Model Price: US$ 281 to US$ 792 Per Carat

Model Grade: 4 to 8 cpht

TORONTO, ON / ACCESSWIRE / January 23, 2019 / Tsodilo Resources Limited (TSXV:TSD) (“Tsodilo” or the “Company”) is pleased to announce the results of a second independent Size Frequency Distribution (“SFD”) modelled grade and diamond value for the BK16 Large Diameter Drilling (“LDD”) aggregate 77.94 carat parcel of 502 commercial size (+1mm) diamonds initially reported on November 7, 2018.

In early December 2018, Dr Paddy Lawless of PJL and Associates discovered that the size frequency model he utilized resulted in an overly optimistic projection of grade values. These results were presented in the Company‘s press release on November 7, 2018. Given the potential significance of this error, the Company immediately retained the services of Mr. Stephen Coward of Interlaced to review and develop new model grade and valuation figures based on the same raw BK16 data. The approach included in-depth SFD modelling and simulation, and provides direct comparisons with comparable projects, the results of which are reported herein. The results of the prior press release are thus superseded with those contained in this press release. Given Mr. Cowards specific experience in the SFD modelling discipline the Company has accepted the results of Mr. Coward as definitive for the grade and value modelling of the BK16 deposit.

Mr. Coward has over 30 years’ experience in the diamond industry, including over 20 years with De Beers, this experience has included work in project estimation, evaluation and value chain modeling across several commodities. Ranging from statistical and geostatistical modeling of diamond content, SFD and diamond value to project risk modelling. Mr. Coward’s specific grade and diamond value modelling using SFD data includes work used in the writing up of De Beers assets for privatization and several subsequent empowerment transactions. More recently he has contributed to studies on both fissure and pipe bodies located in southern Africa and Australia. Mr. Coward is an expert in SFD modelling of grade and diamond value and is a “qualified person” as such term is defined in National Instrument 43-101.

As previously reported by Tsodilo, modelling of drill hole data to 450m indicates a kimberlite tonnage of 18.2 to 20.1 million metric tonnes (Mt), this exploration target is described below. The LDD program produced 2,077 dry metric tonnes of sample from the VK2, VK3, VKxxx and CB lithological domains, which were treated to recover 502 diamonds (stones) weighing 77.94 carats (cts).

The SFD modelling results (Table 1) and other BK16 diamond characteristics can be summarized as follows:

- Using a combination of simulation and extrapolation, the SDF grade (cpht) and value (UD$ per carat “$/ct”) have been re-modelled to give the following likely in-situ or “run of mine” grade and value (#1 DTC bottom-cut off size):

- The diamond value ranges from $/ct 281 to $/ct 792;

- The grade ranges from 4 cpht to 8 cpht (carats per hundred tonne);

- The Size Frequency Distribution (“SFD”) study demonstrates the potential presence of large stones, indicating that ~2% to 5 % of the total carats may be greater than 10.8 carats (specials). This compares favorably to Lucara’s Karowe Mine on AK06 of which some ~5 % of the total carats produced are greater than 10.8 carats;

- BK16 contains high quality diamonds dominated by highly marketable shapes (makeable and sawable), and no boart has been recovered to date;

- 3.8% of the diamonds tested were identified as high-quality Type IIa diamonds consisting predominantly of D color stones;

- Due to the small size of the LDD sample, stones above 2 carats have not yet been recovered but can be expected based on the SFD analysis;

- Diamonds were individually assessed for damage by Mr. Ray Ferraris and Dr. Paddy Lawless. Mr. Ferraris and Dr. Lawless are “qualified persons” as such term is defined in National Instrument 43-101. Mr. Coward used these data sets to model the diamond breakage and reconstitution of the diamonds and concluded:

- Approximately 60% of the stones did not display any signs of fresh damage;

- Around 20% showed minor chipping and the remainder had mixed degrees of severity;

- These results are regarded as a low degree of damage and indicate that the LDD and sample treatment used latest best practice methods to avoid undue breakage;

- Diamond reconstruction shows that the majority of the movement of stones after reconstitution occurs between classes -1 to +3 sieve sizes resulting in limited and immaterial changes in the SFD;

- The SFD model suggests that BK16 has the potential to host a coarse size distribution;

- The company believes that the combination of grade, diamond value, and kimberlite value presented in this press release defined by Mr. Coward suggests that BK16 has significant potential to become a minable asset: and

- To improve the confidence on both the grade and value a further phase of bulk sampling of BK16 would be required.

|

Table 1. Summary comparison of Sampled, Published and Current Study Ranges for the BK16 deposit. |

|||||||

|

Variable |

Unit of Measure |

BK16 Sample |

BK16 Published (Lawless 2018) |

Current BK16 SFD Study |

|||

|

Min |

P20 |

P80 |

Max |

||||

|

Grade |

Cpht |

3.8 |

8 to 10 |

4 |

5 |

7 |

8 |

|

Diamond Value |

US$/carat |

177 |

386 to 710 |

281 |

290 |

600 |

792 |

|

Kimberlite Value |

US$/tonne |

6.6 |

30 to 78 |

11 |

15 |

38 |

67 |

Mr. Coward, stated: “Based on my analysis of the SFD of the diamonds recovered from the LDD samples, it appears that the size distribution of BK16 could be coarser than several producers in southern Africa. There are indications that BK16 could have a broadly similarly coarse shaped size distribution to that of the Lucara’s Karowe Mine (Botswana), Petra Diamonds’ Premier Mine (South Africa), and Lucapa Diamond’s Mothae Mine (Lesotho). However, there is a clear under sampling of coarse stones thus far at BK16 which adds significant uncertainty to the grade and value modelled. This uncertainty is explained by the fact that the current 2,077 dry metric tonne LDD sample represents a distinct under sampling of the true SFD of the BK16 kimberlite (~0.01% of the total kimberlite body). This under sampling explains why the sample grade and diamond value are well below the modelled grade and value, and thus why the value and grade modeling reported by this study are so important and should be considered a more accurate reflection of a likely BK16 run of mine production. It is also important to note that whilst the reported modelled grade and diamond value are given as ranges these have been derived from simulations of the sample parcel, the grade and more importantly diamond value could increase as more sample is taken and potentially larger more valuable stones are recovered beyond that indicated by the model. Examples of upward trends in value include the observed increase in very high value large Type IIa diamond population recovered by Lucara’s AK6 mine production vs. the values achieved during exploration LDD sampling. To this end I am very much of the opinion that further work on BK16 is justified, including the execution of an optimized bulk sample campaign to confirm its potential.”

Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, Form 43-101F1 and Companion Policy 43-101CP requires that the following disclosure be made: All references contained herein with respect to the potential quantity and grade derived by any method is at this stage of development is conceptual in nature. At the present time, there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. Further to this modeling of commercial grades is progressively more uncertain with smaller parcels of diamonds. It is important to note that the data presented here are global ranges of grade, diamond value, kimberlite value, and tonnage, and do not constitute a mineral resource estimate as the data have not been spatially modelled in any way. The objective is to derive global deposit scale (as opposed to per lithology or estimation domain) indications of potential value ranges for variables that can be used to inform additional sampling that will be required to evaluate this deposit. These values should be considered as aspirational projections, or targets for future exploration.

BK16 Diamond Valuation by Mr. Ray Ferraris (QTS Kristal Dinamika)

502 diamonds (weighing 77.94 carats) recovered from 3 parcels of commercial size diamonds (+1 mm) were analyzed by Mr. Ferraris at the Diamond Technology Park (“DTP”) in Gaborone after deep-cleaning by acid boiling and sized to the +1 DTC sieve classes. Mr. Ferraris determined current market values for the three LDD parcels as set forth in Table 2, utilizing the QTS proprietary Price-Book.

|

Table 2. Details of the 3 parcels valued by Mr. Ferraris. |

|||

|

Parcel |

# of Diamonds |

Total Carats |

US$ / Carat |

|

1 |

94 |

17.045 |

$195.45 |

|

2 |

130 |

17.700 |

$196.37 |

|

3 |

278 |

43.195 |

$161.03 |

|

All |

502 |

77.940 |

$176.44 |

The five highest individual diamonds constituting more than 4% of the value of the overall parcel ranged in size from 1.935 carats to 0.965 carats, weighed 7.220 carats in total and had an average market value of US$ 612.85 per carat, see Table 3.

|

Table 3. The five highest individual diamonds constituting more than 4% of the value of the overall parcel. |

||||||

|

Parcel |

Hole ID |

Size |

Stones |

Carats |

$ Per Carat |

Total $ |

|

2 |

LDD_020V |

6 Grainer |

1 |

1.535 |

$ 755.00 |

$ 1,158.93 |

|

3 |

LDD_032V |

6 Grainer |

1 |

1.410 |

$ 748.00 |

$ 1,054.68 |

|

1 |

LDD_033V |

5 Grainer |

1 |

1.375 |

$ 705.00 |

$ 969.38 |

|

3 |

LDD_024V |

8 Grainer |

1 |

1.935 |

$ 350.00 |

$ 677.25 |

|

2 |

LDD_021V |

4 Grainer |

1 |

0.965 |

$ 585.00 |

$ 564.53 |

|

Totals |

5 |

7.220 |

$ 612.85 |

$ 4,424.76 |

||

The chain of custody has been maintained to industry standards (see previous press releases describing the systems employed to ensure that industry standards were achieved).

The diamonds were classified using the Diamond Trading Company (“DTC”) mass carater/grainer system for the 6, 5, 4 and 3 grainer size classes and the DTC Diamond Sieves (“DS”) for the -3gr+11, -11+09, -09+07, -07+05, -05+03, -03+01 and – 1DS size classes. The masses of all recovered stones were recorded and valued in their respective size classes.

The valuation of these LDD diamonds is considerably higher than to those of the historical diamonds recovered in 1999 and 2000 from BK16, which were valued in 2016 at $138 per carat.

More than half of the LDD diamonds were tested using a Yehunda Z-50 colorimeter and 3.8% of these were positively identified as Type IIa stones. Most of these are D color with one DE, one E and one F+ colors.

Type II diamonds are rare diamonds which have no measurable nitrogen levels. Type IIa diamonds are generally devoid of impurities and tend to have a colorless and low to no ultraviolet light fluorescence.

Mr. Ferraris stated that, “The overall parcel is dominated by white, gem-quality diamonds, many of which are G-color or higher. The proportion of low-quality diamonds is very low compared to other Botswana kimberlites. There is a general prevalence towards resorbed dodecahedron shaped diamonds, no boart quality diamonds were seen, and the presence of the high-quality Type IIa diamonds was confirmed.”

Diamond Breakage Studies

Diamond breakage occurs both naturally during diamond emplacement or eruption of a kimberlite, and un-naturally during various processes of extraction, drilling and recovery of the diamond, which create “fresh” breakages. Natural breakages of diamond are subject to chemical attack from the molten kimberlite which would have etched or produced resorbed broken surfaces, making them recognizable as “old” or “natural” breakage. As such only “fresh” or un-natural breakage is contemplated during diamond breakage studies of this type.

The diamond breakage data by Mr. Ferraris and Dr. Lawless are show in Table 5.

|

Table 5. Breakage classification data for both Mr. Ferraris and Dr. Lawless for the BK16 LDD diamonds. |

|||||

|

Mr. Ferraris Breakage Categories |

Dr. Lawless Breakage Categories |

||||

|

Description |

Number |

% |

Description |

Number |

% |

|

Unbroken |

350 |

69.7 |

Unbroken – 0 |

344 |

68.5 |

|

Chipped |

88 |

17.5 |

Chipped – Ch |

101 |

20.1 |

|

Lightly Broken |

39 |

7.8 |

Significant – 1 |

22 |

4.4 |

|

Heavily Broken |

16 |

3.2 |

Serious – 2 |

23 |

4.6 |

|

Fragment |

9 |

1.8 |

Severe – 3 |

5 |

1.0 |

|

Total |

502 |

Very Severe – 4 |

7 |

1.4 |

|

|

Total |

502 |

||||

The diamond breakage studies while not directly equivalent are similar enough to draw the following conclusions about the diamond breakage at BK16. They indicate a low level of un-natural or ‘fresh’ diamond breakages for the BK16 LDD diamonds. Most diamonds (68.5 to 69.7 %) were unbroken (zero breakage), and only 17.5 to 20.1 % were chipped. Breakage beyond this was limited to 11.4 to 12.7 %. This low level of fresh breakages illustrates the well managed LDD and dense media separation (“DMS”) plant treatment programs.

BK16 SFD Modelling of In-Situ “Run of Mine” Grade and Value by Mr. Coward and comparison to Karowe mine (AK6)

The BK16 24-inch large diameter reverse flood air assist drilling (simplified to LDD) campaign is considered to be best practice and an industry standard for diamond project evaluation. The LDD tonnage estimate of 2,077 dry metric tonnes is based on the product of average domain density and the calipered volume of the drill holes from which the samples were extracted. Domain densities are derived from density measurements, made on cores from pilot holes that are twinned with the LDD holes.

Processing diamonds obtained from LDD samples is complex and cannot be considered an ‘assay’ as would be the case for many types of metal mineral sampling. Material differences are thus common between the raw diluted recovered grade or ‘sample grade’ from a set of samples and the true in-situ or ‘global’ grade of the target kimberlite body. The basis for this difference arises from:

- Low diamond concentration and high dispersion of diamonds in kimberlites;

- Variable degrees of dilution within the kimberlite;

- Wide distribution of diamonds resulting in under representation of coarse diamonds especially in small sample sizes;

- Diamond breakage during sample recovery such a drilling and sample treatment processes;

- Loss of diamonds due to lock up; and

- Loss of diamonds to undersize

Diamond sample size is critical when assessing a kimberlite body as under sampling can give a dramatically skewed representation of the diamond distribution in a kimberlite.

The objective of the present studies was to establish the plausible ranges for the recoverable in-situ diamonds size frequency and the resultant average target grade and target diamond value. The belief that diamond SFD of the BK16 kimberlite is predictable is based on previous studies by Davy (1989) and Ferreira (2013). Methods used to assess the potential target values include the following process steps:

Sample analysis:

- Assess the range of possible stone concentration in the 243 LDD samples (representing ~3.4m3 on average), through modelling and simulating the stone concentration, using the raw data acquired from treatment of the LDD samples;

- Assessment of diamond loss potential attributed to breakage, quantification of the impact this may have had on the diamond size distribution observed and hence the resulting SFD model;

- Review the recovered size distribution and simulate samples of 502 stones from this distribution to determine a plausible range for sample grades; and

- Review of sample $/ct to assess relationships between size and value.

Global Modelling:

- Use of the model size frequency with the recovered size grade distribution to develop plausible ranges for the in-situ grade-size model;

- Comparison with producing operations to verify the reliability of the derived rages of the grade size model and $/ct value models; and

- Obtain some indication of the plausible global range of recoverable in-situ kimberlite value in $/tonne from the diamond $/ct ranges and grade size distribution models.

The diamonds have been individually valued and classified by assortment. The samples contain several high-quality Type IIa diamonds and the parcels have a substantial proportion of highly marketable shapes in the assortment. This information was used to develop estimates for the revenue that might be achieved for larger diamonds assuming the assortment in larger sizes reflects the quality of the assortment observed in the smaller size fractions. These models were applied to the size distribution models to produce a range of average $/ct values.

Forward modelling of diamond reconstitution for breakage analysis by Mr. Coward using the diamond breakage data supplied by Mr. Ferraris and Dr. Lawless suggests that at most, reconstitution modelling may add ~6% by value to the recovered parcel, but when using a conventional reconstitution method, the difference is less than 2%. The impact of reconstitution was immaterial on the modelling of the SFD.

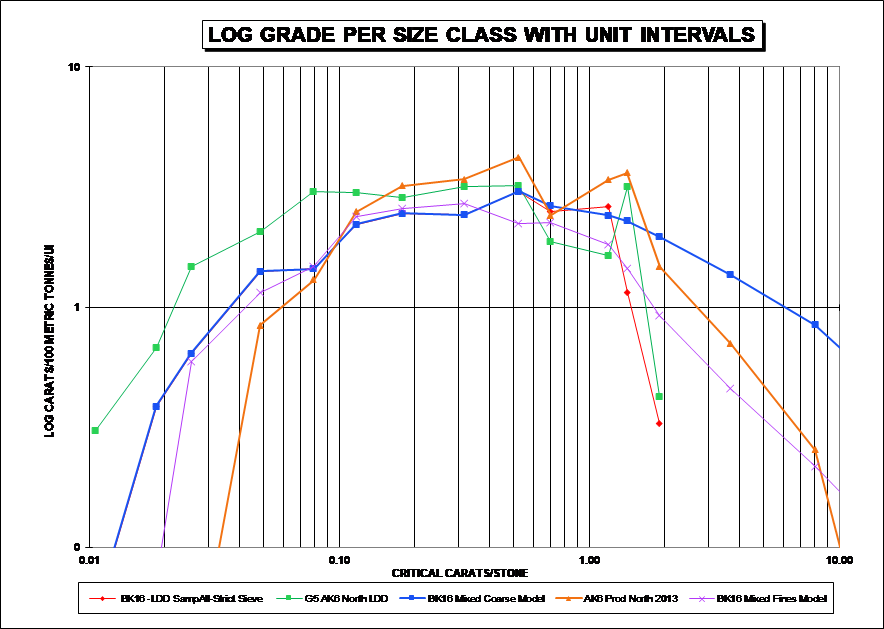

Analysis of the values for stone concentration suggest good continuity and the associated grade uncertainty is considered low. Analysis of the size distribution of the diamonds recovered at BK16 indicates there may well be a coarse component to the distribution. Figure 1 shows the SFD modelling curves for the BK16 kimberlite (course = blue, and fine = purple). Included in Figure 1 is a direct comparison to the AK6 north lobe LDD (green) and production (gold) SFD curves, this was done as it became apparent that there was a similarity between BK16 and the AK6 north lobe SFD.

image: https://www.accesswire.com/users/newswire/images/533393/tsodiloimage1.png

Figure 1. A plot of grade vs size for BK16 samples (Red) and AK6 samples at grade of 5 cpht (Green), as well as the BK16 coarse model (Blue), and the BK16 fine model (Purple), and AK6 North production (Orange).

Modelling of the BK16 diamond value in $/ct using the modelled SFD distribution would normally require the fitting of the distribution for diamond value within each size class. In this case however, there are too few stones to do this with any reliability. As such, an extrapolation model of the average within class $/ct was the approach used to derive a range of plausible values for stones that are greater in size than those observed in the sample. It must be noted that this is an aspirational method of arriving at a potential valuation and will have to be treated with due caution until enough stones have been recovered to validate or invalidate any of the projections made.

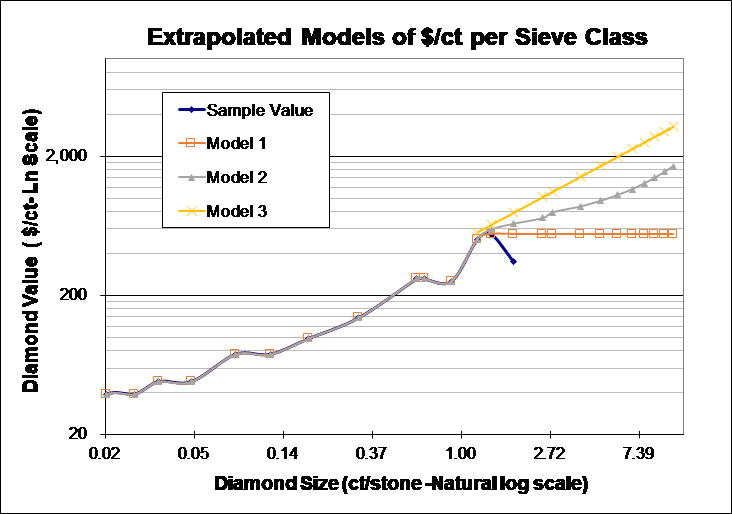

Figure 2 displays three modelled lines (orange, grey and yellow) that represent three methods for extrapolation diamond value into the larger categories. These diamond values can then be applied to BK16 modelled SFD to determine the average overall diamond value in $/ct that might be possible should these values be observed.

- Model 1 (orange line) – Represents a traditional conservative extrapolation of maximum observed values into upper classes in which the value of the highest observed $/ct is kept constant into the higher size fractions. This model returned an average diamond value of 298 $/ct (~70% of the value coming from extrapolation). It should be noted that this conservative method can represent an under extrapolation given that larger diamonds value in $/ct would often increase into larger size categories.

- Model 2 (grey line) – Represents an incremental increase in diamond value based on the increment of value across the last few populated size classes, this proportional increment is then extended into the higher classes. This model returned an average diamond value of 453 $/ct (~80% of the value coming from extrapolation).

- Model 3 (yellow line) – Represents an optimistic model based on the assortment remaining the same into the upper size classes, this assumes that the relationship between value and size is unaffected in the larger categories. This model returned an average diamond value of 792 $/ct (~84% of the value coming from extrapolation).

image: https://www.accesswire.com/users/newswire/images/533393/tsodiloimage2.png

Figure 2. Plot of average $/ct per sieve class overlain with the three extrapolated models for value in classes that have no diamonds.

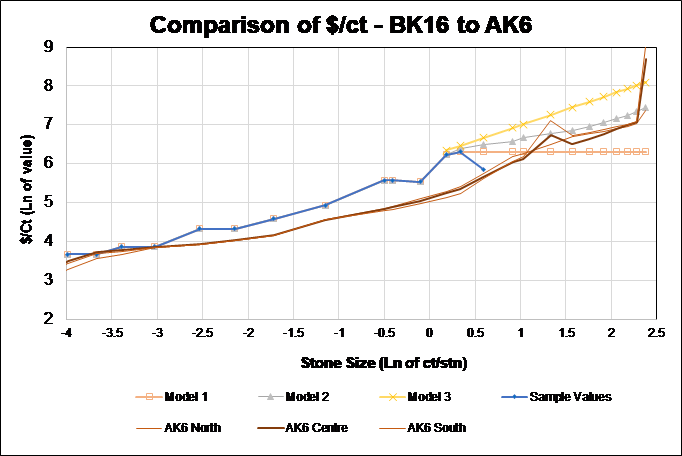

The BK16 modelled grade size distributions, can be used with the modelled diamond value $/ct to compare $/ct diamond value curves with those of AK6 (using production values), see Figure 3. The values from BK16 appear to be higher than those for Karowe in the fine size ranges. Above one carat however the $/ ct increases in slope for Karowe and has a large jump in the value of stones above 10 cts. No exceptionally large high values stones of this size have been recovered from BK16. At this stage, it is not possible to predict the shape of the value curve beyond the application of extrapolations already presented, although given the presence of Type IIa diamonds seen within the BK16 kimberlite there is the potential for a similar upside trend when larger samples are taken.

image: https://www.accesswire.com/users/newswire/images/533393/tsodiloimage3.png

Figure 3. A plot of diamond value in $/ct per sieve class vs stone size, comparing the models developed for BK16 vs the production $/ct/sieve class data for AK6.

These approaches and BK16 SFD models were used to generate a plausible envelope for the BK16 diamond size distribution. These models were used to forward model accurate run of mine production (in-situ/global) grades and diamond value in $/ct. These extrapolated size distribution outcomes of grade and value were combined to calculate the range of potential kimberlite value in $/tonne for BK16. The results have produced feasible ranges for the variables that are required to design and optimize the ongoing evaluation strategy (Table 4).

|

Table 4. Summary comparison of Sampled, Published and Current Study Ranges for the BK16 deposit. |

||||||||

|

Variable |

Unit of Measure |

Current BK16 SFD Study |

*Karowe (AK6) |

|||||

|

Min |

P20 |

P80 |

Max |

North |

Centre |

South |

||

|

Grade |

Cpht |

4 |

5 |

7 |

8 |

13 |

14 |

12 |

|

Diamond Value |

US$/carat |

281 |

290 |

600 |

792 |

222 |

367 |

716 |

|

Kimberlite Value |

US$/tonne |

11 |

15 |

38 |

67 |

29.68 |

53.46 |

91.22 |

*The values for Karowe (AK6) are based on the Open pit Mineral Reserve Estimate as at May 2018, Nowicki, 2018. Note – the grade of AK6 has gone down over time, but the $/ct and $/tonne have steadily increased over time as evidence and thus confidence has increased in the large high-quality component of their diamond population.

These modelled values have been derived from a combination of real data and extrapolation and should be considered as aspirational targets. Given the demonstrated spatial continuity in grade, future sampling should focus on acquisition of larger samples to demonstrate both the coarse size distribution and to produce a large enough parcel of diamonds to demonstrate that the diamond quality observed in smaller size fractions continues into the large diamond sizes.

Links to the reports and presentations prepared by Mr. Coward pertaining to this SFD modelling study of BK16 can be found on the following link http://www.tsodiloresources.com/s/Diamond.asp?ReportID=844024.

Exploration Target Tonnage Update

The quoted Exploration Target tonnage range of 18.2 to 20.1million tonnes is an update and an increase on the tonnages quoted in the Exploration Target Tonnage press release of July 15, 2015. The increase in volume of all the kimberlite units is due to new drill-hole information from the 14-pilot drill-holes (NQ drill core, totaling 3,220 meters) of drilled as pilot holes for the LDD program, of which 2,801 meters were drilled in kimberlite, see press release of June 26, 2017. This resulted in a BK16 model update produced in Gocad 3D modelling software, see: http://www.tsodiloresources.com/i/pdf/BK16.pdf

The tonnages produced for the BK16 kimberlite units are based on the volumes from updated modelling and an updated set of density core measurements of these two units down to a level of 450 meters below surface. The lower Exploration Target tonnage of 18.2 Mt presented is based on the modelled volume and converted to tonnage using the lower average weathered kimberlite density of 2.29 g/cm3. The upper Exploration Target tonnage of 20.1 Mt presented here is based on the modelled volume and converted to tonnage using the higher average fresher kimberlite density of 2.53 g/cm3.

This exploration target and the references made to tonnage of the BK16 deposit are conceptual in nature, and at present time there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Ongoing work

Crushing and X-ray treatment through the Bourevestnik Polus-M X-ray unit of the +3 mm concentrate fractions in order to liberate any locked-up diamonds is ongoing and auditing of the BV tailings through a simple grease recovering unit has recently commenced.

Future work

A second phase of bulk sampling to increase the sample caratage from BK16 is being investigated. This is necessary to improve the confidence limit of the US$ per carat modeled values for feasibility purposes. Several different scenarios are being investigated to recover a minimum of 500 carats either by extending the existing shaft and tunnels or using 24-inch LDD work either as cluster holes or individual holes on a grid system.

Due to the costs associated with bulk sampling, the Company has entered into confidentiality agreements with several firms and entities which have indicated an interest in entering into a transaction via a purchase of an interest in BK16; a joint venture; or a marketing agreement for BK16 diamonds. Discussions are still at a preliminary stage and there is no certainty a transaction will be concluded.

References

Davy, A.T., 1989. The Size Distributions of Diamonds in Kimberlites and Lamproites. PhD Thesis, Imperial College London.

Ferreira, J.J., 2013. Sampling and estimation of diamond content in kimberlite based on microdiamonds. PhD Thésis, Ecole De Mines Paris p.207.

Nowicki, T. E., Armstrong, J., Fourie, L. J. H., and Garlick, G. 2018. 2018 Technical Report for the Karowe Mine: Updated Mineral Resource Estimate. By Mineral Services on behalf of Lucara Diamond Corp.

Zimnisky, P., 2018. Replenishing Economic Diamond Resources, A Daunting task for Miners. Published by the Northern Miner on August 20, 2018.

About Tsodilo Resources Limited

Tsodilo Resources Limited is an international diamond and metals exploration company engaged in the search for economic diamond and metal deposits at its Bosoto (Pty) Limited (“Bosoto”) and Gcwihaba Resources (Pty) Limited (“Gcwihaba”) projects in Botswana and its Idada 361 (Pty) Limited (“Idada”) project in Barberton, South Africa. The Company has a 100% stake in Bosoto (Pty) Ltd. which holds the BK16 kimberlite project in the Orapa Kimberlite Field (OKF) in Botswana and the PL216/2017 diamond prospection license also in the OKF. The Company has a 100% stake in its Gcwihaba project area consisting of seven metal (base, precious, platinum group, and rare earth) prospecting licenses all located in the North-West district of Botswana. Additionally, Tsodilo has a 70% stake in Idada Trading 361 (Pty) Limited which holds the gold and silver exploration license in the Barberton area of South Africa. Tsodilo manages the exploration of the Gcwihaba, Bosoto and Idada projects. Overall supervision of the Company’s exploration program is the responsibility of Dr. Mike de Wit, President and COO of the Company and a “qualified person” as such term is defined in National Instrument 43-101.

This press release may contain forward-looking statements. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements pertaining to the use of proceeds, the impact of strategic partnerships and statements that describe the Company’s future plans, objectives or goals) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, changes in equity markets, changes in general economic conditions, market volatility, political developments in Botswana and surrounding countries, changes to regulations affecting the Company’s activities, uncertainties relating to the availability and costs of financing needed in the future, exploration and development risks, the uncertainties involved in interpreting exploration results and the other risks involved in the mineral exploration business. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not a guarantee of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, uncertainties relating to availability and cost of funds, timing and content of work programs, results of exploration activities, interpretation of drilling results and other geological data, risks relating to variations in the diamond grade and kimberlite lithologies; variations in rates of recovery and breakage; estimates of grade and quality of diamonds, variations in diamond valuations and future diamond prices; the state of world diamond markets, reliability of mineral property titles, changes to regulations affecting the Company’s activities, delays in obtaining or failure to obtain required project approvals, operational and infrastructure risk and other risks involved in the diamond exploration and development business. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not a guarantee of future performance and accordingly undue reliance should not be put on such statements due to their inherent uncertainty.

Neither the TSX Venture Exchange (“TSXV”) nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release. This news release may contain assumptions, estimates, and other forward-looking statements regarding future events. Such forward-looking statements involve inherent risks and uncertainties and are subject to factors, many of which are beyond the Company’s control, which may cause actual results or performance to differ materially from those currently anticipated in such statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

|

James M. Bruchs |

Chairman and Chief Executive Officer |

[email protected] |

SOURCE: Tsodilo Resources Limited