In the wake of the coronavirus outbreak, healthcare stocks have been touted to be immune to the economic downturn resulting from the pandemic. This is because many healthcare companies are actively working on developing treatments or vaccines for COVID-19. The coronavirus pandemic has shaken markets, and the resulting volatility appears to actually be working in favor of several healthcare penny stocks.

However, among the measures taken to combat the spread of COVID-19 is social distancing. This has affected various clinical trials, with several clinics closing and hospitals putting off noncritical procedures to focus on COVID-19. As a result, several healthcare stocks have been blasted this month by market volatility, especially those in the pre-revenue phase.

There has been a massive stock sell-off in the market as of late, which, although worrisome to some, can also create a massive opportunity for investors not afraid of a little risk. Due to their nature, healthcare penny stocks may be a good place to start. Here are four healthcare penny stocks to watch:

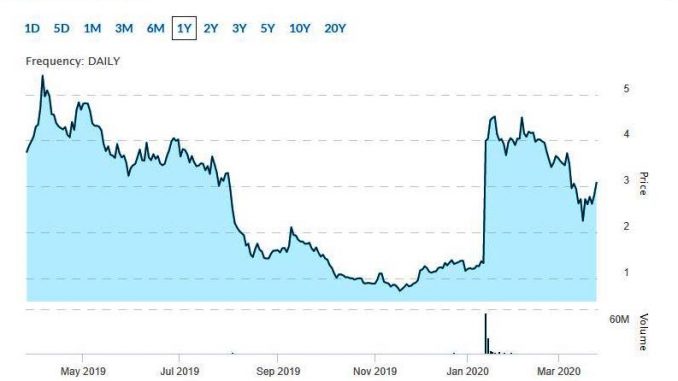

4 Healthcare Penny Stocks to Watch: Adaptimmune Therapeutics (NASDAQ:ADAP)

Adaptimmune Therapeutics is one healthcare penny stock that has performed well this year; however, it shed most of its gains in March. The trigger for the upward trend for Adaptimmune’s stock came following the announcement of its partnership deal with Astellas Pharma (OTCPK:ALPMF).

The companies entered a research and development partnership to explore the use of its stem-cell-derived T-cell therapies in the treatment of cancer. The company received $50 million as part of the deal and shored its cash with $78.1 million from the proceeds of a secondary offering. This penny stock is also expected to launch its first cell therapy, ADP-A2M4, for the treatment of synovial sarcoma by 2022. ADAP stock seems likely to gain more in the next two years if all goes as planned.

ADAP stock has jumped 3% at $3.21 on Wednesday.

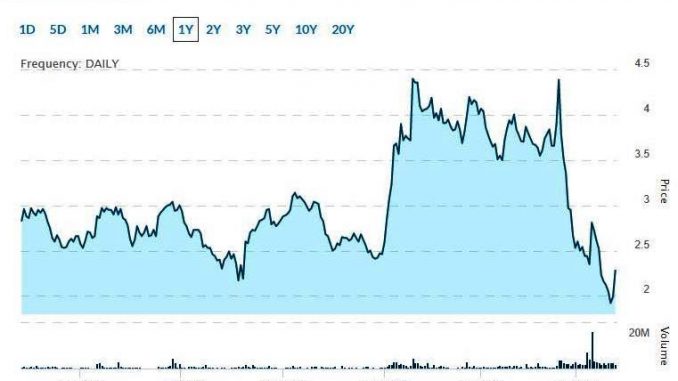

4 Healthcare Penny Stocks to Watch: Agenus Inc. (NASDAQ:AGEN)

Agenus is an immunotherapy penny stock that has had a rough start to 2020, having lost almost 50% of its value year to date. The drop is attributable to the recent market downturn and also to concerns about the company’s cervical cancer product candidate—made up of zalufrelimab (AGEN1884) and balstilimab (AGEN2034)—not being commercially viable.

Although cervical cancer combo therapy won’t break $100 million in annual revenue, it is important to note that the company’s market cap currently stands at $321 million and that Agenus is also involved in other potential cancer treatments. There is also its partnership with Gilead Sciences (NASDAQ:GILD) to keep in mind. For long-term investors, this small-cap biotech stock has an attractive value proposition, despite currently lacking a lead drug candidate.

AGEN stock is up 8% at $2.46 in the early session on Wednesday.

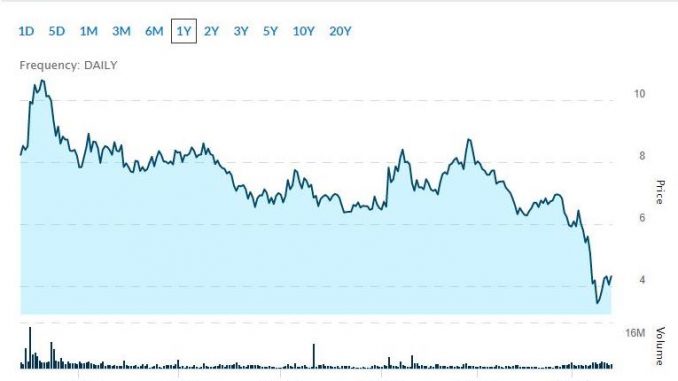

4 Healthcare Penny Stocks to Watch: Viking Therapeutics Inc. (NASDAQ:VKTX)

Until recently, Viking Therapeutics was one of the most sought-after biotech stocks in the market, triggered by its experimental non-alcoholic steatohepatitis (NASH) treatment, VK2809. In a mid-stage study for fatty liver disease, the drug demonstrated that it can clear fat from the liver and enhance the lipid profile of a patient. The company has since progressed to a second mid-stage study for biopsy-confirmed NASH for VK2809, and it expects to release top-line data in the first half of 2021.

The drug offers the company massive potential, and in the next two years, any drug approved for NASH might turn into a mega-blockbuster with more than $5 billion in sales annually. The company’s stock could surge into life once COVID-19 is dealt with, and the market normalizes. This clinical biotech stock might struggle for now, but ultimately, it seems like it could be a big winner going forward.

VKTX stock gained marginally this morning and is now trading at $4.37.

4 Healthcare Penny Stocks to Watch: Precigen Inc. (NASDAQ:PGEN)

Precigen has been raking in gains lately, more than doubling in the last week. At the beginning of this month, the company reported its Q4 and full-year revenue results.

The company reported total revenue of $17 million and a net loss of $169.2 million or $1.09 per share. Out of this loss, $95.7 million was attributable to discontinued operations and to non-cash charges of $33.8 million related to ongoing operations. The company also completed several transactions to support the focus on healthcare.

PGEN stock is now up by 12% at $3.36.

Key Takeaway

Despite the ongoing market turmoil, these stocks have massive potential to one day surge higher once the coronavirus is contained. For investors who are not afraid of risks, these four healthcare penny stocks are definitely worth keeping an eye on.

Featured image: Pixabay