Zacks reports that Wall Street analysts are predicting sales of $108.30 million this quarter from Xcerra Corporation (NASDAQ:$XCRA). Out of two analysts’ estimates, the highest was $110.00 million and the lowest was $106.60 million. In the same quarter last year, Xcerra reported sales of $80.09 million. Based on the previous estimates, that would indicate growth of 35.2%. Thursday, December 7th is the expected date for an official report.

Looking forward, analysts anticipate that the company will post sales of $0.00 per share. Zacks estimates are based on surveys of all applicable sell side brokerages.

During midday trading on Wednesday, shares of the semiconductor company traded down 0.10%, hitting $9.81 with 147,747 shares trading hands. They currently have 50 and 200 day Moving Averages of $9.77 and $9.76, respectively.

Xcerra’s last report came Wednesday, August 30th. The company beat the consensus estimates of $0.19 with posted $0.25 EPS. They also beat revenue estimates of $106.97 million with a reported revenue of $126.93 million. In addition, they reported a net margin of 5.77% and a Return on Equity of 9.08%.

Multiple firms have recently weighed in on the stock:

- BidaskClub: In a research note from Saturday, August 5th, BidaskClub cut their rating from ‘Sell’ to ‘Strong-Sell’.

- B. Riley (NASDAQ:$RILY): In a research note from Monday, August 28th, B. Riley reissued a ‘Neutral’ rating and set a price target of $10.25.

- Needham & Company LLC: In a research note on Friday, September 1st, Needham reissued a ‘Hold’ rating.

- ValuEngine: Also in a research note from Friday, September 1st, ValuEngine increased their rating from ‘Hold’ to ‘Buy’.

- Zacks Investment Research: In a research note dated Saturday, September 2nd, Zacks upgraded their rating from ‘Hold’ to ‘Buy’ and set a price target of $11.00.

The company currently has 5 ‘Hold’ ratings, 2 ‘Buy’ ratings, and 1 ‘Sell’ rating, giving an average rating of ‘Hold’ with a consensus price target of $10.40.

Multiple institutions have recently altered their stakes in Xcerra:

- SG Americas Securities LLC bought an additional 91,581 shares during the 2nd quarter, an increase of 621.8%, for a total of 106,309 shares valued at $1,039,000.

- Morgan Stanley (NYSE:$MS) bought an additional 126,054 shares in the 1st quarter, an increase of 64.2%, for a total of 322,284 shares valued at $2,865,000.

- Citadel Advisors LLC bought an additional 19,451 shares during the 1st quarter, an increase of 26.3%, for a total of 93,463 shares valued at $831,000.

- Marshall Wace North America L.P bought a new stake in the company in the 2nd quarter with an opening purchase of $2,356,000.

- Durmac Inc. bought a new position in the company during the 2nd quarter with an opening purchase of $1,954,000 worth of stock.

86.13% of the stock is currently owned by hedge funds and other institutional investors.

In insider news, VP Pascal Ronde sold 50,000 shares for an average price of $9.74 and a total sale of $487,000.00. The sale was dated Friday, September 8th. Ronde now owns 317,250 shares of the company’s stock, with a value of $3,090,015. Insider ownership currently accounts for 2.60% of the company’s total stock.

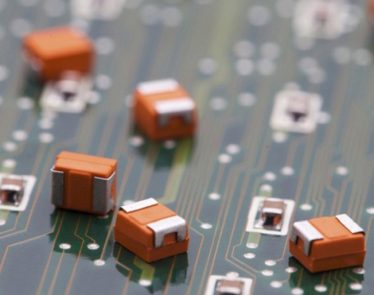

Featured Image: depositphotos/Wavebreakmedia