Zacks Investment Research reports that wall street brokerages forecast an EPS of -$0.15 from pSivida Corp. (NASDAQ:$PSDV). The aggregate is based on two analyst issued earnings forecasts. In the same quarter last year, pSivida Corp. declared a -$0.21 EPS. This would suggest a 28.6% year-over-year growth. Official reports from pSivida are expected November 6th.

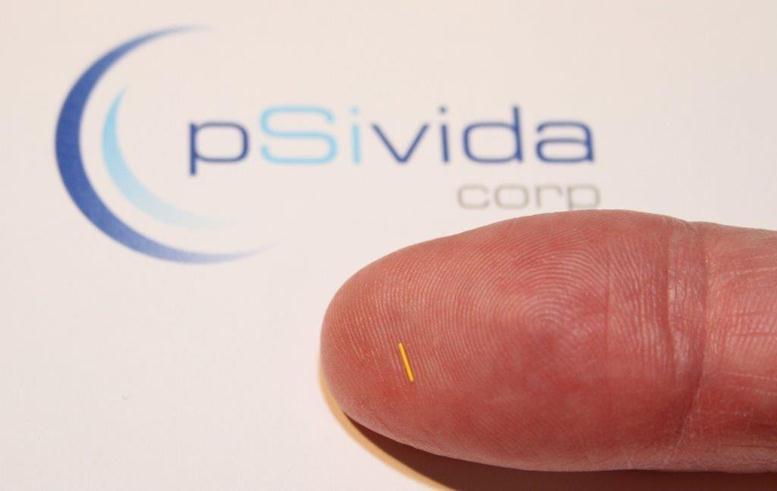

pSivida Corp. is a pharmaceutical company that primarily develops drug delivery systems to treat chronic eye diseases. The company boasts three products for back-of-the-eye disease treatment, including Retisert, ILUVIEN, its lead licensed product which is used to treat diabetic macular edema, and Medidur, which is used in the treatment of posterior segment uveitis.

Analysts are expecting pSivida Corp. to report a full-year EPS of -$0.59 per share for the current fiscal year, with EPS estimates ranging from -$0.57 to -$0.63, according to Zacks.

A number of analyst firms have weighed in on the stock:

- Northland Securities, in a report on June 14th, gave the stock a ‘Buy’ rating with a target price of $10.00.

- FBR & Co, on June 14th, restated a ‘Buy’ rating.

- Also on June 14th, Ladenburg Thalmann Financial Services gave the stock a ‘Buy’ rating and set a target price of $13.00.

- H.C. Wainwright, in a report on June 24th, gave the stock a ‘Buy’ rating at the target price of $8.00.

- Rodman & Renshaw, in a research report from May 30th, began coverage of the stock with a ‘Buy’ rating and a target price of $8.00.

In total, 5 analysts have set a ‘Buy’ rating and the consensus price target is $8.60.

During their last quarterly earnings report on September 11th, the company had an EPS of -$0.16 for the quarter, which matches the consensus. Analysts expected $0.48 million, but the company surpassed that at $0.70 million. The company also reported a net margin of 245.19% and a return on equity of -134.34%.

During Friday trading, the company hit $1.25 per share, an increase of 2.46% on the 599,849 shares that traded hands that day. The company had a market cap of $49.22 million. They had a 50 and 200-day moving average of $1.19 and $1.63. They also had a 52 week high of $3.48 and a 52 week low of $1.03.

14.95% of the stock is now owned by institutional investors after OxFORD Asset Management LLP purchased a new holding in the company during their second quarter that amounted to 69,004 shares valued at roughly $118,000. This means they now own approximately 0.18% of the company in recent quarters.

Featured Image: linkedin