The Alzheimer’s disease (“AD”) market finally saw a ray of hope as the FDA granted accelerated approval to

Biogen

BIIB

and Japan-based partner, Eisai’s Alzheimer’s drug, Aduhelm (aducanumab)on Jun 7. Aduhelm, a monoclonal antibody treatment, has been approved to reduce the accumulation of amyloid beta plaques, a sticky protein, in the brain, which is believed to lead to progression of Alzheimer’s disease.

Afatal condition that causes progressive decline in memory, AD has always been a highly challenging area, and not much progress has been made despite significant investments (both funds and resources). The drugs presently available just treat the symptoms of the disease. Several companies have failed to develop safe and effective treatment options to treat this deadly brain disease. Several large pharma companies, including Roche,

Amgen

AMGN

,

Novartis

NVS

, Merck, Pfizer,

Eli Lilly

LLY

and

AstraZeneca

AZN

stopped development of their AD candidates in the last few years either due to low possibility of success or safety concerns.

After years of failures, Aduhelm has become the first medicine to be approved to reduce the clinical decline associated with this devastating disease. It is also the first medicine to show that removing amyloid beta results in better clinical outcomes in Alzheimer’s patients. It should bring in huge revenues for Biogen with Aduhelm’s peak sales estimated to be in the range of $3-6 billion. The drug is expected to meaningfully change the course of AD treatment.

In fact, other companies working on AD therapies saw their shares soar as FDA approval of Aduhelm improves the likelihood that these companies will also gain approval for their Alzheimer’s candidates.

Eli Lilly

Eli Lilly’s stock rose 10.2% on Monday to a record high as it is also developing an Alzheimer’s drug similar to Biogen’s called donanemab, which recently completed a phase II study in patients with early symptomatic Alzheimer’s disease. In January, the company announced that the phase II study on donanemab met its primary endpoint. The data showed that donanemab slowed disease progression significantly by 32% compared to placebo, as measured on the integrated Alzheimer’s Disease Rating Scale (iADRS), a composite measure of cognition and daily function, over a treatment period of 76 weeks.

In addition to slowing of cognitive and functional decline, treatment with donanemab also resulted in substantial clearance of amyloid plaques and slowing of spread of tau pathology. Following the positive data, Lilly expanded the phase II study to a phase III study. Meanwhile, a phase III study in asymptomatic Alzheimer’s disease is expected to start in 2021

Lilly believes that donanemab has the potential to become a key treatment for Alzheimer’s disease.

Lilly’s shares have risen 31.8% this year so far compared with the

industry

’s increase of 5.5%.

Image Source: Zacks Investment Research

Lilly has a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Small-cap companies working on treatments for Alzheimer’s disease also rose.

Cassava

Sciences

SAVA

stock witnessed 5.4%gain, while

Annovis Bio

ANVS

rose as much as 31%. These two companies are lucrative buy opportunities for investors who are looking to profit from Alzheimer’s drug stocks, if their AD candidates are successfully developed and launched.

CassavaSciences

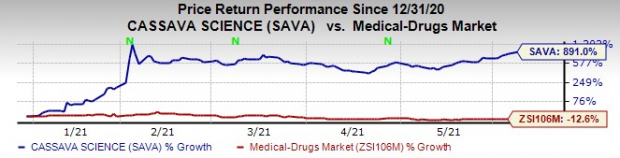

The company’s stock has skyrocketed 891% this year so far against the

industry

’s decrease of 12.6% as it has made rapid progress in the development of its AD candidate, simufilam.

Image Source: Zacks Investment Research

This company plans to initiate two pivotal phase III studies to evaluate simufilam for mild-to-moderate AD dementia in the second half of 2021.

In February 2021, Cassava Sciences announced encouraging interim data from the open-label study of simufilam. Both cognition and behaviour scores of patients improved following six months of treatment with simufilam, with no safety issue observed.

Cassava Sciences currently has a Zacks Rank #3 (Hold).

Annovis Bio

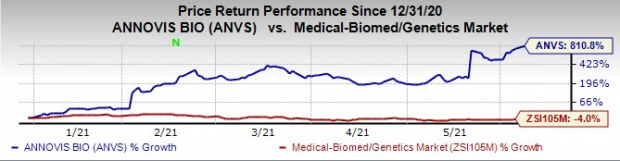

Annovis Bio’s stock has risen 810.8% this year so far against a decrease of 4% for the

industry

.

Image Source: Zacks Investment Research

Last month, Annovis Bio announced data from a phase II study on ANVS401, its lead drug candidate for the treatment of AD and Parkinson’s disease (PD). The data showed that patients treated for 25 days with ANVS401 achieved statistically significant cognitive improvement as measured by the Alzheimer’s Disease Assessment Scale–Cognitive Subscale 11 (ADAS-Cog11) test, which is one of the most frequently used tests to measure impaired cognition in clinical studies for AD. The drug also demonstrated improvements in speed, coordination and motor function in PD patients. Overall, the data proved that ANVS401 is efficacious in both AD and PD.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report