Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) Announces Projects on Arkansas’ Smackover Formation, One of the World’s Most Strategic Lithium Deposits

As lithium demand has soared investor attention has shifted from the top lithium producers who are already valued highly and operating at near peak efficiency to smaller companies with the potential to step in and grow fast.

One company that fits that description is Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) which now has access to one of the most extensive and best geographically located lithium deposits in the world!

BREAKING NEWS: Standard Lithium Ltd. (OTCQX:STLHF) (TSX.V:SLL) has announced a maiden inferred resource of 3,086,000 metric tonnes of lithium carbonate equivalent (LCE) for their 150,000 acre Lanxess Project in south-central Arkansas. The Company has also signed a term sheet with global specialty chemical company LANXESS Corporation for a contemplated joint venture in the commercial production of battery grade lithium from brine extracted from the Smackover Formation in South Arkansas

This under-the-radar company has just signed a binding agreement with LANXESS (ETR: LXS) (OTC: LNXSF), a $7 billion chemical company, that gives it direct access to the “world class” lithium brine resource located[1] in an a geological region called the Smackover Formation in Arkansas.

Why is that important? Recent testing of brine samples from two existing wells in the Company’s southern Arkansas project area showed lithium concentrations ranging between 347 and 461 milligrams per litre lithium, with an average of 450 mg/L lithium in one of the wells and 350 mg/L in the other. These results will be combined with extensive geophysical survey work and will form the basis of an upcoming maiden resource report on this strategic resource.

By leveraging existing infrastructure, Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) are set to rapidly advance towards production of this massive resource!

Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) is Growing at the Perfect Time – Lithium Demand is Surging!

Here’s the deal: increased production of electric vehicles, large stationary storage batteries, laptops and smartphones has resulted in high demand for lithium ion batteries to power those vehicles and devices. Experts say that they now expect lithium to grow at a CAGR of 17.0% in the next decade.

Simon Moores, Managing Director at Benchmark Mineral Intelligence, says: “Quite simply, there’s not enough supply to meet the demand, and the demand is increasing quicker than the supply is. Much, much quicker. Therefore, lithium’s price will remain strong.”

Plus, in the US There is Another Factor Driving Demand for American Supplied Lithium Like that Provided by Standard Lithium – President Donald Trump!

Trump is pushing an America first philosophy when it comes to critical minerals such as lithium[2]. In fact, in December 2017, Trump signed an executive order to reduce dependency on imported critical minerals.

That means companies with U.S. assets like Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) are finding themselves in strategically positioned in the US.

The truth is while the world has an abundance of lithium resources, they are often found in remote and environmentally sensitive locations with next to no infrastructure.

Deposits located in these types of jurisdictions are often burdened with time-consuming permitting challenges, prohibitive royalties and production caps. Those expensive obstacles are not a problem for Standard Lithium thanks to their project’s location, a region with decades of brine production, and Trump’s executive order.

Standard Lithium’s business model is focused on efficient implementation while minimizing risk. The company’s strategy is to consolidate the most promising lithium assets in the U.S, demonstrating to the market a clear and clean path to production by securing agreements with existing, permitted commercial brine operators.

Others Are Beginning to Take Notice of Standard Lithium & Its Vast Potential

For example, Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) was recently named a Venture 50 Company!

This prestigious honor is only bestowed upon 10 companies from five industry sectors. It is based on the three criteria that matter most to equity investors:

- Market capitalization growth

- Share price appreciation

- Trading volume

Source: Standard Lithium Ltd. – 2018 Venture 50

The Booming Lithium Market Needs Companies Like Standard Lithium (OTCQX:STLHF) (TSX.V:SLL)

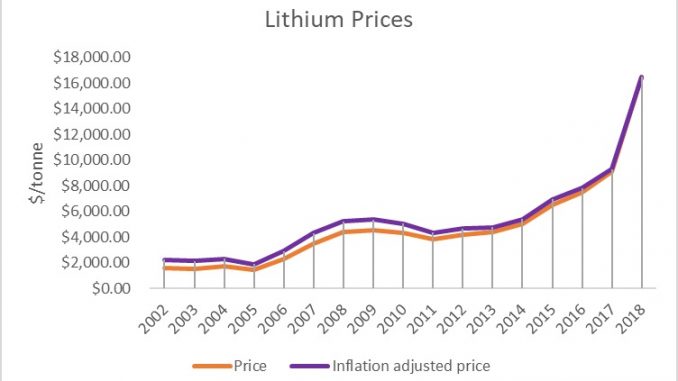

Lithium prices have enjoyed a strong growth and are now averaging $13,500 per ton for battery-grade Lithium Carbonate.

This only reinforces the current value of the lithium market … and it makes it easy to understand why this element is now often referred to as “white gold.” Here’s a chart showing lithium’s rising price:

Chart 1: Annual lithium prices up 45% y.o.y ($/t)

As demand soars, the market needs companies that can step in and deliver lithium. After all, without lithium all those electric cars and laptops and smartphones aren’t going to be operational.

Without Lithium, the Planned Electric Car Revolution Simply Won’t Happen

Right now:

-

Volvo has announced plans to sell more than 1 million electric vehicles by 2025

-

Market experts say that electric vehicle sales will rise at a rate of 25 percent a year and exceed 17 million in total sales by 2030

But again, none of that happens without lithium. What about all those gigafactories like the one Tesla built in Nevada? They won’t be producing lithium ion batteries for electric cars without lithium.

Will Standard Lithium (OTCQX: STLHF) (TSX.V: SLL) Be One of the Leaders of That New Generation?

It certainly has the assets and the leadership to become a major player.

First, let’s look at the assets:

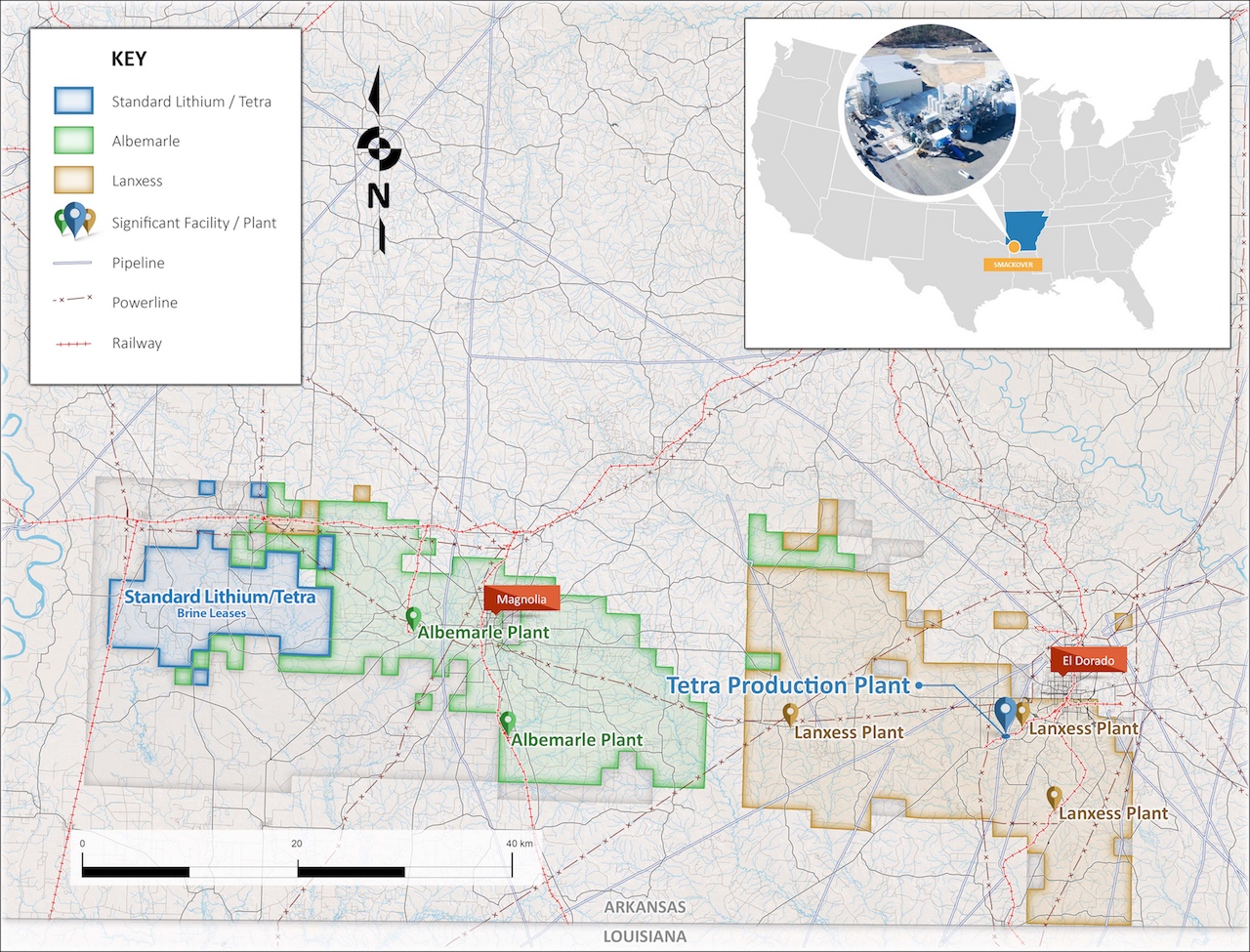

As we mentioned, Standard Lithium (OTCQX: STLHF) (TSX.V: SLL) has signed a binding MoU[3] with (ETR: LXS) (OTC: LNXSF) for the purpose of highlighting the commercial viability of lithium extraction from brine (“tail brine”) that is produced as part of LANXESS’s bromine extraction business at its three Southern Arkansas facilities.

LANXESS’ land operations in Southern Arkansas encompass more than 150,000 acres, 10,000 brine leases and surface agreements, and 250 miles of pipelines. LANXESS extracts the brine from wells located throughout the area, transporting it to processing plants through a network of pipelines. The three bromine extraction plants currently employ approximately 500 people, processing and reinjecting several hundred thousand barrels of brine per day.

The agreement with LANXESS will enable Standard Lithium to locate a pilot plant demonstrating its proprietary extraction technology on one of LANXESS’s three production facilities. This will save the company months if not years of development time and drastically reduce cost expenditures.

Plus, This Agreement is Not Standard Lithium’s Only Access to the Smackover Formation

The company has also signed an agreement with Tetra Technologies for the lithium rights to explore and develop 30,000+ acres of brine leases located in the same brine production region of the Smackover Formation.

Tetra Technologies, Inc. (NYSE: TTI), which is currently trading at $4.39 USD per share, is an established oil and gas company worth over USD $550 million. By securing the lease agreement with Tetra, Standard Lithium has locked down one of the last remaining lease packages in the area.

According to Garrett’s Lithium Handbook[4], the Smackover oilfield brine in Arkansas could contain 1 million metric tons of lithium – about a third of the reserves of the massive Atacama Salt Lake in Chile.

Standard Lithium Also Has Additional Projects Underway …

Standard Lithium (OTCQX:STLHF)(TSX.V:SLL) has begun sampling at all active and permitted brine production wells across over 150,000 acres of brine leases. These samples, along with production data received from the Arkansas Oil and Gas Commission (“AOGC”) will be included in a resource assessment report anticipated in late Q3 2018.

Now let’s look at the company’s leadership:

Robert Mintak, CEO

Led by co-founder and CEO, Robert Mintak, Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) is guided by a trusted team of industry experts with a history of developing successful projects in the mining industry. Robert was one of the founders of Pure Energy Minerals and served as the company’s CEO from 2013 to 2016 and most recently as Executive Chairman was recognized as the top mining company in the 2016 TSX Venture 50.

Andy Robinson, President & COO

Dr. Andy Robinson is known for compiling North America’s first N.I. 43-101 compliant resource estimate for lithium brine[5] and was responsible for developing a world-class lithium brine process engineering team at Pure Energy Minerals. This team successfully developed and tested efficient and effective modern brine processing techniques that will help shape the way in which lithium products are extracted from brine in the future.

Robert (Bob) Cross

Co-founder Bob Cross is a mining legend and one of the original shareholders in Standard Lithium (OTCQX:STLHF) (TSX.V:SLL). Bob was recently appointed as Non-Executive Chairman to the company’s Board of Directors. A well-known and respected name in the mining industry, he and brings years of experience and knowledge to the team. Bob is:

-

Co-founder and currently non-executive chairman of B2Gold (TSX: BTO), which began trading at $0.30 and is currently trading at $3.21 with a market value of CAD$3.23 billion

-

He was also co-founder and Chairman of Bankers Petroleum Ltd and Petrodorado Energy Ltd.

Investors Aren’t the Only Ones Taking Notice of Smaller But Growing Companies Like Standard Lithium (OTCQX:STLHF) (TSX.V:SLL)

Industry giants have begun to notice smaller players such as Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) as well. Mergers and acquisitions are taking over the lithium industry, and junior companies are beginning to position themselves as attractive acquisition partners.

Just this year Lithium X was snapped up by Nextview New Energy Lion Hong Kong Ltd. in a $265-million deal.

More recently, Chinese mining company Tianqi Lithium acquired a 24% stake in SQM, with the intention to inject over $500 million into the company’s existing facilities.

The move is expected to quadruple the amount of lithium carbonate SQM is capable of producing, indicating partnerships can be lucrative for all parties involved.

As Standard Lithium advances toward production, competitors across the industry are likely to recognize the company’s sterling reputation for rapid growth.

The Bottom Line …

Thanks to its valuable assets and strong leadership team, Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) seems uniquely positioned to excel in the red-hot lithium marketplace and thus could be very well worth further investigation by interested investors.

5 Factors Working in Standard Lithium (OTCQX:STLHF) (TSX.V:SLL)’s Favor as the Next Breakout Lithium Miner

- 1

Lithium Deposits

The company quite simply has access to one of the most extensive and best geographically located lithium deposits in the world! It is currently engaged in the testing and proving of commercial viability for lithium extraction from 150,000+ acres of permitted brine operations and the resource development of 30,000+ acres of separate brine leases, both located in the productive Smackover Formation in Arkansas. - 2

It Has Important Alliances

The company’s agreements with TETRA and LANXESS should accelerate development as Standard Lithium (OTCQX:STLHF) (TSX.V:SLL) is now able to leverage existing commercial infrastructure, working inside the fence of a global specialty chemical company. - 3

It Has Prestigious Accolades

The company was recently named a Venture 50 company. This is a prestigious honor that is based on three criteria that matter most to equity investors: market capitalization growth, share price appreciation and trading volume. - 4

It Has Strong Leaders

The company is led by an innovative and results-oriented management team that also has a strong focus on technical skills. The company’s all-star management team includes Robert Mintak CEO, Director, a pioneer in the rapidly evolving lithium space; and Dr. Andy Robinson, President & COO, who lead the first Inferred Resource assessment for a lithium brine deposit in North America and while at a prior company, signed one of the only supply agreements for Tesla’s gigafactory. - 5

It Has Shortened Development Timelines

The signed agreements with LANXESS and Tetra Technologies place the company in the enviable position of being able to leverage existing production infrastructure and to work inside permitted chemical processing facilities.

[1] https://www.sec.gov/Archives/edgar/data/915913/000119312515319617/d55208dex991.ht

[2] https://www.bloomberg.com/news/articles/2017-12-20/trump-issues-order-to-boost-production-of-critical-minerals

[3] http://standardlithium.com/2018/05/09/standard-lithium-signs-mou-with-global-specialty-chemical-company-lanxess-for-the-development-of-commercially-viable-extraction-of-lithium-from-operational-smackover-brine-resource/

[4] https://www.amazon.ca/Handbook-Lithium-Natural-Calcium-Chloride/dp/0122761529

[5] https://globenewswire.com/news-release/2017/07/13/1044101/0/en/How-Standard-Lithium-Intends-To-Disrupt-Lithium-Mining.html