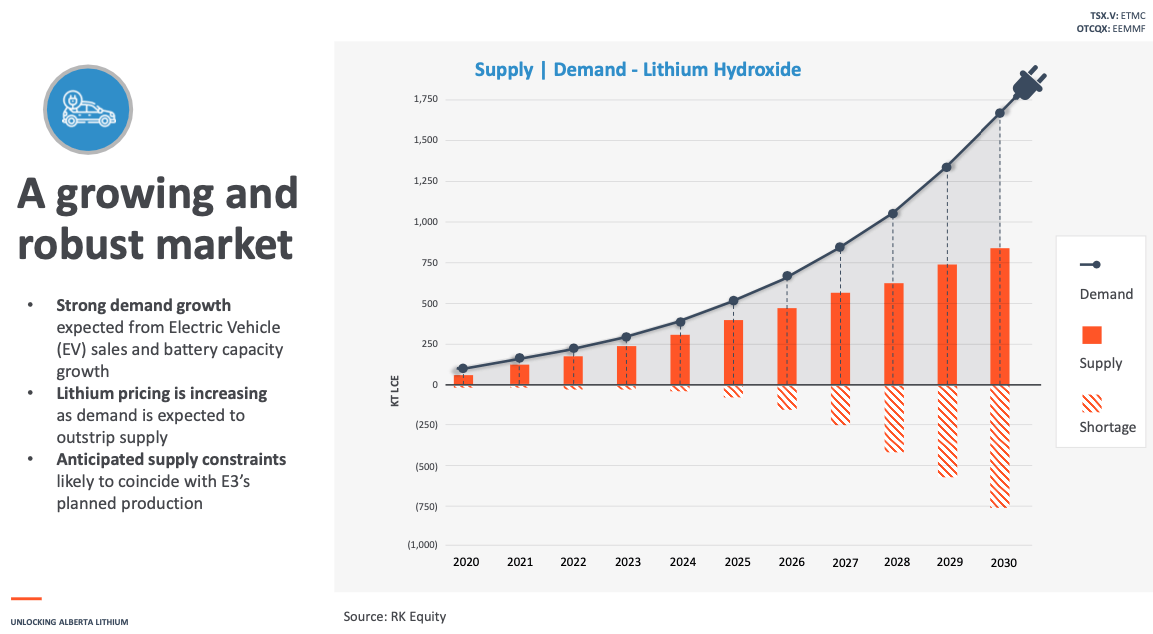

While the world seems to be undergoing a great GREEN revolution, there’s a potentially catastrophic problem on the horizon before we get there.

According to Benchmark, lithium demand is expected to reach 2.4 million tonnes LCE (lithium carbonate equivalent) in 2030 – this is almost 1.8 million tonnes more than the 600,000 tonnes of lithium Benchmark expects will be produced in 2022.1

This means the mining sector will need to step up its production by at least 3x to meet demand, at a cost estimated to be an additional US$42 billion to accomplish.2

And the costs to consumers could keep rising, as we’ve already seen in 2022 with top bids for lithium up 140%, causing Tesla CEO Elon Musk to call the new price point ‘Insane Levels’. 3

Luckily, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) is getting ready to help increase the global lithium supply with Canada’s largest recorded lithium resources and the proprietary technology to become a dominant lithium producer for +20 years.

Now we’re seeing even more factors piling up that could cause even these price estimates to come in low and/or overly conservative.

On top of all that… there’s also a growing chorus of criticism against conventional lithium miners for not being overly ESG-friendly.4

Considering all of these factors, it’s no wonder the market has turned its attention toward lithium projects, particularly those with the perfect combination of long-term lithium production that’s ESG-friendly, and safely located in a reliable jurisdiction.

Enter E3 Lithium (TSXV:ETL) (OTCQX:EEMMF), which not only holds an impressive land position in business-friendly Alberta, Canada, but it also brings to the table one of the largest lithium resources on the planet, and a proprietary technology that could change the lithium industry as we know it.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) just released some extraordinary news that simply can’t be ignored – it has upgraded its resource to 16.0 million tonnes (Mt) Measured and Indicated (M&I) lithium carbonate equivalent (LCE) at its Clearwater Lithium Project – making it the largest M&I lithium resource in Canada.5

And believe it or not, this is just one of the many accomplishments this company has achieved.

Now let’s break down the numerous reasons E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) is poised to be a key player in the coming lithium shortage crisis.

[BONUS-POPUP id=”1″]

8 Reasons

To Invest in E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) may be a Lithium Production Game Changer

1

Lithium Market is Booming: Thanks to surging demand for EVs and lithium-ion batteries for tech, the world is scrambling for lithium supply, with structural shortages in the lithium market for years to come.

2

Flagship Asset with Globally Significant Resource: With 16 million tonnes of Measured and Indicated (M&I) LCE on the books, E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) has the largest M&I LCE resource in Canada. This only entails about 70% of the company’s entire permit area.

3

Very Attractive Economics: The project outlines a US$1.1B NPV (8%), for just the first phase of production of 20,000 tonnes of lithium hydroxide annually over the first 20 years, according to ETL’s Preliminary Economic Assessment (PEA)5

4

Proprietary, ESG-Friendly Technology: 100% brine aquifer reinjection and a small land footprint makes the company’s proprietary DLE ion-exchange technology a potential monumental game changer in the lithium space.

5

Well-Funded: In November, E3 Lithium received a C$27 million investment from the Government of Canada’s Innovation, Science and Economic Development’s Strategic Innovation Fund (SIF).7 Since then it has been granted another C$3.545 million from the Government of Canada8 and gained $4.9 million since Q3 2022 from the exercise of warrants from financings that closed in December 2020 and February 2021.

6

World-Class Jurisdiction: Within industry-friendly Alberta, E3 is capitalizing on the famous “Alberta Advantage”, with over 600,000 hectares of brine permits in an area where 4,000 oil and gas wells have already been drilled to date.9

7

Progressing Towards Commercial Operations: Using brines derived from drilling Alberta’s first brine production wells in the Clearwater Project area, the company is steadily progressing towards commercial production in 2026.

8

Strong Leadership Team: Proven management team with over 150 years of combined experience in emerging technologies, finance, mining, petroleum and unconventional resource plays, including Peter Ratzlaff, who has over 25 years of experience in engineering and production/operations at companies like ConocoPhillips and Independent director Kevin Stashin, an oil and gas executive with over 40 years of experience and companies like Devon Canada Corp, Anderson Exploration, and Petro-Canada.

Lithium: The Next Gold Rush

It can’t be stressed enough how big of an opportunity the lithium market presents at this stage in time. We’re living through a wild shift, with lithium consumption nearly quadrupling since 2010.10

“I’d certainly encourage entrepreneurs out there who are looking for opportunities to get into the lithium business. We think we’re going to need to help the industry on this front.”

– Elon Musk, CEO of Tesla Inc.

Clearly it’s time for something big to hit the lithium market, and give consumers something to hope for. This is where E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) is not only well-equipped but also perfectly timed to succeed.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) is Targeting Commercial Production by 2026

Unlike conventional lithium producers like Albemarle and Lithium Americas, who produce from evaporation ponds and/or hard rock mining, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) has a unique strategy to succeed.

E3 has outlined a Preliminary Economic Assessment (PEA) from third-party experts, revealing that its proprietary DLE ion-exchange technology, large resource, and favorable jurisdiction are ideal for lithium development.

As you can see from the chart above, despite having a significant LCE resource compared to Vulcan Resources, Standard Lithium and Lithium Americas, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) is trading at least a fifth of the price.

E3 Lithium also has a tidy share structure and is well-funded after getting a hefty C$27 million investment from the Government of Canada and C$3.545 million in funding from Natural Resources Canada’s Critical Minerals Research, Development, and Demonstration (CMRDD) program,14 a part of the Government of Canada’s federal Budget 2021. E3 Lithium was chosen as one of six organizations throughout Canada.

E3 Lithium also received $4.9 million since Q3 2022 from the exercise of warrants from financings that closed in December 2020 and February 2021.

Globally Significant Lithium Resource In Energy-Friendly Alberta

As mentioned, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) just upgraded its mineral resource to 16 Mt Measured & Indicated (M&I), which includes 6.6 Mt of LCE Measured and 9.4 Mt of LCE Indicated, making it the largest M&I lithium resource in Canada.

As mentioned, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) just upgraded its mineral resource to 16 Mt Measured & Indicated (M&I), which includes 6.6 Mt of LCE Measured and 9.4 Mt of LCE Indicated, making it the largest M&I lithium resource in Canada.

The project economics are also very attractive. According to the Preliminary Economic Assessment (PEA) on the Clearwater Lithium Project, it has an NPV 8% of US$1.1 billion with a 32% IRR before taxes and US$820 million with a 27% IRR after taxes.

Now that the resource has been upgraded, E3 (TSXV:ETL) (OTCQX:EEMMF) will focus on completing a Pre-Feasibility Study (PFS) by the end of the year, which will outline the detailed plans for its first commercial facility and one of the world’s first DLE reserves.

Following the completion of the PFS, E3 plans to conduct a Feasibility Study (FS), obtain all necessary regulatory approvals and deliver a project finance arrangement to enable the construction of its first commercial facility in Alberta.

The ‘Alberta Advantage’

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) owns over 600,000 hectares (~1.48 million acres) in industry-friendly Alberta, where the government has committed to a strategy that it hopes will help the province become an international player in mineral extraction—and they believe E3 Lithium will help them get there.

The province has provided $1.8 million to E3 in grant funding, as historically there have been over 4,000 oil and gas wells drilled within the same areas of the company’s brine permits.

E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) began by re-entering these wells to conduct sampling and testing and leverage over 70 years of historical data to understand the lithium potential at depth. The company has already drilled its first brine production wells —the first of its kind in Alberta.17

As part of its first exploratory drill program, E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) has pulled up brine samples from each well to verify lithium concentrations and production testing, confirming flow rates and deliverability from the Leduc Reservoir.

In the first well, E3 achieved its total planned depth of 2,670 meters (m) in its first well, allowing for full data collection, including 36.9 meters of core sample. It also reached total depth in its second well. The company acquired an existing well for its third, saving about $1.5M.18

E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) found consistent concentrations of lithium in the Leduc Aquifer from its three wells. The first well showed a P50 lithium concentration of 76.5 mg/L in a previously untested area.19 The second well, 20 km south of the first, showed consistent concentrations of 74 mg/L.20 The third well showed consistent thickness of 202 meters and a concentration of 74 mg/L from a single interval.21

Press Releases

- Lithium Company With Vast Resources In Central Alberta Expects A Big Year

- E3 Lithium Outlines 2023 Company Goals and Path to First Lithium

- E3 Lithium Announces Participation in Red Cloud’s 2023 Pre-PDAC Mining Showcase

- E3 Lithium Expands Team

- E3 Lithium Received $4.9 Million Since Q3 2022 from Exercise of Warrants

Alberta’s First Lithium Mogul

If Canada is going to fulfill its electric vehicle production goals, it’s going to  need companies like E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) and visionary CEOs like Chris Doornbos, who was just ranked among the Top 10 EV Entrepreneurs in 2023.22

need companies like E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) and visionary CEOs like Chris Doornbos, who was just ranked among the Top 10 EV Entrepreneurs in 2023.22

According to Maclean Magazine’s Power List 2023, Doornbos could become Alberta’s very first lithium baron.

Alberta has historically been focused on oil and gas, but the future could be all about lithium due to the resource at E3’s project.

The article outlined the company’s milestones along its pathway to commercialization which it is anticipating as early as 2026.

The Clearwater project could produce 20,000 tonnes of lithium annually starting in 2026 which Maclean’s describes as being enough for 300,000 Teslas.

ESG-Friendly Lithium Ion-Exchange Tech: The Next Generation of Li Production

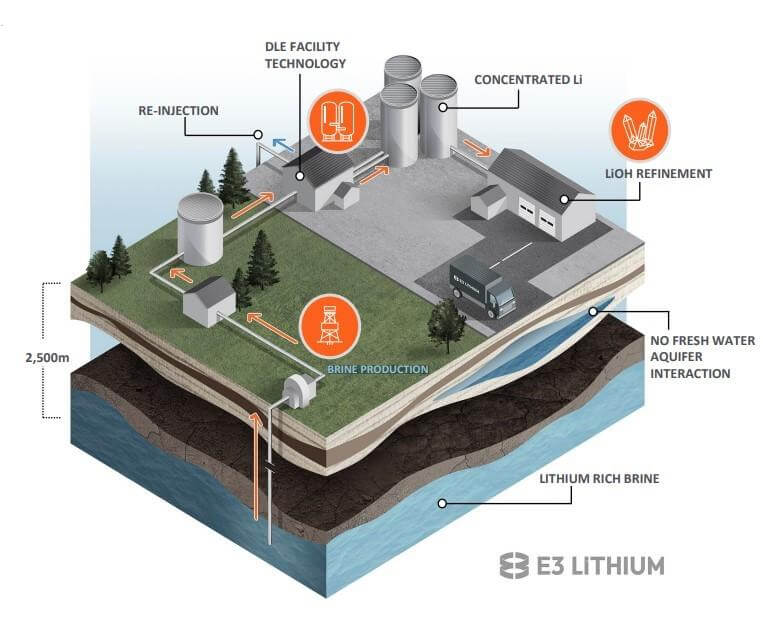

Beyond the globally-significant lithium resource, one of E3’s most promising assets is its Direct Lithium Extraction (DLE) Ion-Extraction Technology, which utilizes a proprietary sorbent designed to be highly selective towards lithium ions.

At an energy conference in April 2022, US Energy Secretary Jennifer Granholm had this to say about DLE: “It’s such a game-changer. There’s huge opportunities.”23

DLE’s potential has drawn the interest of Warren Buffett’s Berkshire Hathaway to the tune of a $15 million investment to test the technology at California’s Salton Sea—ahead of what is proposed to result in a multibillion-dollar production facility, capable of producing 90,000 metric tons of lithium per year.

On February 2, E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) reached a monumental milestone in the development of its Lithium Ion-Exchange (Li-IX) pilot plant in the Clearwater Project Area, which is now on track to begin construction and operation in Q3 2023.

Read more about the pilot project with Imperial Oil here

The pilot plant is a crucial step in unlocking the value of E3 Lithium‘s lithium resources. At the pilot scale, demonstrating Li-IX technology significantly de-risks the commercial design.

E3’s (TSXV:ETL) (OTXQC:EEMMF) lab results demonstrated lithium recoveries consistently exceeding 90%, with peak recoveries exceeding 95% and high contaminant rejection exceeding 98% removal.

E3’s resource – the Leduc Reservoir is capable of producing 130,000m3 of brine per day via its Clearwater Project Area alone (PEA basis) and plans to utilize a closed loop system, with 100% brine re-injection.

E3’s DLE technology generates a high-purity concentrate solution. Refinement of the lithium concentrate results in battery-quality lithium hydroxide for direct sale to battery manufacturers that could include Tesla, Panasonic or others.

E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) has already partnered up with Pure Lithium to create its first successful lithium metal battery using lithium from its resources to demonstrate the proof of concept. Now they are completing a series of testing to define how their technologies can be combined to produce a commercially-viable production process for lithium metal batteries and electrodes.

The next steps in the construction of the field pilot plant include obtaining approval from the Alberta Energy Regulator, completing detailed design and engineering, publishing KPIs on expected performance, and commissioning equipment on site.

By actively examining commercially accessible technologies and lowering risk, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) believes it may shorten the project development schedule and have a commercial plant by 2026.

[BONUS-POPUP id=”1″]

Incredibly ESG Friendly

E3 Lithium’s DLE provides the potential for industry-leading ESG, and carbon sequestration in Alberta offers the potential for Carbon Neutrality.24

100% of the brine brought to surface for lithium extraction will be recycled back into the aquifer. Less than 3% of land is anticipated to be required for E3’s development compared to similar conventional lithium projects.

And on top of all that, E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) process requires no open pit mining, tailings ponds or evaporative ponds.

Furthermore, E3 recently acquired25 a third-party well in its Clearwater Project Area within the Bashaw District, allowing the repurposing of the oil and gas infrastructure and reducing the environmental footprint associated with E3’s inaugural drilling program for a potential cost savings of more than $1.5 million.

Strong Leadership Team

It takes more than just a friendly business jurisdiction to make something like this work. Thankfully, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) is in VERY capable hands.

8 Reasons

To Seriously Look Into E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)

1

Booming Market: Growing demand for EVs and lithium-ion batteries has created a global scramble for lithium supply, resulting in structural shortages for years to come

2

Globally Significant Resource: E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) boasts Canada’s largest LCE resources, with 16 Mt M&I LCE on the books, representing only 70% of the company’s entire resource area.

3

Attractive Economics: E3‘s PEA reveals a US$1.1B NPV (8%) for the first phase of production of 20,000 tonnes of lithium hydroxide annually over 20 years.

4

Proprietary and ESG-Friendly Technology: Proprietary DLE ion exchange technology boasts 100% brine disposal and a small land footprint, potentially revolutionizing the lithium space.

5

World-Class Jurisdiction: E3 operates in industry-friendly Alberta, capitalizing on the famous “Alberta Advantage,” with over 600,000 hectares of brine permits in an area with a history of successful oil and gas drilling.

6

Progressing Towards Commercial Operations: E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) is steadily moving towards commercial production in 2026, using brines derived from drilling Alberta’s first brine production wells in the Clearwater Project area

7

Well-Funded: In November, E3 Lithium received a C$27 million investment from the Government of Canada’s Strategic Innovation Fund,26 followed by another C$3.545 million from the Government of Canada’s CMRDD program.27 The company also gained $4.9 million since Q3 2022 from the exercise of warrants from financings that closed in December 2020 and February 2021.28

8

Strong Leadership Team: E3 Lithium‘s management team has over 150 years of combined experience in emerging technologies, finance, mining, petroleum, and unconventional resource plays, including Peter Ratzlaff, who has over 25 years of experience in engineering and production/operations at companies like ConocoPhillips, and Kevin Stashin, an oil and gas executive with over 40 years of experience at companies like Devon Canada Corp, Anderson Exploration, and Petro-Canada.

E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) has plenty of potential to make a significant impact in the lithium market, with its large land portfolio, globally-significant resource, and potentially industry-changing DLE technology, making this an ideal time for investors to follow this story.

So, make sure you don’t miss out on any of E3 Lithium’s (TSXV:ETL) (OTXQC:EEMMF) news and milestones by clicking here to sign up for the company’s newsletter.

[BONUS-POPUP id=”1″]

Chris Doornbos P. GeoPresident, CEO and Director

Chris Doornbos P. GeoPresident, CEO and Director Chris Ward P.EngVP, Clearwater Project

Chris Ward P.EngVP, Clearwater Project Peter Ratzlaff P.EngVP, Resource Development

Peter Ratzlaff P.EngVP, Resource Development Joanie Kennedy, P.Geo, PMPManager, Geosciences

Joanie Kennedy, P.Geo, PMPManager, Geosciences Caroline Mussbacher, B.Sc, P.EngActing Director, Commercialization

Caroline Mussbacher, B.Sc, P.EngActing Director, Commercialization