VBI Vaccines Inc (NASDAQ:$VBIV) saw its stock rating with Zacks Investment Research rise from ‘Sell’ to ‘Hold’ in a research note from Tuesday.

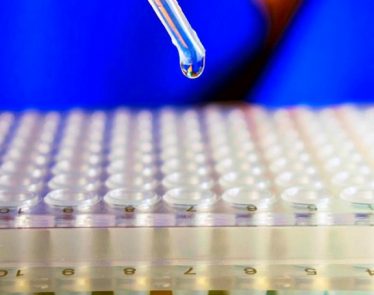

VBIV is a biopharmaceuticals company that develops new technology focused on expanding vaccine protection. Formerly known as SciVac Therapeutics, the company employs an eVLP platform that allows for the design of virus mimicking enveloped particles. The eVLP itself is prophylactic cytomegalovirus vaccine. The company also boasts other platforms, such as a thermostable technology that helps develop biologics and vaccines. They are located in Cambridge, MA.

Other research reports have taken note of VBIV. Noble Financial reiterated a ‘Buy’ rating for VBIV on Monday, July 31st. Not all analysts are sold on the stock’s growth, however. On Thursday, August 3rd, ValuEngine lowered the stock from ‘Hold’ to ‘Sell’. On Wednesday, May 31st, TheStreet – who use a letter grade system – lowered the stock from a ‘C-’ to a ‘D+’. Altogether, the stock has an average rating of ‘Hold’ and an average target price of $5.38.

On Tuesday, the stock traded down by 0.25%, dropping down to $4.00 and a total of 4,340 stocks were traded. The company has a 1 year high of $6.60 and a 1 year low of $2.75.

The Bank of Montreal recently increased its share by 8.6% in the second quarter. California State Teachers Retirement System bought a new stake in the company’s second quarter, totaling in at $167,000. Schwab Charles Investment Management also bought a new stake in the company’s second-quarter worth $187,000. Teachers Advisors LLC bought a new stake in the second quarter as well, valuing in at $195,000. Bank of New York Mellon Corp purchased a new stake at $19,300. Institutional investors currently own 31.52% of the company’s stock.

Jeff Baxter, CEO of the company, also bought 10,000 shares back in August, at a price of $3.22 per share for a total of $32,000.00. Baxter now directly owns 120,255 shares valued at roughly $387,221.00. In the last quarter, insider buying accounted for 23,000 shares valued at $74, 510. Ths accounts for 34.10% of the company’s total stock.

Featured Image: twitter