The gold price hit a 7-year high on Thursday, increasing by 0.9% to $1,626.50 per ounce, following an update from the US Federal Reserve regarding rate cuts.

While the yellow metal has been on the rise since the end of 2019, minutes from a recent Fed monetary policy meeting have driven the gold price higher yet. According to the meeting minutes released Wednesday, Federal Reserve officials are confident that current interest rates will remain unchanged for the foreseeable future.

Despite cutting rates three times in 2019, the Federal Open Market Committee voted to leave its benchmark overnight funds rate at the current range of 1.5% to 1.75%, noting that economic outlook has gotten stronger since the previous forecast last December.

Monetary policy and gold have always had a complex relationship, and when interest rates struggle to keep up with inflation like they are now, the gold price is typically boosted. At the same time, coronavirus fears and the slowing global economy are causing investors to seek out gold as a safe haven.

Naturally, the uptick in gold price is good news for these investors.

So, is now the best time to invest in gold? And if so, which gold stocks offer the brightest outlook for investors?

Is Now the Time to Invest in Gold?

As mentioned, several factors are suggesting that gold could be a good investment this year. From rising tensions in the Middle East to interest rates to the US-China trade war, there is no shortage of drama that could further boost the price of gold.

Add to that the global fears surrounding the deadly coronavirus, which has now reached a death toll of over 2,000 and has infected more than 74,00, and it’s clear why investors are looking at gold.

Even analysts see the price rising further in 2020. Earlier this week, Citi upgraded its 6-to-12-month gold price target to $1,700 per ounce and upgraded its 2020 base case average price forecast from $1,575 to $1,640 per ounce.

The commodity strategists at Citi also expect the price of gold to surpass $2,000 per ounce in the next 12 to 24 months, which is very encouraging indeed.

On the flip side, others see a recovery in global economic growth happening by the end of 2020, which would weigh on the gold price down the road.

According to Capital Economics commodity economist Alexander Kozul-Wright, the UK-based research firm expects the price of the precious metal to drop down to $1,400 per ounce by the end of the year.

Again, it remains to be seen what will happen with the coronavirus outbreak. If the spread continues and creates any additional economic slowdown in China, it will likely prove favorable for the price of gold.

>> TOCA Stock Doubles Ahead of Forte Bioscience Merger

Which Gold Stocks Offer the Most Promise?

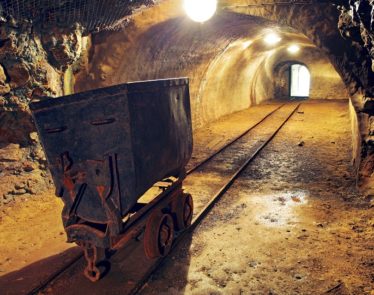

There are several ways to invest in gold, including physical gold, gold exchange-traded funds (ETFs), and mining companies. The gold mining space is mainly dominated by big industry players; however, there are several smaller plays that could offer investors an opportunity to gain a slice of the market.

One of these is Osisko Mining Inc. (TSX:OSK), a gold explorer with a promising gold project in Quebec, Canada.

On Thursday, Osisko provided an updated resource estimate for its 100%-owned Windfall gold deposit, which showed a 60% increase in its indicated resource estimate and a 66% increase in the inferred mineral resource estimate.

The news boosted the company’s stock by 4.57% to C$3.89 by market close Thursday.

Another small-cap gold stock that investors might consider adding to their portfolio this year is BTU Metals Corp. (TSXV:BTU), another company with a promising flagship project in Canada.

Earlier this month, BTU announced that it has identified two areas with high-probability gold targets at its Dixie Creek Target area, a property that runs adjacent to Great Bear Resources’ gold discoveries.

According to the release, the SGH soil sampling program at the site showed two gold target zones with surface areas of approximately 650,000 square meters and 140,000 square meters at the Dixie Creek target.

In the last 12 months, BTU Metals’ share price has increased by 155% from C$0.10 to $0.25. Of course, if the rising gold price continues to boost investor interest, the company’s stock could rise further still.

Great Bear Resources Ltd. (TSXV:GBR) (OTCQX:GTBDF) is also seeing a lot of promise in the area. On Thursday, the company announced that it has made significant progress at its Dixie Project thanks to a fully-funded $21 million exploration program.

Ongoing drilling at the project, which is comprised of 9,140 hectares of contiguous claims that extend over 22 kilometers, has revealed that the gold-mineralized system is at least 11 kilometers in strike extent.

Great Bear Resources has also seen a significant uptick in its share price in the last year, going from C$3.71 to C$8.99, which represents a 142.32% increase.

Indeed, the increased gold price has shined the spotlight on the gold space, and there are plenty of opportunities for investors to get in.

Featured Image: Depositphotos ©photooasis