Takeda Pharmaceutical TAK announced that the FDA has granted approval to Livtencity (maribavir) for treating post-transplant cytomegalovirus (“CMV”) infection/disease in pediatric patients aged 12 years or older and adults whose disease is refractory to treatment (with or without genotypic resistance) with conventional antiviral therapies — ganciclovir, valganciclovir, cidofovir, or foscarnet.

The approval was based on data from a phase III study — SOLSTICE — that treatment with Livtencity met the study’s primary endpoint of CMV DNA level less than the lower limit of quantification (“LLOQ”) of 137 IU/mL in more than twice the proportion of adult transplant patients compared to conventional antiviral therapies.

Takeda evaluated the efficacy and safety of treatment with either maribavir or investigator-assigned conventional antiviral therapy in patients who have undergone solid organ transplant (“SOT”) or hematopoietic stem cell transplant (“HSCT”) for up to 8 weeks in the SOLSTICE study.

Please note that CMV infection acquired or reactivated following a transplant can lead to loss of transplanted organ or loss of life. Although CMV infection is a rare disease, Takeda stated that it occurs in 15-56% of patients who have undergone SOT and 30-70% of HSCT patients.

Takeda is also developing maribavir as a potential first-line treatment for CMV infection in patients who have received hematopoietic stem cell transplant in a phase III study.

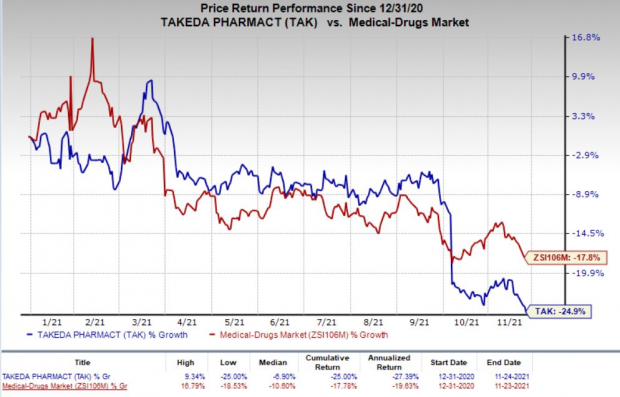

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Shares of Takeda have declined 24.9% so far this year compared with the industry ’s decrease of 17.8%.

Takeda has a diverse oncology pipeline with multiple candidates targeting hematologic malignancies, other blood cancers, and novel immuno-oncology targets. The company’s Ninlaro received approval in Japan in May this year as a first-line treatment for multiple myeloma without prior stem cell transplant.

Apart from oncology, the company is also focused on commercializing and developing drugs for treating rare diseases and neurological disorders. The company is also developing treatments for short bowel syndrome and a vaccine for dengue.

Zacks Rank & Stocks to Consider

Takeda currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the pharma/biotech sector are Assertio ASRT , IVERIC bio ISEE and Inhibrx INBX , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Earnings per share estimates for Assertio have narrowed from a loss of 33 cents to 7 cents for 2021 and improved from a loss of 20 cents to earnings of 20 cents for 2022 in the past 30 days. Assertio delivered an earnings surprise of 4.95%, on average, in the last four quarters. Shares of ASRT have gained 36.1% in the past three months.

The bottom-line estimates for IVERIC bio have improved from a loss of $1.18 to $1.12 for 2021 and from $1.17 to $1.10 for 2022 in the past 30 days. IVERIC bio’s stock has gained 64.3% in the past three months.

Inhibrx’s loss per share estimates have narrowed from $2.31 to $2.07 for 2021 and from $2.27 to $2.21 for 2022. Inhibrx delivered an earnings surprise of 4.95%, on average, in the last four quarters. Shares of INBX have gained 44.8% in the past three months.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report