During Tuesday trading, shares of Cobalt International Energy Inc (NYSE:$CIE) trade at a price of $1.36 with a volume of 0.4 million. This represented a move of -0.73%. The company also has a 3-month average volume of 0.52 million, giving them a relative volume of 0.77.

Current trade prices sit 0.74% above the 52 week low and -93.79 below the 52 week high. Their 0.04 outstanding shares hold a total dollar value of 31.33 million.

The company’s Return on Assets, the measure of the profitability compared to company assets, sits at -107.30%. This reflects poorly on the company’s management of their assets. Another ratio we can consider is the Return on Equity, which measures profits against the income from shares. A higher ROE indicates a company that is good at generating profits. Cobalt currently has a 443.80% ROE.

Finally, we can look at Return on Investment. Like the other ratios, it compares profits to a given factor, in this case, income. A high ROI indicates that a company’s returns exceed their costs. In the case of Cobalt, their ROI sits at -138.10%.

Moving Averages are another helpful tool investors can look at. They represent the average price over a given period and can be helpful for filtering out day to day fluctuation noise. Short-term averages are useful for identifying swings, recording price fluctuations, and identifying trend changes quickly. Long-term averages, on the other hand, are less susceptible to ‘whipsaws’ or erroneous trade signals. It can also be useful for price trend, secondary, and minor price trends.

As it stands, Cobalt’s 20-day Moving Average dropped -18.88%, its 50-day moving average dropped -30.82% and its 200-day Moving Average dropped -80.19%.

So what are analysts saying?

The stock currently holds an average rating score of 2.70, wherein 1 represents a ‘Strong-Buy’, 2 is a ‘Buy’, 3 is a ‘Hold’, 4 is a ‘Sell’, and 5 is a ‘Strong-Sell’. Though they sometimes conflict, these ratings are useful research tools that provide you with a wide range of information at a glance.

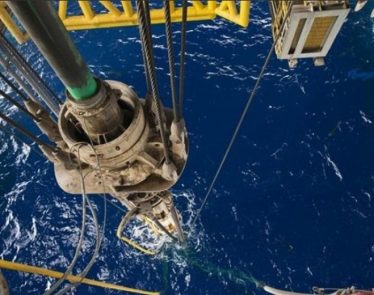

Featured Image: twitter