LYD stock climbed 33% to $0.12 today after Lydian International Limited (TSX:LYD) (OTC:LYDIF) announced that an environmental audit into its Amsular mine in Armenia had been conducted by the government of Armenia. A conclusion is expected at some stage next week.

LYDIF stock hit its lowest value of the year yesterday at $0.09 USD but rebounded well following today’s announcement. The Head of the Special Investigative Committee (The SIC), the body responsible for the audit, Mr. Hayk Grigoryan, announced that Lydian International had answered all questions raised during the audit and that the company was exhaustive in its cooperation with The SIC. The company also provided over 20,000 pages of documents as part of the investigation.

Surging Gold Prices

While a positive outcome from this environmental audit is likely and has clearly helped boost LYD stock, a surge in gold prices is also a factor to consider.

>> How Gaming Penny Stock Zynga Grew Up: Shares Soar 53% in 2019

Yesterday, gold prices topped $1,500 per troy ounce for the first time since April 2013. This recent surge has most likely been driven by a drop in bond yields as well as investor uncertainty in the volatile global markets. Many investors are concerned that escalating trade tensions across the globe, particularly Trump’s trade war with China and the ever-increasing likelihood of a No-Deal Brexit, will damage an already fragile global market.

“The concern is that the global economy may have a much steeper decline than investors have been pricing in,” said Bart Melek, head of Commodity Strategy at TD Securities. The rise in the value of gold has been a boon for investors, who have seen gold prices stay in the range of $1,150 and $1,350 for about three years.

While this obviously has major benefits for the gold market’s top performers, such as The VanEck Vectors Gold Miners ETF, which is up 41% in the past three months, it could also be a sign that LYD stock represents a stock on the rise for keen investors.

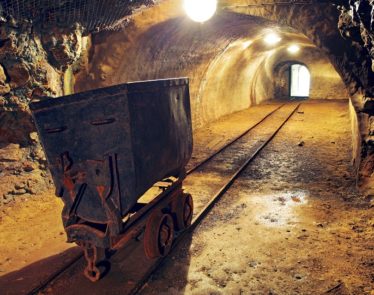

Featured image: DepositPhotos © PhotoWorld