One of the few constant truths of the stock market is that gold always goes up. Investors covet the best gold stocks just as ancient peoples coveted the material itself. No matter what’s going on in the world, gold remains a valuable investment.

For example, over the past 15 years, the price of gold increased by 315%. Over the same period, the Dow Jones Industrial Average only increased by 58%. Gold’s growth remains roughly consistent over the last thirty years, while other markets boom and bust.

So, when gold occasionally trends downwards, it makes for a clear investment opportunity.

Over the last three weeks, gold futures rose over fear caused by the coronavirus. Now, though, as the fear begins to die down, people no longer feel they need a safe haven for their investments. This means they’re getting their money out of gold, bringing stock prices back down.

It’s times like these that investors should be studying the market and looking for the best gold stocks. Fortunately, there are a number of low-price gold stocks in Canada that show a lot of promise.

Best Gold Stocks: Amex Exploration

Amex Exploration Inc. (TSXV:AMX) is a junior mining company that focuses on exploration activities in both Canada and Mexico. While its portfolio includes nine properties, its flagship asset is the Perron property in Northern Quebec.

The Perron property consists of approximately 120 mining claims covering an area of over 4,510 hectares (11,144 acres). Amex is currently executing a 100,000-metre drill campaign on Perron and is aiming at “numerous cryptic faults which may be associated with gold mineralization.”

AMX is currently trading at C$1.44, having nearly doubled in value since last June. Recently, Amex received a C$2.30 price target from investment analysts at Pi Financial. This represents a 60% upside for the stock’s current price.

>> Namaste Stock Continues Strong Start to 2020 with STRONG BUY Rating

Best Gold Stocks: Benchmark Metals

Benchmark Metals Inc. (TSXV:BNCH) is focused on exploring and developing its Lawyers Gold and Silver project located in the prolific Golden Triangle of northern British Columbia on the Toodoggone river.

This property contains an existing Mineral Resource. Notably, this resource hosts at least 16 gold and silver occurrences that were never fully mined, developed, or even explored.

Last month, Benchmark released preliminary results from its geological mapping of Lawyers. The company sees the potential for the property “to emerge as a gold-silver metallogenic belt having discreet high-grade zones with lower grade halos.”

BNCH is currently trading at $0.39. Approximately 16%—or C$7.4m worth of shares—are under insider ownership. This indicates that Benchmark management has a considerable amount of confidence in the price going up from here, and will be mindful of investor concerns.

Best Gold Stocks: Orvana Minerals

Based in Toronto, Orvana Minerals Corp. (TSX:ORV) is a multi-mine, gold-copper-silver producer. It currently holds two properties. One is the El Valle and Carlés underground mines in Orovalle, Northern Spain. The other is the Don Mario Mine Complex based in southeastern Bolivia, though it recently suspended operations there.

Additionally, in May, the company entered into a purchase agreement to acquire the Taguas property in Argentina.

Orvana’s highlights from 2019 include the production of 110,063 gold equivalent ounces. The vast majority of this (97,259 ounces) came from actual gold operations.

For the Orovalle operation, in particular, the company’s Q4 gold production increased by 17% compared to the previous quarter due to higher throughput.

ORV stock has been on a rally since late December, doubling from $0.13 to $0.26 in just six weeks.

All of these stocks have major long-term potential and are showing signs of consolidating. Whether the economy remains strong or not, keep these mining companies in mind.

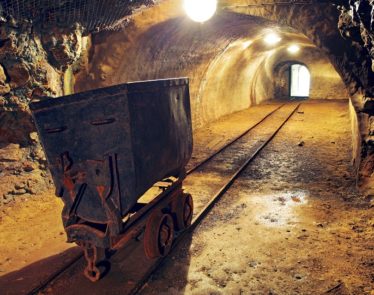

Featured image: DepositPhotos © Petrovich99