capacitors.

The Zacks Rank #1 stock belongs to the Semiconductor – Discretes industry (top 20%). Its Value, Growth and Momentum Scores are A, B and C, respectively.

Vishay’s March quarter sales beat the Zacks Consensus Estimate by 1% while its earnings beat by 22.4%. The lone analyst providing estimates for the stock has raised his 2022 estimate by 25 cents (10%) and the 2023 estimate by 4 cents (2%). 2022 revenue and earnings are currently expected to grow a respective 7% and 16%.

The shares are ridiculously cheap (7.41X P/E) compared with the industry’s 38.32X P/E and also the S&P 500. They are also trading well below their median value over the past year.

ON Semiconductor Corp. ON

Phoenix, AZ-based ON Semiconductor provides intelligent sensing and power solutions worldwide. The company has grown through organic innovation as well as strategic acquisitions that have increased the breadth and depth of its product range. Today, its intelligent power technologies enable the electrification of the automotive industry (for lighter and longer-range electric vehicles and their fast-charging systems). They are also used in solar and other power systems and storage systems.

The Zacks Rank #1 stock belongs to the Semiconductor – Analog and Mixed (top 8%). Its Value, Growth and Momentum Scores are D, B and B, respectively.

In the March quarter, ON Semiconductor’s earnings came in 16% above estimates while its revenue was about 2% ahead. Analysts have steadily raised their estimates for this company’s earnings. In the last 30 days, the 2022 Zacks Consensus Estimate increased 75 cents (18%) while the 2023 estimate increased 52 cents (12%).

Analysts are currently looking for 2022 revenue and earnings growth of 19% and 66%, respectively. To top it all, ON Semiconductor shares trade at 11.20X P/E, which is not only below its own median level of 17.35X, but also below the industry’s 16.51X and the S&P 500, which makes the shares are hugely undervalued.

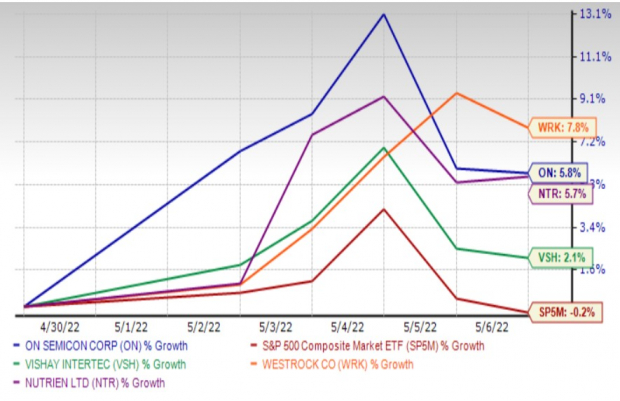

Last Week’s Price Action

Image Source: Zacks Investment Research

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report