Outlook

- With 2017 Fiscal sales predicted to be in the range of $1.5 billion to $1.7 billion, Fitbit is looking at a year-over-year decrease of approximately 26%.

- With a Price/Sales multiple of 0.63x, this is the lowest Fitbit has ever traded at.

- On average, Fitbit is seen to have a 36% upside potential according to Wall Street analysts.

Fitbit (NYSE:$FIT) shares continue to tumble as they hover around their all-time lows. This negative trend has only been complimented by a depressed 2016 Christmas season, leaving 2017 without much optimism. As a result, the fitness technology company currently trades at $5.24 per share, a fraction of it’s former $50.00 per share value. This was expected however, as Fitbit’s CEO expected a slow start to 2017, deeming this time frame as a “transition period”. That is, fitbit has plans to expand into higher-end smart watch technology. It is clear that this is a difficult time for Fitbit, however investors may have over punished the stock, as the company still holds attractive valuation. Based on their current Enterprise Value and Price to Sales Multiple, there is reason to believe in the big upside potential for those willing to accept the risks.

Fitbit’s Financial Position

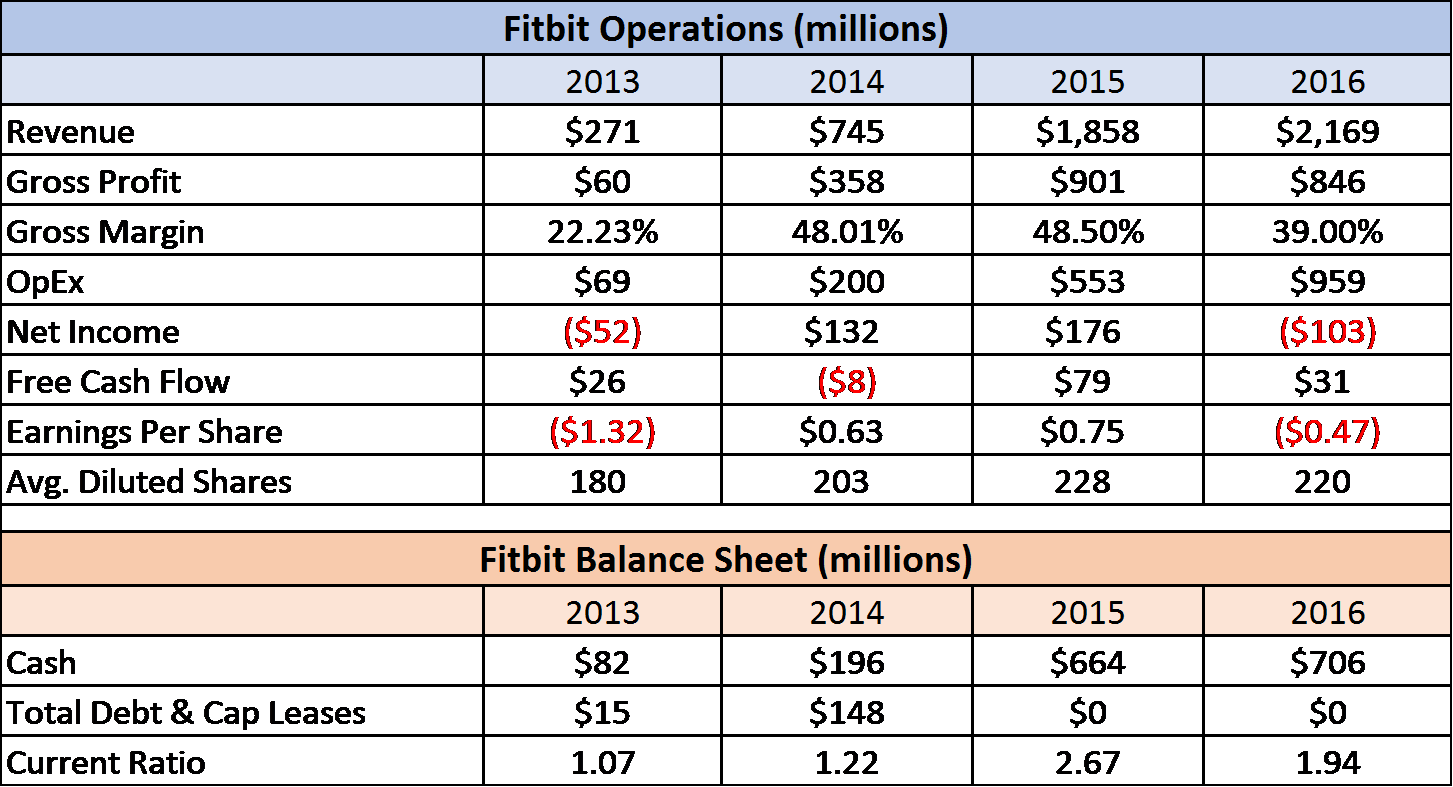

Although revenue had increased from 2015 to 2016, operating expenses also increased. This narrowed margins, and ultimately contributed to the decrease in bottom line margins. In Fitbit’s 2016 annual report, the slimming of profits in 2016 was explained to be driven by a number of reasons including: increased warranty costs from legacy products, charges for liabilities to contract manufacturers for additional parts, an increase in rebates and promotions to retailers and distributors, and the increased depreciation of manufacturing and tooling equipment. This is a cause for concern, as Fitbit’s operating expenses almost doubled from 2015 to 2016, when revenues only experienced a meager 17% increase.

Featured Image: depositphotos/geoffgoldswain