Are you tired of the low returns you’re getting on your savings accounts?

Who in their right mind would be happy with a 1% ROI when inflation just shot up to 6.2%?¹

In fact, some so-called high-interest savings accounts at banks pay measly annualized interest of just 0.05%!

Isn’t it pathetic to earn only $10 a year on a $20,000 balance?

And even worse, how safe and secure is your money with these “trusted” banks?

We all remember what happened in the 2008 financial crisis.

The truth is, we’re still feeling its aftershocks, AND many experts believe we’re facing another imminent economic turmoil.

So, it should come as no surprise that millions of people have lost trust in traditional banking.

But what if there was a way for you to earn up to 5%, 10%, or even 30% interest (returning $6000 or more on a $20k investment)?

Now there is, by means of a company called Wellfield Technologies (TSXV:WFLD).

Here’s Why Now May Be The Perfect Time

To Invest Your Time To Research The Coming Of The New “Financial Revolution”

Think of a financial system² that isn’t run by banks or governments, but rather by Blockchain, a technology that keeps everyone’s records safe and secure without a central authority.

This is called decentralized finance, or DeFi for short.

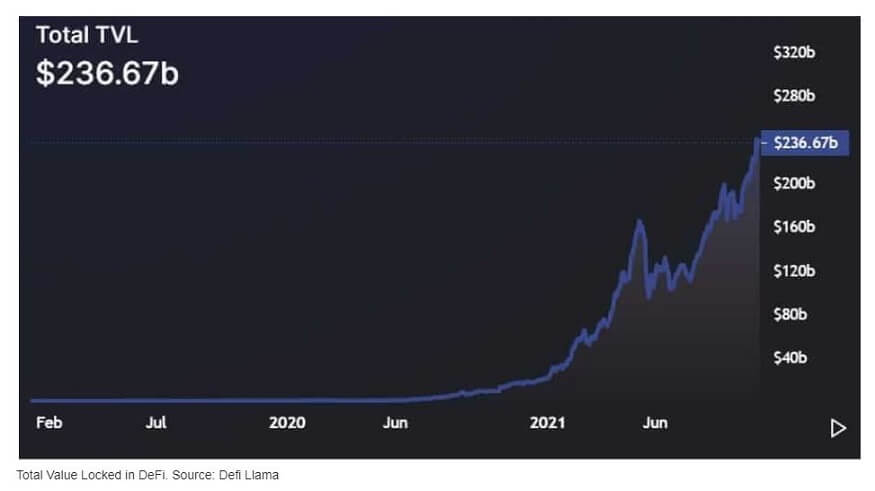

If this sounds crazy, you may be pleased to know there’s already $236 billion³ (equal to 31 Netflix’s!) invested in the space even though DeFi only came out roughly 3 years ago.

Total Value Locked in DeFi. Source: Defi Llama

In fact, according to Forbes…⁴

DeFi’s Growth In The Past Year

Alone Has Been Nearly 88 TIMES!

And there are plenty of good reasons for that.

Today, all our financial services are centralized.

Banks, stock markets, insurance companies, and other financial institutions all have someone in charge, whether it’s a company or an individual.

As you can imagine, a centralized financial system has risks like fraud, corruption, and mismanagement (like the 2008 financial crisis).

What if we could improve the world’s financial system to eliminate these problems?

This is exactly how the new era of financial revolution will be ushered in due to the emergence of DeFi.

That’s because DeFi is able to cut out all kinds of financial middlemen, so you can experience faster, cheaper, safer, and frictionless transactions.

Listen To These Leading Financial Experts

“Banks should be scared of DeFi.”⁵

“Banks should be scared of DeFi.”⁵

– Mark Cuban – Billionaire owner of the Mavericks

and star of Shark Tank.

“[DeFi] represents a genuine paradigm shift [in] the financial market]”⁶

“[DeFi] represents a genuine paradigm shift [in] the financial market]”⁶

But here’s the thing — despite its tremendous growth in the area of crypto investment, DeFi faces one barrier that prevents it from becoming truly decentralized and thus reaching mass adoption.

And Wellfield Technologies (TSXV:WFLD), which IPO’d on the Toronto Venture Exchange on November 30, has the PERFECT solution.

This is why Wellfield just raised over $20 Million to implement it.

With 45% insider ownership (over 13% owned by its CEO), it’s clear this company is going for (digital) gold!

Press Releases

- Wellfield Technologies Announces Appointment of Global Financial Leader Tamir Agmon as Member of Advisory Board

- Wellfield Technologies Announces Global Payments and Fintech Leader William Keliehor as First Member of New Advisory Board

- Wellfield Technologies Inc. Announces Closing of Business Combination

- Wellfield Technologies Receives TSX Venture Exchange Conditional Listing Approval

Wellfield Technologies (TSXV:WFLD) Could

Be A Second-Chance Windfall For

Investors Who Missed Out On Web 2.0

So, what’s limiting DeFi to an even bigger explosion today?

And what role does Wellfield Technologies (TSXV:WFLD) play in this megatrend?

The DeFi entire ecosystem consists of three layers, each building on top of the other:

- The bottom layer is Blockchain, the foundation technology.

- The middle layer is the Protocol, which is like the “software,” “program,” or “codes” that tell the top layer what to do.

- And the top layer is the Application, which is the interface the world will one day experience like DeFi apps.

To get DeFi off the ground, it needs to build its ecosystem in this hierarchical fashion – from the basement to the skyscraper tip. But no one has gotten to the middle layer (Protocol)

Evidently, Blockchain alone will not provide DeFi because each layer needs to contribute to making DeFi work.

To illustrate the point, consider the early days of Netflix:

Back then, Netflix used to ship DVDs to our houses before we could watch their movies online. And even before that, people used to rent VHS tapes from Blockbuster.

That’s because cloud computing wasn’t established, fiber optics weren’t available, and server capacity wasn’t fast enough to feed us instant content.

Simply put, there’s a lack of infrastructure, which is why video streaming took a while to reach the mainstream.

Similarly, DeFi is still in its “shipping DVDs” phase because the Protocol layer isn’t fully developed yet.

What’s the consequence?

Many band-aid solutions like crypto exchanges, which are essentially centralized services, have swooped in to fill the gaps while charging hefty fees for DeFi users.

A situation like this is an oxymoron because it is the opposite of DeFi’s end goal of eliminating middlemen.

So, here’s where Wellfield Technologies (TSXV:WFLD) comes in.

The company builds infrastructures within the protocol layer, helping remove all intermediaries.

Wellfield’s subsidiary, Seamless, builds the Protocol layer

This means, as the first public company to attempt this, Wellfield Technologies (TSXV:WFLD) can speed up DeFi adoption around the world.

And that’s why it’s estimated…

Wellfield Technologies’ (TSXV:WFLD) Revenue Could Hit $180 Million By 2024, Which Is Only 2 Years From Now!

By 2024, Wellfield Technologies (TSXV:WFLD) could generate $180 million in revenue, with exponential growth year-over-year

Imagine what a $500 stake could potentially turn into in just a few years.

However, if you’re still not entirely sure how Blockchain, DeFi, or any of this works, that’s okay because the truth is most investors feel the same way.

And so, if you take just one thing away from this, then it should be the fact that…

Wellfield Technologies (TSXV: WFLD) Could Potentially Take Off Like Netflix & Uber Did In The Early Days!

That’s because the world likes to cut out the middlemen, and those who have helped do so — Netflix for entertainment, Uber for transportation, and Amazon for commerce — are among the top-ranking stocks of all time.

Many people have regretted not getting on-board earlier.

And Wellfield Technologies (TSXV: WFLD) is just starting to do the same for finance, which is why some may see them as a threat, but it’s good news for us who are sick and tired of the extra costs of middlemen.

And it’s even better news for investors who see this trend for what it is.

Here are more specific reasons why smart money will continue to pour into Wellfield Technologies (TSXV: WFLD).

Reason #1 – Wellfield Technologies (TSXV:WFLD)

Simplifies Access To DeFi

Besides building the protocol layer, Wellfield Technologies (TSXV: WFLD) is taking another step further by building the top application layer.

Here’s an example of why that’s important:

While the Internet comprises lots of protocols and infrastructure, people connect with it only through browsers like Google Chrome, Internet Explorer, Firefox, and others.

And ultimately, that’s what everyday people care about — not cloud computing, server farms, ISPs, fiber optic cable networks, and all that crazy stuff behind the scenes.

Similarly, DeFi needs “browsers for the Internet of money.”

And applications like digital wallets are what connects users to the protocol layer in the DeFi ecosystem.

That is why Wellfield Technologies (TSXV: WFLD) created MoneyClip, a digital wallet based on new protocols.

MoneyClip links your bank to the Blockchain and provides you with the best DeFi solutions.

Not only will you be able to send cash as easily as sending a text, but you’ll also be able to split bills, keep track of who owes what, buy and sell on Facebook Marketplace privately with ease, and tap and pay with the cash in your phone, with a click of a button, in seconds, and for absolutely free.

All thanks to the fact that money can be sent from anyone to anyone without involving middlemen.

And this aspect is what Cointelegraph, a DeFi authority website, calls…

“The Second-Gen DeFi Protocol”

…highlighting just how powerful MoneyClip⁷ is.

If this reminds you of Web 2.0, then you’ll be shocked to know this is just the tip of the iceberg.

Because as Wellfield Technologies (TSXV:WFLD) develops more protocols, more DeFi features will roll out on the app.

And these breakthrough features could be as revolutionary as credit cards were in 1951, and PayPal was in 2000.

Reason #2 – Wellfield Technologies (TSXV: WFLD)

“Connects” Both Of The Largest Cryptocurrencies

One of the best things you’re going to love about Wellfield Technologies’ (TSXV:WFLD) stock is that they make Bitcoin more compatible with DeFi, increasing the likelihood of real-world use.

If you haven’t heard of Bitcoin, it’s the first-ever DeFi-based currency created by Satoshi Nakamoto in 2009 in response to the 2008 financial crisis.

In his attempt to make Bitcoin inflation-proof, he created only a fixed number of 21 million coins, hoping it would someday replace our reliance on fiat currency, which is everyday money that governments and banks can manipulate.

Unfortunately, the Blockchain technology behind Bitcoin is too limited to deliver the DeFi’s full promise, so Bitcoin’s real-world use remains impractical.

But with Wellfield Technologies’ (TSXV:WFLD) protocols, Bitcoin could “dock” with a more advanced Blockchain called Ethereum.

This “docking” is revolutionary, as all crypto exchanges today are tied to only one Blockchain (Ethereum).

As a result, Wellfield Technologies (TSXV: WFLD) can optimize liquidity for investors who trade Bitcoin and Ethereum and enable crypto-holders to earn cash flow in ways never thought possible.

Given the daily trading volume is sitting at over $1.5 billion, it’s easy to see why there’s a market demand for Bitcoin compatibility with DeFi.

Plus, more incredibly, by leveraging the advanced potential of the Ethereum Blockchain, Bitcoin can finally unleash its commercial value.

As a result, you’ll see more Bitcoin-related products on apps like MoneyClip and others in the future.

And for investors like yourself, this means Wellfield Technologies (TSXV: WFLD) doesn’t simply rely on “one-trick pony” products or linear business plans to be successful in the unimaginable new era of finance.

Wellfield is already working hard behind the scenes with multi-pronged efforts to unlock DeFi’s true potential.

Considering the company offers breakthroughs similar to companies like Uber and Netflix, it will be no surprise if Wellfield Technologies (TSXV:WFLD) becomes a household name everyone wishes they’d got in early on.

Imagine finding a stock whose potential could go ballistic once people begin to see where our financial world could be headed.

Reason #3 – Wellfield Technologies (TSXV: WFLD)

Has The First Mover Advantage

You’re in luck discovering Wellfield Technologies (TSXV:WFLD) for yourself because it’s the only public company building DeFi protocols this way.

Developing infrastructure at DeFi’s protocol layer has been a hot topic for the last decade, but many companies have only dreamed of being the first to “dock” Bitcoin with Ethereum and create apps like MoneyClip.

So, as you look at Wellfield Technologies’ (TSXV:WFLD) stunningly low share price below, consider how their peers focus only on non-protocol routes AND how their prices compare.

Experience has shown that companies that are “First Movers,⁸” such as Apple for smartphones, Coca-Cola for soft drinks, and Kellogg’s for cereals, can be extremely profitable.

Each of these household companies had one thing in common —

they all had the First Mover Advantage.

Given Wellfield Technologies (TSXV: WFLD) is the leading force in this untapped opportunity, it’s no wonder many insiders agree their stock could explode, especially once it launches its decentralized Seamless Exchange.

Reason #4 – Wellfield Technologies (TSXV:WFLD)

Is Led By An Outstanding Management Team

The fact that Wellfield Technologies (TSXV:WFLD) has accomplished what many couldn’t while DeFi sat dormant in the last decade means it has got a fantastic team running it.

With the combined effort of 18 engineers and 5 Ph.D. contributors in multi-party computation, cryptography, computational and algebraic complexity, and economics, the team developed 4 patent applications, with 3 more in the approval phase since 2018.

Combined with top-of-the-line leadership and years of experience building disruptive technologies in Silicon Valley and Israel, Wellfield Technologies (TSXV:WFLD) is ideally positioned to expand its R&D, product pipeline, and customer base.

Levy Cohen – CEO and Director

Levy Cohen – CEO and Director

Levy Cohen has extensive experience leading technology-driven banking and payment companies in Silicon Valley and Israel while building strong customer experiences. Levy is a seasoned technologist focusing on the R&D of innovative computer science and Blockchain technologies.

Marc Lustig – Board Chair

Marc Lustig – Board Chair

Marc Lustig is an entrepreneur and founder with strong experience in corporate finance. Since the landmark 2020 $1.1 Billion cannabis merger between Origin House (of which he was the founder, CEO, and Chairman) with Cresco Labs, Marc has been focused on managing L5 Capital, his investment company and serving on the boards of several public companies, including Cresco Labs, Aequus Pharmaceuticals Inc. and PharmaCielo Ltd. He is also Chairman of IM Cannabis Corp.

Yishai Steinhart – CTO

Yishai Steinhart – CTO

Yishai Steinhart is the CTO and VP of R&D of Wellfield Technologies (TSXV:WFLD). Yishai had worked with Apple, ilmpact, and Digilabs before co-founding MoneyClip. With over 30 years of experience in Israel and Silicon Valley, Yishai has shipped multiple products used by millions of customers.

Yishai holds a BA in Computer Science & Economics & is also an MBA.

Brian Lock – CFO

Brian Lock – CFO

Brian Lock is a CPA/CA with ten years of experience in public accounting, focusing on assurance and corporate finance. Before co-founding MoneyClip, Brain was an early digital currency investor and Blockchain startup advisor.

Chanan Steinhart – Chief Strategy Officer and Business Development and Director

Chanan Steinhart – Chief Strategy Officer and Business Development and Director

Chanan Steinhart is a tech CEO, speaker, and author who has spent two decades at the forefront of emerging consumer-product technology. Before founding MoneyClip. Chanan was the founder and CEO of disruptive technology companies in Israel and Silicon Valley, leading three businesses from startups to scale and exit.

Investors May Want to Get In Early On Wellfield Technologies (TSXV:WFLD)

90% of institutional investors in the UK and US are rushing to increase their stake in DeFi.

36% of investors have already flooded into the DeFi sector.

The total locked value (asset deposits) of DeFi has hit an all-time high of $236 billion9 as of today (equivalent to 31 Netflixes!), and it could continue to explode as its value has nearly 88 times10 since last year.

The financial sector in the US alone is worth more than $1.5 trillion11, so the growth of DeFi, as astounding as it is already, is likely only just beginning.

Wellfield Technologies (TSXV:WFLD) is building infrastructures that will drive DeFi to hypergrowth (similar to what cloud computing, fiber optics, and servers did for Netflix, allowing it to become mainstream).

First Mover Advantage12 — Wellfield Technologies’ (TSXV:WFLD) Seamless subsidiary is developing never-before-seen protocols and the first product of its kind, MoneyClip. This gives the company immediate credibility in the market AND the opportunity to conquer market share before any competitors enter the space (it’s like Apple for smartphones, Coca-Cola for soft drinks, and Kelloggs for cereals).

An Unmatched Position That Could Reach $180 Million In Revenue By 2024 — no other Canadian public company builds decentralized and permissionless protocols in public markets. Other peers are doing “more of the same” in DeFi, keeping it somewhat centralized still. As such, this is a largely untapped opportunity.

Unique Vision – Wellfield Technologies (TSXV:WFLD) believes that the Decentralized protocols will power Fintech apps that survive DeFi disruption, and this vision is driving the direction we take MoneyClip. Wellfield owns the playground (exclusive protocols), so competitors must collaborate with them or get pushed out. Either way, Wellfield could win.

Experienced Leadership Team – Levy, Chanan, and Yishai have decades of experience (each) starting, scaling, and selling technologies in hyper-growth sectors in Israel and Silicon Valley. Not to mention Wellfield Technologies (TSXV:WFLD) also has research and engineering teams in Multi-Party Computation, Cryptography, Computational & Algebraic Complexity, Economics, etc.

Wellfield is fully financed after raising $20,475,000 at $1.00 in a concurrent subscription receipt financing prior to listing on the Toronto Venture Exchange.

Final Thoughts:

As you can see, Investing in Wellfield Technologies (TSXV:WFLD) may be a wise move in 2022.

DeFi paves the way for us to no longer be dependent on banks that offer meagre returns, but it could also keep us from entering another economic doom.

And Wellfield Technologies (TSXV:WFLD) could be the catalyst for this new era.