Nobody likes going to the doctor. And not just the appointment.

We’re talking about going to the doctor where you need to wait in a room with a bunch of other patients for an hour with old magazines and an antiseptic smell.

Telehealth solves all of that, and we saw it in full action this past 18 months as market share for companies offering this essential service soared.

Companies like Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) are making our lives way easier by taking telemedicine services one step further by adding its revolutionary virtual pharmacy to its offering. Why would we ever go back to the old way of doing things?

It seems that many are on board with the new norm for healthcare, with the global telehealth market jumping from $50 Billion in 2019 up to a staggering $144.3 Billion last year.1

Inevitably, investors are pouring into this sector like crazy at every level from angel to early-stage to startups to M&A.2

In fact, the revolution has already caused digital health investments to hit an all-time high of $57.2 billion in 2021, a 79% leap from 2020.3

A company by the name of WELL Health Technologies Corp. (TSX:WELL) garnered support from billionaire investor Mr. Li Ka-shing aka Superman, who is one of the most influential businessmen in Asia, and raised over $300 Million.

In turn, WELL saw its stock go from CAD$1.28 to CAD$6.89 in just two years from October 2019 to October 2021 – a 438% increase!4 Fast-moving mergers are also sweeping through the sector. For example, the Teladoc/Livongo merger in August 2020 was worth $18.5 Billion5, giving the companies a joint enterprise value of $37 Billion.6

Fast-moving mergers are also sweeping through the sector. For example, the Teladoc/Livongo merger in August 2020 was worth $18.5 Billion5, giving the companies a joint enterprise value of $37 Billion.6

The same year, while the rest of the economy was swirling around the drain, telehealth IPOs boomed.

American Well Corporation saw a 42% spike on its first day of trading7 and skyrocketed past $40 on October 8, 2020, while, GoodRx Holdings popped 53% on its IPO,8 jumping from $33 up to $46 on its first day.9 Think it’s a fluke?

Think it’s a fluke?

While past events are not always indicative of what may happen in the future, it may be helpful to review some relevant historical trends – for instance, let’s take a look back to 2018.

[BONUS-POPUP id=”1″]

What happened then? A little company you may have heard of called Amazon bought PillPack for US$753 million (or approximately CAD$950 million today).10

You can be forgiven for not taking much note of this transaction at the time. Many investors didn’t. But in the wake of recent events – namely the rapid rise of telehealth – that purchase can now be recognized for what it was.

Since that little-known purchase by the world’s largest retailer outside of China, things have really taken off.

Here are a few of the other deals that have taken place: Money talks, and this industry is having a field day.

Money talks, and this industry is having a field day.

It’s that market that played a role in leading Amazon to jump into online pharmacies by buying PillPack for $753M.12

It’s also why Mednow (TSXV:MNOW) (OTCQB:MDNWF) could potentially be a prime acquisition target, especially considering the M&A activity in the telemedicine space that took place last year.

Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) management reasonably believes that these deals were the opening salvo in what may be the next growth market within telemedicine.

What market is that? It’s virtual pharmacies.

It only makes sense. Many people are now visiting doctors and receiving health treatment virtually… It was only a matter of time before they also wanted to receive their medication that way as well.

Mednow (TSXV:MNOW) (OTCQB:MDNWF) recognized this pending market shift early and has since become Canada’s only publicly-traded virtual pharmacy.

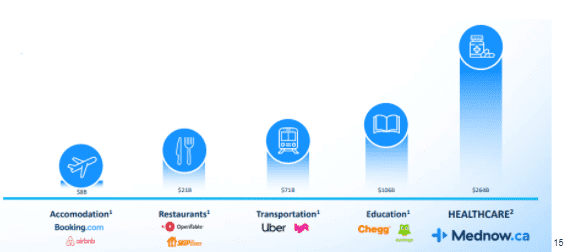

With $264B in healthcare spending overall, Canada’s pharmacy market is currently worth $47 billion.13 But while there’s over 10,000 pharmacies in Canada, only a handful have an online delivery model!

Mednow (TSXV:MNOW) (OTCQB:MDNWF) was created to fill that gap and it is now working towards doing just that – acting both as a regular retail pharmacy AND a virtual pharmacy.

Press Releases

- Mednow to Attend 8th Annual AlphaNorth Capital Conference

- Mednow Launches Personalized Supplement Program

- Mednow to Host Q2/22 Conference Call on Wednesday March 23, 2022, at 8:30am EST on Financial Results and Corporate Update

- Mednow Enters Into Agreement to Acquire Mednow East Inc. in Ontario

- Mednow Provides Corporate Update on Progress and 2022 and 2023 Financial Forecasts

Reason #1 – Mednow (TSXV:MNOW) (OTCQB:MDNWF) Stands Out in a Rapidly Evolving Marketplace

Healthcare is smack dab in the middle of a revolution thanks to CV19 and the trend of consumers adopting remote, tech-enabled services like DoorDash, which went public in December 2020 in an IPO valued at over $25 billion.14 It appears that people simply may not want to go back. Taxis have been replaced by Uber, Lyft, DiDi, and more, and proprietary takeout and groceries have been replaced by DoorDash, Skip the Dishes, Uber Eats, and more.

It appears that people simply may not want to go back. Taxis have been replaced by Uber, Lyft, DiDi, and more, and proprietary takeout and groceries have been replaced by DoorDash, Skip the Dishes, Uber Eats, and more.

As mentioned, $57.2 billion was invested into digital health investments last year alone, up 79% from 2020.16

But here’s the thing for investors – most telemedicine companies have similar platforms and similar services. Yes, San Francisco-based 1Life Healthcare and Boston-Based American Well (Amwell) have in-office care… but their telemedicine services are similar.

Mednow (TSXV:MNOW) (OTCQB:MDNWF) is like a breath of fresh air to this marketplace. Not only can it tap into all the telemedicine excitement, but management believes that it also has a major advantage over the competition with a different business model and a significant revenue-generating differentiator…

…the ability to sell prescriptions anywhere it can make deliveries. Now that Mednow (TSXV:MNOW) (OTCQB:MDNWF) has started scaling up across the country, that advantage could prove to be a major catalyst for gaining market attention and creating shareholder value in the coming weeks and months.

Now that Mednow (TSXV:MNOW) (OTCQB:MDNWF) has started scaling up across the country, that advantage could prove to be a major catalyst for gaining market attention and creating shareholder value in the coming weeks and months.

Reason #2 – Telemedicine Company With Vast Upside Potential

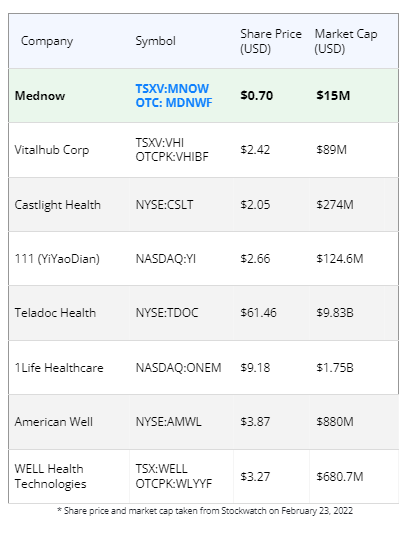

As seen in the table below, compared to generic telemedicine companies, Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) market cap has significantly more upside potential that it could realize if it gains greater market penetration in 2021.

The BIG THING working in Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) favor is out of the 10,000+ Canadian pharmacies only a handful has an online delivery model. Mednow’s virtual pharmacy is in a unique position to prevail in the marketplace.

has an online delivery model. Mednow’s virtual pharmacy is in a unique position to prevail in the marketplace.

Management believes that Mednow can also quickly extend its market reach thanks to its connection with CarePharmacies.ca.17

And the company just reported its Q1 2022 financial results showing that revenue increased over 4.5X QoQ, and more than 13.5X YoY.

The release of the financial results included an operational update, highlighting the recent acquisitions of Liver Care Canada Inc., London Pharmacare, and Infusicare.

Keep in mind, this is all before Mednow (TSXV:MNOW) (OTCQB:MDNWF) builds and opens retail pharmacies in Manitoba, Alberta, and Quebec, as it plans to in 2022!¹⁸

[BONUS-POPUP id=”1″]

Reason #3 – First-Mover Advantage in One of the Fastest Growing Telemedicine Solution Areas19

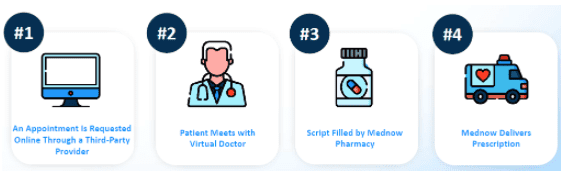

Mednow (TSXV:MNOW) (OTCQB:MDNWF) was quick to realize that telemedicine and teleconsultation is here to stay and that patients typically see PHARMACISTS up to 10x more frequently than their family PHYSICIANS.20

That’s why Mednow’s model of bringing the pharmacy to the patient is potentially so disruptive.

This unique business model separates Mednow from the competition and enables it to stand out in the marketplace.

After raising C$6.5M in a Q3 2020 seed round,21 Mednow went public in early March with a $37M upsized IPO.22

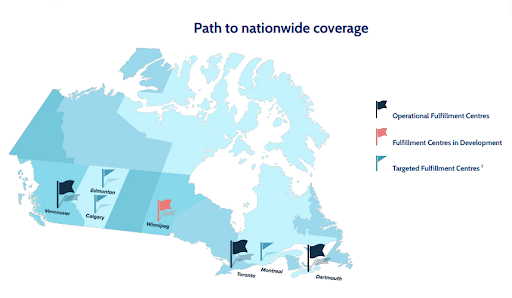

Since joining the public markets, Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) has been working hard to open new warehouses in Canada, with a goal to achieve national coverage by the summer of 2022.

Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) business model includes such breakthroughs as:

- Free, contactless, same-day and next-day delivery of prescriptions right to the patient’s doorstep

- Medvisit, acquired by Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) to provide doctor home visits for primarily acute and episodic illness and injury treatment.

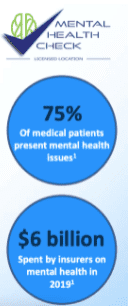

- Mental health support when people need it most through Mental Health Check, a service offered by Life Support Mental Health Inc., a company that Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) has a significant equity interest in.

- User-friendly interface for easy upload, transfer, and refill of prescriptions

- PillSmart™ medication management system that organizes each patient’s pills by dose in an easy-to-use pouch that is sorted by day and date

- Karie home personal health companion that organizes, schedules, and dispenses pills with one-button technology, ensuring that patients are taking the right meds at the right time

Reason #4 – Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) Aggressive Market Expansion and M&A Activity

In order to maintain its competitive advantage, Mednow (TSXV:MNOW) (OTCQB:MDNWF) intends to push forward with aggressive market expansion. Over the fall, the company focused its efforts on expanding within Canada. Then on November 22, 2021, Mednow made a strategic investment in a company operating in the US telehealth market, the US telehealth market was worth a whopping $144.38 billion in 202023 and has continued to grow since.24

Mednow announced a $500,000 investment in Doko Medical, a US virtual health provider that operates in 38 US states, with plans to obtain national coverage in 2022.25 Doko Medical has over 100 physicians and healthcare workers using its platform to provide urgent care and medical health services to patients including CV-19 tests, prescriptions, mental health, sick notes, referrals and video visits.

Mednow (TSXV:MNOW) (OTCQB:MDNWF) has also worked hard to expand its presence in the Canadian market.

On September 10, Mednow expanded its pharmacy business in Nova Scotia after receiving a license from the Nova Scotia College of Pharmacists. The company now offers digital pharmacy services through three fulfillment centers in Ontario, British Columbia and Nova Scotia.26

Then, less than two weeks later, Mednow (TSXV:MNOW) (OTCQB:MDNWF) signed an agreement to acquire a brick and mortar pharmacy in BC to align with its goal of building a national pharmacy footprint.

In Toronto, the company received approval from the Ontario College of Pharmacists at its location on Eastern Avenue, and is fully operational. Expansion plans in Alberta, Manitoba, and Quebec are all underway – an ambitious and potentially incredible roadmap to a national presence in just a short time-frame.

But, that’s not all. Mednow is also working to open fulfillment centers in other Canadian provinces and has already filed applications for a Winnipeg fulfillment center that, upon receiving the applicable approvals, will allow the company to service both Manitoba and Saskatchewan.

Mednow (TSXV:MNOW) (OTCQB:MDNWF) is basically building its own “Silk Road” – and the further it reaches across the country, the more money it can tap into from prescription fulfillment.

Mednow (TSXV:MNOW) (OTCQB:MDNWF) is basically building its own “Silk Road” – and the further it reaches across the country, the more money it can tap into from prescription fulfillment.

Mednow completed the acquisition of Medvisit, Canada’s largest, and longest standing doctor home visit provider in August to enhance its multidisciplinary, full spectrum healthcare services in Canada.

In the last fiscal year alone, Medvisit’s network of over 100 doctors across Ontario provided approximately 30,000 patient home visits and has served over 400,000 patients since inception.27

Those visits clocked a revenue of approximately $3 million for the year, and approximately $790,000 in profit. Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) goal of providing a comprehensive and holistic offering of health services is now more complete.

Through this, Mednow is building its national footprint in the hopes of securing big-name clients from coast to coast who want to help their employees during this unprecedented health crisis – something that in all likelihood is going to become the “new normal”.

Through this, Mednow is building its national footprint in the hopes of securing big-name clients from coast to coast who want to help their employees during this unprecedented health crisis – something that in all likelihood is going to become the “new normal”.

Mednow (TSXV:MNOW) (OTCQB:MDNWF) took a huge step in this market when it invested in Life Support Mental Health Inc., a company providing mental health support to patients through an assessment tool administered by a health professional through Mental Health Check.28

On November 18, 2021 Mednow (TSXV:MNOW) (OTCQB:MDNWF) also entered into an agreement to acquire Infusicare Canada Inc., whose wholly-owned subsidiary is a specialty pharmacy in London, Ontario. The pharmacy is located in the Arva Clinic, which offers comprehensive support for patients receiving biologic drugs for rheumatoid arthritis (RA) and other specialty medications.

This is expected to kick off Mednow‘s entry into the specialty pharmacy market, and bring in accretive revenue to Mednow’s balance sheet. This also gives Mednow the ability to expand same-day delivery services to London, Ontario – marking its 4th major Canadian city.

In their last fiscal year, Infusicare had C$9.3 million in revenue and approximately C$400,000 in gross profit, a boost to Mednow’s income, and it’s presence as it continues to scale.

Think that’s big? How about the company’s acquisitions of Liver Care Canada Inc. and London Pharmacare Inc.? These acquisitions bolster Mednow’s specialty pharmacy services, adding hepatology and liver disease treatment expertise to its offerings.

Plus, headline numbers are great – combining Liver Care, London Pharmacare, the previously mentioned acquisition of InfusiCare Canada, and the aggregate revenue from Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) last fiscal year brings total revenue to C$33.6 million.

This is a big boost to the company’s offering of specialty pharmacy and clinical services.31

Another milestone Mednow (TSXV:MNOW) (OTCQB:MDNWF) achieved in the last couple months was the establishment of Mednow for Business, the company’s institutional services business.

Through partnerships with companies, brokers and insurance companies, Mednow is creating a gateway to employers that seek to offer the best benefits to its employees, increase employee productivity and decrease the cost of benefit plans through a digital first and patient centric healthcare platform.

In January 2022, Mednow partnered with PACE Consulting Benefits and Pensions Ltd. and PACE Consulting MGA Services Inc. to allow PACE to market Mednow’s digital pharmacy and healthcare platform to its network of plan members.

PACE is one of Canada’s largest independent group advisory firms, specializing in Group Benefits, Group Retirement, and Group MGA/advisor support services.

This is yet another tool for Mednow (TSXV:MNOW) (OTCQB:MDNWF) to connect with employer looking for an improved standard of benefits, and limit the costs for benefit plans

Reason 5 – Medication Management Another Big Part of Mednow’s Success!

A big problem when it comes to prescription medications is patients either failing to take them or taking them incorrectly.

This is called “medication non-adherence,” and Mednow (TSXV:MNOW) (OTCQB:MDNWF) is tackling the problem head on, much to the benefit of its customers.

According to a 2018 article, medication non-adherence in the U.S.:32

- Accounts for up to 50% of treatment failures33

- Causes about 50% of Americans to not take their meds as prescribed34

- Leads to 125,000 preventable deaths each year in the US and about $300B in avoidable healthcare costs35

In Canada, medication non-adherence is estimated to cost the healthcare system $4 billion annually.36

By far, the biggest reason for non-adherence is forgetfulness. That’s why Mednow (TSXV:MNOW) (OTCQB:MDNWF) has created unique dose packages that it calls the PillSmart™ medication management system.37

dose packages that it calls the PillSmart™ medication management system.37

With no extra cost to the patient, Mednow’s PillSmart system organizes each patient’s pills by dose in easy-to-use pouches sorted by day and date.

If a patient wants even more help avoiding non-adherence, they can also get Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) Karie Health Device.

Karie is an automatic medication dispenser that organizes, schedules, and delivers a patient’s medication with the touch of a button.

Karie is an automatic medication dispenser that organizes, schedules, and delivers a patient’s medication with the touch of a button.

The device is connected to a cell phone network, so caretakers with permission can see when meds are taken and when, enabling them to take action if needed.38

Both Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) PillSmart and Karie help ensure that patients are taking the right medication at the right time, and that helps keep people out of emergency rooms and nursing homes.

That’s the kind of patient care that’s loved by doctors, governments, and caregivers.

Mednow management believes it is also the kind of cutting-edge innovation and revenue generation that markets look for when getting behind a company.

Leading the Way With Knowledge & Experience

Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) leadership team doesn’t just have the proven ability to build and scale a successful company and range of services, it also has the pedigree and access to the large networks that give the company a distinct competitive advantage.

Co-founders Ali Reyhany and Felipe Campusano co-founded CarePharmacies.ca, the largest pharmacist-controlled independent pharmacy chain in Canada with over 50 locations from coast to coast.

They also grew their previous venture to $150M in revenue before securing a $30M investment from the private equity arm of France’s 5th largest bank.

Here’s a brief look at Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) top team members.

Karim Nassar, MBA – Chief Executive Officer & Co-Founder

- Computer engineer with 15 years in pharmacy, technology, & healthcare logistics

- International marketing division at VitalAire Home Healthcare, helping build their Western Canada home oxygen logistics network

- Previously led retail & specialty pharmacy strategy initiatives at McKesson and Innomar Strategies, a subsidiary of AmerisourceBergen

- Former Vice President of Digital Strategy at CarePharmacies.ca

Ali Reyhany, RPh – Director, Co-Founder, & President

- 15+ years’ experience in the Canadian healthcare industry

- Proven operator & creator of profitable businesses

- CEO and Co-Founder of CarePharmacies.ca

- One of Canada’s Top 40 Under 40 for 2020 (BNN Bloomberg & Financial Post)39

Felipe Campusano, RPh – Director & Co-Founder

- Co-Founder of CarePharmacies.ca

- Purchased first pharmacy upon graduating from pharmacy school

- Has expanded his pharmacy & healthcare operations to 70+ businesses with annual revenue of ~$180M

- Founder and Chair of Liver Care Canada, a network of specialty liver disease treatment clinics

Ben Ferdinand – Chief Financial Officer

- CPA, CMA designation and holds the ICD.D designation from the Institute of Corporate Directors

- Previously served as CFO to a publicly traded medical health and wellness company (acquisitions of over $300 million, with over $70 million in capital raised)

- Served on the boards of CanDeal Inc., a provider of electronic debt trading services (co-owned by Canada’s six major bank-owned dealers and TMX) and Shorcan Brokers Ltd., an interdealer debt broker.

Sean Hurley – Chief Growth Officer

- 10+ years’ experience in scaling and building growth teams

- Experience scaling start-ups, including Opencare, Animoto, and ChefHero

- Founder of Pathright, an enterprise focused on helping others market and grow their company

Why Mednow Should Be on Your Watchlist:

The digital healthcare market is growing substantially.40

Medvisit is the largest and longest-standing doctor home visit company in Canada, giving Mednow (TSXV:MNOW) (OTCQB:MDNWF) a significant portion of the market share.

There is big gap in Canada’s on-demand virtual pharmacy market and Mednow is aiming to fill that gap

Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) acquisition of Medvisit and Life Support Mental Health solidifies its mission of providing a holistic experience for patients.

Mednow (TSXV:MNOW) (OTCQB:MDNWF) is not only Canada’s first publicly-traded virtual pharmacy, but it also has a recent $37M IPO under its belt

By combining cutting-edge virtual pharmacy services with more traditional telemedicine services, Mednow (TSXV:MNOW) (OTCQB:MDNWF) has separated itself from the competition

Only Mednow (TSXV:MNOW) (OTCQB:MDNWF) offers free same-day and next-day delivery of medications right to customers’ doorsteps

Mednow (TSXV:MNOW) (OTCQB:MDNWF) makes customer well-being a priority with its PillSmartTM system and Karie device that both help improve medication adherence – products that many pharmacies don’t offer

Experienced leaders are also co-founders of CarePharmacies.ca and quickly grew their previous venture to $150M in revenue41

[BONUS-POPUP id=”1″]