With many mining companies’ exploration and development projects ramping up in 2021, the Mining Association of Canada believes that the industry will be able to bounce back from the initial economic downturn caused by the health crisis. For companies such as Graycliff Exploration Ltd. (CSE:GRAY) (OTCQB:GRYCF) and Pure Gold Mining Inc. (TSXV:PGM) (OTC:LRTNF), commercial production is on track for 2021, while the likes of Yamana Gold (NYSE:AUY) (TSX:YRI), Newmont Corporation (NYSE:NEM) (TSX:NGT), and Great Bear Resources (TSXV:GBR) (OTC:GTBAF) are looking forward to a more consistent year of mining production.

Phase Two Commences for Graycliff’s Shakespeare Gold Project

Graycliff Exploration Ltd. announced in early March that the company has resumed drilling production at its Shakespeare Gold Project, located near Sudbury, Ontario. The project is currently in Phase 2 of its 2020/2021 exploration program. At present, Graycliff is awaiting assay results for the final three holes of its initial Phase 1 drill program. This project was extended from the previously identified mineralization, which led to the outcome of a new mineralized zone.

Graycliff’s Technical Advisor, Bruce Durham, commented on the progress of the project, stating, “we are extremely motivated by the success of the Phase 1 drilling program, which saw Shakespeare’s mineralized area expanded and directed us to earmark more drilling in the vicinity of the Miller Shaft and the Number 3 adit. We are working in the ‘shadow of a historic headframe’, deemed often to be the best place to find a new gold mine.”

Graycliff also shared details of two additional drill holes from the 2020 Phase 1 exploration program for the Shakespeare Gold Project. Key highlights include findings for drill hole J-3-20, which intersected a near surface mineralized interval of 5.37 g/t gold over 5 meters, including 18.50 g/t over 1.0 meter and 4.34 g/t over 0.7 meter. Drill hole J-4-20, meanwhile, confirmed the interpreted zone of mineralization remains open at depth. Together, the drill holes confirm that mineralization also extends along strike.

Core drilling of Graycliff’s Phase 2 exploration program will include 1,000 meters averaging a hole length of 150 meters. Additionally, once the Phase 2 assay data has been established on these new holes, Graycliff plans to carry out 3D modeling of the area, a core foundation for digital mining. The company will then proceed with the interpreted structure and gold mineralization.

A Steady Year Ahead For Other Exploration Projects Underway

With mining productions in full swing, Pure Gold Mining (TSXV:PGM) (OTC:LRTNF) reports that it is on track to begin commercial production at the company’s Red Lake mine. With first gold being poured last December, Pure Gold believes there will be a declaration of commercial production by Q2 2021. The site currently has employed an approximate 260 people for the mining site.

In February 2021, the Canadian Malartic Partnership, which consists of Yamana Gold (NYSE:AUY) (TSX:YRI), Agnico Eagle Mines, and Osisko Gold Royalties, approved the construction of the Odyssey underground project at the Canadian Malartic mine. The partnership plans to invest US$30 million into the drilling and exploration work for this project, which will begin to receive royalty payments from underground production beginning in 2023. In Yamana Gold’s Q4 and full-year financial results, the company explained further that this approval will help to extend the mine’s life up to at least the year 2039.

Newmont Corporation (NYSE:NEM) (TSX:NGT) is expanding its world-class portfolio by introducing the Tatogga project, which is located in the highly desired Golden Triangle district in British Columbia. The Tatogga project appears to have a promising future, with the primary Saddle North deposit contributing to a significant amount of gold and copper production on an annual basis. Furthermore, this site projects a long mine life, as the Saddle North site provides further exploration opportunities across the land.

Great Bear Resources (TSXV:GBR) (OTC:GTBAF) reported results from its fully funded $45 million 2021 exploration project located in the Red Lake district of Ontario. During the drilling process along the northwestern kilometer of the LP Fault zone, the company came across new high-grade gold mineralization. This was in addition to the expected bulk tonnage intervals, and will now require auxiliary drilling in the area over the next several months.

The industry for mining exploration and commercial production is heating up as companies like Graycliff Exploration begin to focus more on their anticipated projects for 2021 and beyond.

For more information on Graycliff Exploration, click here.

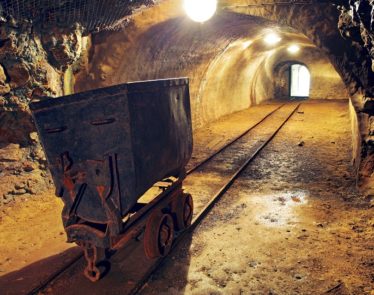

Featured image: DepositPhotos © belchonock