Gold is continuing its bull run and creating a ton of opportunity for investors who are interested in gold penny stocks. Gold futures just topped $1,800 an ounce on Tuesday and is headed for its highest finish since 2011.

However, this recent uptick could be just the beginning. Analysts from the Bank of America see gold prices reaching $3,000 in the next 18 months, which is 50% higher than the existing record.

For investors who don’t already have gold in their portfolios and for those who wish to add a little more sparkle, the following three sizzling hot gold penny stocks are a great place to start.

Sizzling Hot Gold Penny Stocks: Bullfrog Gold Corp. (CSE:BFG) (OTCQB:BFGC)

First on the list of sizzling hot gold penny stocks is Bullfrog Gold Corp., a US-based gold and silver exploration company with a commanding land and mineral position in the Bullfrog mine area in Nevada.

The area has been dubbed one of the world’s premier mining jurisdictions and has been ranked number three on the Fraser Institute’s 2018 Investment Attractiveness Index out of 76 jurisdictions.

On Tuesday, Bullfrog Gold announced gold and silver assay results from nine more holes of the 25 holes recently drilled at its Bullfrog Project, which comprises 2,125 hectares (5,250 acres) of strategic land, established resources, and prospective exploration potential. According to the assay results, drilling continued to intercept thick intervals of gold mineralization in the Mystery Hill deposit.

BH 20-6 intersected 110 meters averaging 0.41 grams per ton (g/t) gold, including 26 meters of 0.91 g/t, while BH-20-9 intersected 91 meters averaging 0.33 g/t and an upper interval of 6 meters averaging 0.53 at 23 meters.

The results sent BFG stock up 24.32% on Tuesday to C$0.23, while BFGC stock was up by 25.93% to $0.17 by midday.

According to TradingView’s technical analysis, 14 moving averages signal a “Strong BUY” for BFG stock, while 16 moving averages are signaling a “Strong BUY” for the company’s OTC-listed stock.

Investors who are interested in Bullfrog Gold Corp should keep an eye out for assays coming in the next few weeks, which will include three holes in the Montgomery-Shoshone (MS) deposit, five holes in the MH deposit and two holes in the new Paradise Ridge exploration target.

Sizzling Hot Gold Penny Stocks: KORE Mining Ltd. (TSXV:KORE) (OTCQB:KOREF)

Second on the list of sizzling hot gold stocks to buy in July is KORE Mining Ltd., a gold miner with a portfolio of advanced gold exploration and development assets in California and British Columbia, Canada.

>> Most Active Penny Stocks in the Tech Sector This Month (So Far)

On Tuesday, KORE announced a non-brokered private placement consisting of 6,000,000 subscription receipts at a price of $1.00 per unit and 1,000,000 subscription receipts for flow-through units at $1.50 to raise gross proceeds of up to $7.5 million. The Non-FT Units are being fully subscribed and invested into by gold market guru Eric Sprott.

“I believe KORE is extremely undervalued and have positioned myself as their largest shareholder with over $12 million invested over the last ten months,” said Sprott. “KORE owns 100% of three district scale exploration opportunities, all with shallow high-quality drill targets. Add to that the Imperial PEA and the resources in the ground to back-stop value, KORE is set up to deliver outsized returns.”

The announcement sent KORE stock soaring 21.31%, adding to consistent gains throughout the year. Since the beginning of 2020, KORE has gone from C$0.28 up to C$1.50, representing a 435% increase in six months.

According to TradingView’s technical analysis, 16 moving averages indicate KORE stock as a “Strong BUY,” and one analyst has offered the stock a 12-month price target of C$2.00, a 33% increase from its current price.

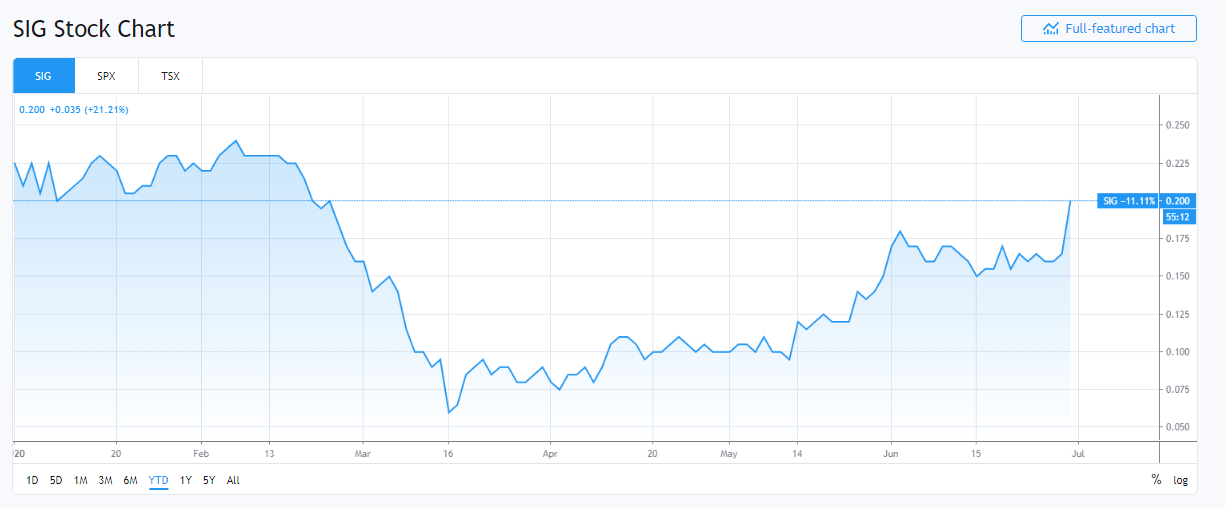

Sizzling Hot Gold Penny Stocks: Sitka Gold Corp. (CSE:SIG) (OTC:SITKF)

Last, but definitely not least on the list of hot gold penny stocks to buy in July is Sitka Gold Corp., a mineral exploration company that is focused on exploring for economically viable gold, silver, and copper mineral deposits.

On Tuesday, the company announced that it has entered into an option agreement with veteran prospector Bernie Kreft to acquire a 100% interest in the Barney Ridge gold property, which is located next to Sitka’s RC Gold project in Yukon.

The Barney Ridge and RC Gold projects are situated in the Tombstone Gold Belt, which hosts several intrusion-related gold deposits, including Victoria Gold’s Eagle Gold Mine and Golden Predator’s Brewery Creek Mine.

“The Barney Ridge Gold Property is an excellent addition to our large RC Gold Project land package located in Yukon’s Tombstone Gold Belt, a region that continues to gain prominence as an underexplored gold-bearing district,” said Sitka Gold Director and CEO Corwin (Cor) Coe. “We are looking forward to following up on the recent gold exploration results at Barney Ridge as part of our exploration efforts at RC Gold this summer.”

The news sent SIG stock up 21.21% on Tuesday to C$0.20, while SITGF was up 29.17% to $0.15 on the OTC. The uptick helped gain back previous losses from March and April when the stock experienced lows of C$0.06 and $0.03.

According to TradingView’s technical analysis, 16 moving averages suggest a “Strong BUY” for SIG stock.

At the same time, Morningstar.com believes fair value for SIG stock is C$0.25, meaning that despite the uptick, the stock is still undervalued and trading at a 20% discount.

Takeaway

Gold prices have been on a rally since the beginning of 2020 and are showing no signs of stopping. If you haven’t already added some gold to your portfolio, the aforementioned gold penny stocks are a great way to start.

Of course, these are only a handful of promising gold stocks. There is a ton of opportunities to be found in the gold market today, whether you decide to invest in small-cap gold stocks, gold producers, or choose to put your money into a gold exchange-traded fund (ETF).

Are there any gold penny stocks on your radar right now? Tell us about them in the comments!

Featured Image: Depositphotos ©tuncelik81