The demand for gold from central banks has increased significantly from last year, pushing the price of gold up to nearly $1,400 USD per ounce. Analysts expect that this upward trend will continue, creating a renewed interest in gold stocks.

Swiss multinational investment bank UBS expects the gold price to rise to $1,450 per ounce by the end of 2019 and reach $1,500 in 2020, which is higher than the yellow metal has been for the last five years.

“Over the longer term, the dollar and real rates are the two key drivers for gold prices. While the dollar may not provide much help, yields remain skewed to the downside, and should support the yellow metal,” said UBS.

This bullish market signals the perfect time for investors to add small-cap gold stocks to their portfolios, as opposed to larger gold miners or the metal itself.

Weak Dollar Boosts Gold Price

While the increased demand for gold from central banks is supporting the gold price, with the People’s Bank of China adding 10.3 tonnes to its reserves in June alone, it is the weakening US dollar that is expected to continue gold’s price momentum moving forward.

Although the US Dollar Index has been on the uptick recently, a stronger-than-expected US Non-Farm Payrolls report and uncertainty over interest rate cuts are likely to cause increased volatility.

The upcoming decision from the US Federal Reserve regarding interest rate cuts is expected to be clarified later this month at an upcoming policy meeting. If the Feds decide not to cut interest rates, it will further weaken the US dollar and, in turn, boost gold stocks.

>> Glu Stock: In a Bearish Trend, Can Shares Resurge? Analysts Think So!

Investors interested in the gold space will definitely want to keep an eye out for what the Feds decide.

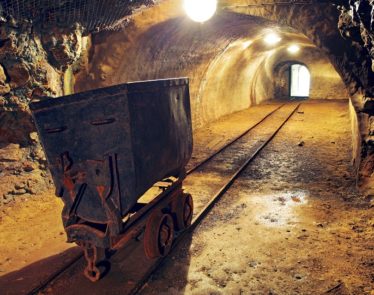

Investing in Small-Cap Gold Stocks

Investors who are interested in getting in on gold stocks while they’re hot can either opt to do so via the VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ). The exchange-traded fund tracks the overall performance of small-cap gold stocks that are primarily involved in mining for gold and/or silver.

The fund is focused on replicating the MVIS Global Junior Gold Miners Index (MVGDXJTR) and is mainly made up of gold companies that have assets in Canada and Australia, as well as South Africa, the US, and Peru.

While smaller cap gold stocks are typically more volatile, the elevated gold price is expected to push junior miners ahead of major gold stocks. What’s more, those large gold miners will likely be looking to acquire some of the juniors in order to replenish dwindling gold reserves at their own projects.

In fact, one Cox Advisors chairman believes that big gold companies will buy a number of small-cap gold stocks within the VanEck Vectors Junior Gold Miners ETF.

The fund’s top holding at present is Northern Star Resources Ltd. (OTCPK:NESRF), an Australian gold producer that has a portfolio of low-cost, high-grade underground mines. Northern Star saw a net profit of $194 million in fiscal 2018, and its share price has continued on an upward trend for most of this year.

>> MDGS Stock Rockets 50% on a Major Order Announcement

Canadian-based gold producer Yamana Gold Inc. (TSX:YRI) (NYSE:AUY) is another company that is in the ETF’s top 10. The company exceeded its production guidance last year at costs that were in line with expectations, and at the same time saw a total revenue of $1.79 billion USD in 2018.

Then there is Bluestone Resources Inc. (TSXV:BSR) (OTCQB:BBSRF), a mining development and exploration company that owns one of the world’s highest grade undeveloped gold projects that is permitted for production. Bluestone continues to report positive results from its Cerro Blanco project in Guatemala, which will have an average production rate of 146,000 ounces per year in the first three years of production.

For investors who are keen on penny stocks, Wallbridge Mining Company Ltd. (TSX:WM) is an affordable pickup. Like Bluestone, Wallbridge has continued to release favorable results from its 100%-owned gold property. Most recently, the company reported that its exploration drilling program has intersected high-grade gold mineralization.

Are there any small-cap gold stocks on your radar? Share them in the comments!

Featured Image: DepositPhotos @ photooasis