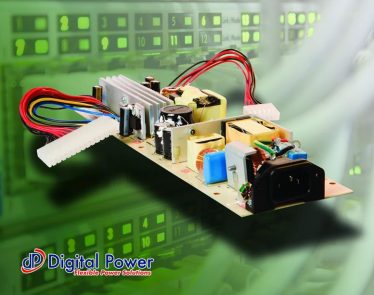

DPW Holdings Inc. (NYSE:DPW), a diversified holding company engaged in, among other ventures, the design, manufacture, and sale of switching power supplies and converters, is currently experiencing a recovery in its stock from the recent decline of the past five days.

At the time of writing, DPW’s stock is trading at $3.049, putting the stock up $1.079, or 55%, from the previous closing price of $1.97. So far, the day’s pricing has ranged from $2.07 to $3.05, putting the current trading price near to the day’s highest point. In comparison, the 52-week range has gone between $0.40 and $5.95. DPW’s current market cap is sitting at $70.871 million.

DPW stock began declining in December. Most recently, on January 4, 2018, the stock experienced a low of $3.00. On January 5, continuing its decline, the stock experienced a low of $2.67. Then, on January 8, the stock reached a low of $2.38, with January 9 giving the stock its lowest price of $1.93. It wasn’t until today, January 10, that the stock began to experience a recovery from this decline.

It appears, due to this upswing, that things are starting to move more positively for the company. The company’s most recent news, on January 5 and January 8, are maybe beginning to take effect. Respectively, DPW announced that it had put forward investments in first WSI Industries, Inc. (NASDAQ:WSCI), a precision contract company for aerospace, communication, and industrial markets, and in Sandstone Diagnostics (private), a developer of point-of-care medical testing equipment and systems.

On the day of each of these announcements, there was little impact on DPW’s stock, which instead, as mentioned above, continued on its month-long decline. So is the current recovery a result of these announcements finally taking hold on the stock? I would posit the answer as yes, given that these announcements mark a positive direction for the company.

Featured Image: dpwholdings