Robinhood is an excellent platform for traders looking to invest in everything from stocks to crypto. But when looking at the 100 Most Popular shares on the website, it can be hard, in a sea of large-cap companies, to find Robinhood stocks under $1.

Here are three on April 14.

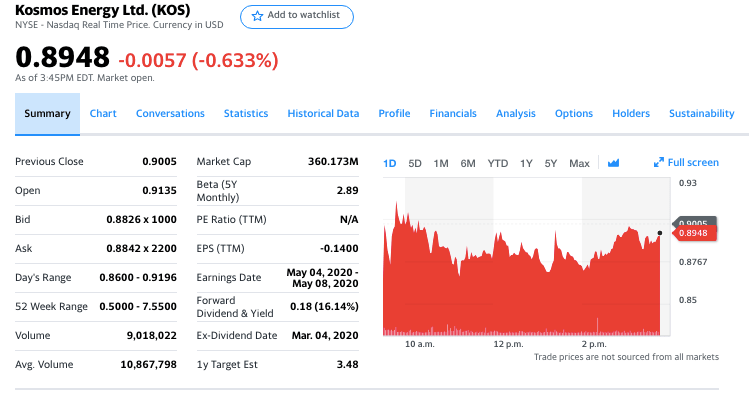

3 Robinhood Stocks Under $1: Kosmos Energy Ltd. (NYSE:KOS)

Kosmos Energy Ltd. is a deepwater independent oil and gas exploration and production company, which focuses along the Atlantic Margins.

As of 3:45 p.m. EDT on April 14, KOS stock is down 0.63% at $0.8948.

The drop comes around a week after the company announced that it completed the re-determination of its RBL facility. On April 13, shares of Kosmos Energy were up 85.63% from its 52-week low, and during the last month, nine analysts have given the company a Buy rating. With a float of 386.27 million as well, investors can consider KOS to be one of the Robinhood stocks under $1 that is a high float stock, indicating predictability and not volatility.

3 Robinhood Stocks Under $1: Chesapeake Energy (NYSE:CHK)

We include Chesapeake Energy as one of the Robinhood stocks under $1, because, at the time of writing, CHK is trading at $0.1328. But it’s also down 17%, and some analysts have become bearish about the stock in recent months.

As of April 4, 2020, the company, which is engaged in hydrocarbon exploration, has seen its share price fall 95% over the last twelve months. On the same day, figures were showing that the CHK share price was down 81% in the previous 90 days.

>> 5 Nasdaq Penny Stocks to Watch

Things didn’t get much better this week when shares fell 1.4% on Monday in the extended session. This drop was triggered by the company disclosing that the board approved a 1-for-200 reverse stock split. This split is an attempt to bring the company back into compliance with the NYSE trading regulations.

“As a result of the reverse stock split, each 200 pre-split shares of common stock outstanding will automatically be combined into one issued and outstanding share of common stock without any action on the part of the shareholder,” the company stated. “The total number of shares of common stock that the Company is authorized to issue will also be reduced from 3,000,000,000 to 22,500,000 shares.”

3 Robinhood Stocks Under $1: Groupon, Inc. (NASDAQ:GRPN)

Groupon is an American company that operates online local commerce marketplaces that connect merchants to consumers.

At market close on April 14, GRPN stock closed down 1.85% at $0.85, adding it to the list of Robinhood stocks under $1. The stock is currently up 0.14% in after-hours trade, and according to FinVinz, has a float of 438.95 million.

Groupon has struggled immensely because of the coronavirus, plunging more than 60% as of April 13 over the past three months. The stock rose 2.9% on Monday in pre-market trade, however, before closing at 87 cents after it announced that it had adopted a shareholder rights plan. It also said Monday that it plans to either furlough or lay off over 40% of its staff.

“The [rights plan] may cause substantial dilution to any person or group that attempts to acquire the Company without the approval of the board,” the company explained.

Takeaway

March and April have been tough for many companies, and Kosmos Energy, Chesapeake Energy, and Groupon have all experienced this hardship. Things may get worse before they get better, too. To see the direction shares will take in the coming weeks, we recommend keeping an eye on these Robinhood stocks under $1.

Featured image: PixaBay