It’s no secret that Canadian gold production took a hit in 2020. The country produced 1,160 koz of gold in Q2 2020, a significant drop from the 1,482 koz produced over the same period in 2019. However, the gold market looks likely to surge in 2021 and the Great White North is once again an attractive destination for the mining industry. The global health crisis was a significant cause for the drop in production last year, and companies are looking to make up for lost time. New mines are set for exploration and development and major miners are set to ramp up production in the coming months as companies like Fury Gold Mines (TSX:FURY) (AMEX:FURY), Newmont Corporation (NYSE:NEM) (TSX:NGT), Kirkland Lake Gold Ltd (NYSE:KL) (TSX:KL), Agnico Eagle Mines Ltd (NYSE:AEM) (TSX:AEM), and Barrick Gold Corp (NYSE:GOLD) (TSX:ABX) explore and develop Canadian assets. Due in part to these companies, Canadian gold output is set to rise to 7.6Moz by 2023.

Fury Gold Mines Develops Prime Canadian Gold Assets

Fury Gold Mines (TSX:FURY) (AMEX:FURY) is focused on new discovery and resource growth at its properties in some of Canada’s most prolific districts. 2021 promises to be a big year for Fury as the company brings these assets closer to production through project development and potential new discoveries.

Fury’s flagship project is its wholly-owned 24,000 hectare Eau Claire Project in the James Bay region in Northern Quebec. In 2021, the company plans to focus on expanding the Eau Claire deposit while also drill testing additional targets throughout the property. The company is working towards a goal of producing around 150k to 200k ounces annually from Eau Claire. The company is also developing its Homestake Ridge project in British Columbia’s prolific Golden Triangle, which reported 165,993 oz of total indicated gold at Homestake at 7.02 g/t in 2019, as well as its Committee Bay Gold Project in Nunavut located along the Committee Bay Greenstone Belt.

“We are anticipating a very active and exciting year as we continue drilling to add ounces and discover new areas of high-grade mineralization both at depth and at surface along the deposit trend,” Fury President and CEO Mike Timmins said in a recent release.

“We will continue to apply our systematic exploration approach as we advance our entire project portfolio in 2021 and position our shareholders to also benefit from the large-scale exploration programs planned later in the year at Homestake Ridge and Committee Bay,” Timmins said.

Mining Companies Expand Canadian Operations

Located just 57 kilometers away from Fury Gold Mines’ Eau Claire Project is Newmont Corporation’s (NYSE:NEM) (TSX:NGT) Éléonore project, one of the largest gold mines in Quebec. In 2019, Éléonore saw annual production of 246k attributable oz, and in 2021, Newmont intends to bring the property to full production capacity with the development of a fifth mining horizon and a new production shaft.

Kirkland Lake Gold Ltd (NYSE:KL) (TSX:KL) operates several gold assets in Ontario, including the company’s flagship Macassa Mine, located in the town of Kirkland Lake, and open-pit Detour Lake mine, located outside of Timmins. Both of these projects were limited by pandemic-related issues in 2020, and the company intends to increase output in 2021. For Detour, Kirkland wants to increase production by as much as 720,000 ounces in 2021.

About 180 kilometers southwest of Fury Gold’s Committee Bay Gold Project in Nunavut sits the Agnico Eagle Mines Ltd (NYSE:AEM) (TSX:AEM) Meadowbank open-pit gold mine. Meadowbank produced 158,208 ounces of gold in 2019 and the company intends to ramp up production through 2021 and produce approximately 2.5 million ounces of gold by 2026.

In October, Barrick Gold Corp (NYSE:GOLD) (TSX:ABX) announced plans to extend the lifespan of its Hemlo Mine, located about 350 kilometers east of Thunder Bay, Ontario. The mine has been operating continuously since 1989 and has produced more than 2.8 million ounces of gold. As the company begins to wind down the open pit section of the mine, Barrick will be transitioning it to a modernized Tier Two asset with a purely underground operation in order to extract further value from the property in 2021 and beyond.

After a year where gold production was significantly hindered, gold companies like Fury Gold Mines are looking to make up for lost time by ramping up exploration and development just as the gold market begins to gain steam once again.

Click here to find out more about Fury Gold Mines.

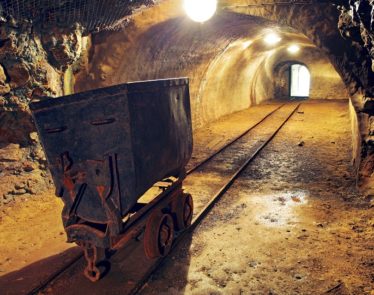

Featured image: DepositPhotos © belchonock