NIO stock is in the news for multiple reasons this week. Let’s try and understand what’s happening with China’s young EV-maker, NIO Inc (NYSE:NIO). Should investors be concerned and, importantly, should you buy or sell? At the time of writing, NIO shares are selling for $4.72 USD on the NYSE.

NIO Stock: Zack’s Consensus

Arguably one of the most worrying signals about these shares at present is how much they are dividing analysts.

Notably, Zacks issued a downgrade on Wednesday, rating the stock as a “Sell”. Its sentiment was mirrored by 86 Research in January—the firm issued a “sell” rating and a price target of $4.70 for NIO stock. Then in March, Bank of America downgraded NIO from a “neutral” rating to an “underperform” rating and decreased its price target for the company from $8.00 to $6.80.

But there have been other analysts who are saying “Buy”. These include Goldman Sachs, Deutsche Bank, and CitiGroup.

Overall, according to FIDaily, “the stock presently has an average rating of “Hold” and an average target price of $8.02.”

>> FIT Stock Drops 24HRS After Beating Q1 Expectations

What’s an Investor to Do?

If you are torn about NIO stock, then the company’s closure of one of its offices in Silicone Valley may sway you to the “Sell” side. The startup laid off 70 employees since early April, shortly after it announced it was also laying off 3% of its workforce in China.

However, considering the company still has some 10,000 employees worldwide, the cuts are relatively small by comparison and certainly don’t spell doom (might this sway you back to the “Buy” side?).

Rather, the company describes the decision as a measure to optimize “management efficiency this year.” It almost suggests that it over-hired; an oversight resulting from such rapid expansion:

“After four years of rapid growth, we’ve set up a global organization. However, fast development has also posed issues like repetitive functional departments, undefined work tasks, unclear work responsibilities, and insufficient work for certain people.”

NIO Stock: The Takeaway

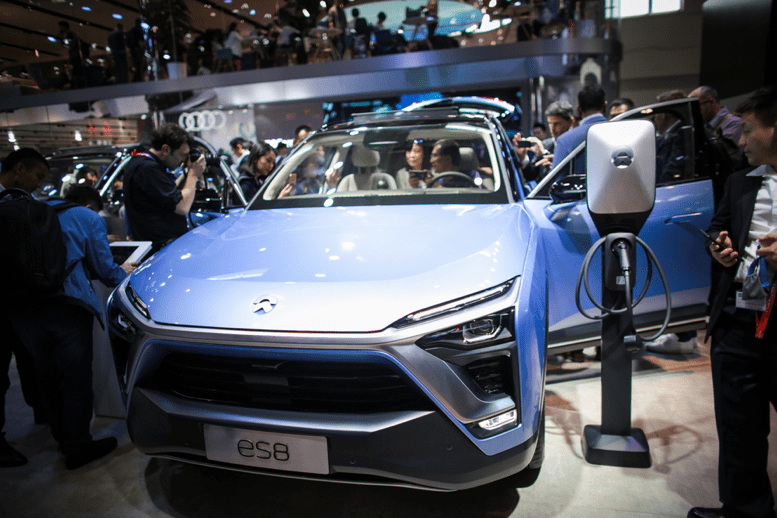

Founded in 2014, NIO is still young. The company only has one commercially available vehicle that began shipping last summer, the ES8. The ES6 is expected to go into production later this year. As an all-electric car maker, it is a prime position to reap the benefits of a changing car climate; of course, the market is competitive, and there’s always Tesla (NASDAQ:TSLA) to contend with.

Featured Image: DepositPhotos © Imaginechina-Editorial