Gold price is trading near all-time highs in recent weeks. As such, now might be a good time for investors to consider adding gold stocks to their portfolio.

In the US in June, the price of the precious metal breached $1,350 USD per ounce and has continued to soar since.

When looking at this market, it’s important to note that different gold economies show differing results. For example, the current US price of $1,501 USD is still a ways away from its all-time high of roughly $1,900 per ounce.

But, in Australia it is different. As explained by SeekingAlpha (SA), “because of favorable currency exchange rates versus the dollar, the metal has performed even better in Australia, having crossed above AUD$2,000 for the first time ever last Friday.”

The publication says further that in Canada, “its price is within striking distance of its 2011 record high of nearly CAN$1,880.”

Keeping that in mind, finding key small-cap plays that hail from or operate in these leading gold economies may boost your prospects of a solid investment.

Gold Stocks to Consider

Many investors have already jumped on board the gold train in recent weeks. In fact, according to SA, Bloomberg reported that “SPDR Gold Shares, the world’s largest ETF backed by physical gold, attracted nearly $1.6 billion last Friday alone, the fund’s biggest one-day haul since its inception in 2004.”

Yes, the sector is hot once again, and investors are clambering to buy-in. Where should they look?

Well, some of the best potential gainers are often not the big players as you might expect. Rather, small-cap companies such as junior miners, producers, and explorers are the ones to be watching. And as stated, opting for gold stocks that operate in the meccas of gold exploration such as Australia, Canada, and the US is a worthy starting point.

Here are some of our favorites.

>> LYD Stock Climbs 33% After Conclusion of Environmental Audit

Gold Stocks to Consider: Canada

Most recently, Vancouver’s Westhaven Ventures (TSXV:WHN) (OTC:WTHVF) became the center of a surge. The junior miner reported a new discovery from a drill hole that shows a high grade of mineralization. The news caused shares to skyrocket 38% in one month. Now, priced at $0.92, WHN shares may easily continue to gain as the overall gold climate becomes exceedingly bullish.

The company saw impressive runs like this before; last September, its stock surged 345% over a period of six weeks when the company reported positive drill results at its Shovelnose gold property in British Columbia.

Also hailing from Canada, another small-cap gold play to watch is Ontario’s Wallbridge Mining (TSXV:WM) (OTC:WLBMF). These shares have already climbed 187.5% year-to-date, having grown from $0.16 to $0.46 at present.

Now, the company boasts a market cap of $204.86 million and continues to go from strength to strength. Throughout the year, Wallbridge has showcased positive results from its underground drill program at its Fenelon gold property in northwestern Quebec.

Further, the company recently hinted at even more upside potential. In recent months, there has been significant insider buying. Managers, Directors, and other executives have bought as much as $12.1 million in Wallbridge shares. Only $700,000 worth has been sold by comparison.

Gold Stocks to Consider: Australia

Looking at an Australian play, Panoramic Resources (OTCPK:PANRF) (ASX: PAN) is on an upward trajectory at present. Shares are currently trading for $0.40 AUD and are up 16.18% on the day. But since the end of June, these shares have packed on 42% and are well on their way back towards its year-high of $0.50 per share.

Panoramic entered the gold exploration business when it acquired Horizon Gold Limited (ASX: HRN) in October 2018. Horizon is a gold exploration and developer based in Perth, Western Australia. Its flagship Gum Creek Gold Project in Perth is smack in the middle of one of Australia’s most giving gold provinces.

Also based in Perth is one of the country’s most promising small-cap gold miners: Gold Road Resources (OTCPK:ELKMF) (ASX: GOR). Shares are up a whopping 141% year-to-date, with much of those gains occurring since the end of June. Now, with a market cap of $1.42 billion and shares trading for $1.62, these small-cap gold stocks look set to continue on the bullish trend.

Gold stocks are offering some exciting opportunities right now as the sector explodes. These are only a few options out there; there are a host of alternatives to choose from, but the time to choose is now!

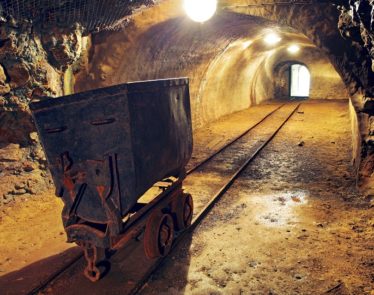

Featured Image: DepositPhotos © scanrail