Investors in Axcelis Technologies, Inc. (NASDAQ:$ACLS) can expect the company to post sales in the neighborhood of $95.05 million in the current quarter, according to Zacks Investment Research.

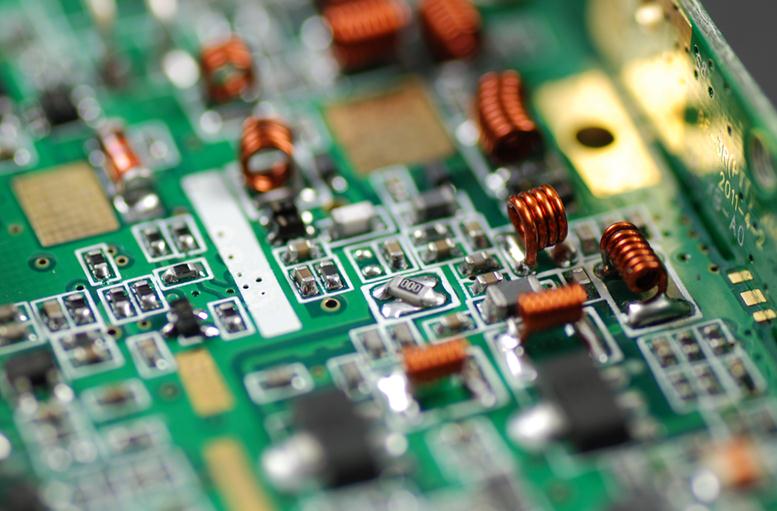

ACLS designs, manufactures, and serves ion implants and the equipment used to fabricate semiconductor chips. They also sell aftermarket lifecycle products and services such as parts, upgrades, maintenance services, customer training, and lifecycle products.

Zacks’ estimates are corroborated by another analyst firm which pegs the earnings between $95.00 million and $95.10 million. Last year at this time, ACLS reported sales of $65.65 million, indicating 44.8% growth since the same quarter last year. Official reports from the company are expected November 1st.

An aggregate of analysts notes average the full-year sales for ACLS at $95.05 million with estimates ranging from $367.60 to $380.00 million. Analysts expect growth in the next year, with a forecast estimating between $402.60 million to $427.60 million.

ACLS last reported its quarterly earnings on Thursday, August 3rd, at $0.33 EPS. This missed consensus estimates by $0.01 – an estimate of $0.34. They also had a Return on Equity of 12.52% and a Net Margin of 9.10%. The quarter also saw $102.80 million in revenue, which exceeded estimates by $2.73 million.

Some analysts recently evaluated where the stock stands;

- On Saturday, August 5th, BidaskClub dropped ACLS’ rating from “Hold” to “Sell”.

- B. Riley reiterated a “Buy” rating and gave ACLS a $30.00 target price in a report from Wednesday, August 9th.

- On Friday, September 1st, ValuEngine increased its rating on the stock from “Hold” to “Buy”.

- On Friday, September 8th, Benchmark Co. issued a target market price of $28.00 and reiterated a “Buy” rating.

- On Thursday, September 14th, Zacks Investment Research downgraded the stock from “Buy” to “Hold”.

The stock also recently experienced some insider trades. EVP William J Bintz sold 12,500 of his stock at an average price of $22.57 for a total of $282,125.00 on Tuesday, September 12th. EVP Douglas A. Lawson also sold 14,454 shares on Tuesday, August 15th for an average price of $21.12 and a total value of $305,268.48. 5.66% of the company is currently owned by corporate insiders.

Featured Image: Depositphotos/© 9albln